Personal Injury Lawsuit loans In Alpharetta

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xPersonal injury lawsuit loans in Alpharetta are a lifesaver for people who are struggling to make ends meet while dealing with the many legal issues arising from accidents or injuries. These loans offer financial support to plaintiffs, enabling them to cover medical bills, living expenses, and other necessities while awaiting settlement.

These loans ease the financial burden frequently connected with protracted legal proceedings by filling the gap between filing a lawsuit and getting paid, enabling people to pursue their claims with more resilience and peace of mind.

In this article, we will discuss five such lenders in Alpharetta who specialise in providing personal injury lawsuit loans. These respectable organisations provide plaintiffs with specialised financial solutions, giving them the assurance they need to confidently handle the legal process.

With transparent terms and a commitment to serving their client’s best interests, these lenders play a crucial role in empowering individuals to pursue justice without compromising their financial stability.

Top 5 Lenders Offering Personal Injury Lawsuit Loans in Alpharetta

Best 5 Lenders Offering Personal Injury Lawsuit Loans in Alpharetta

1. 50kLoans

50kLoans.com is a leading provider of personal injury lawsuit loans in Alpharetta, offering tailored financial solutions to individuals involved in legal battles. The company focuses on transparency, efficiency, and client satisfaction, making it a reliable partner for plaintiffs seeking financial support during the litigation process. There are no upfront costs, no paperwork requirements, and an easy application process.

The approval process is swift, often providing funding within 24 to 48 hours. 50kLoans.com also offers pre-settlement funding, providing a portion of the anticipated settlement upfront, allowing plaintiffs to cover immediate expenses like medical treatment and household bills.

Because the business is non-recourse, plaintiffs are only obligated to pay back the loan in the event that they prevail in court. In the event of an unsuccessful case, plaintiffs are not obligated to repay the loan, providing peace of mind and highlighting 50kLoans.com’s commitment to supporting individuals throughout the litigation process.

Highlights:

- Premier provider of personal injury lawsuit loans in Alpharetta

- Transparent, efficient application process with no upfront fees

- Swift funding within 24 to 48 hours

- Pre-settlement funding available for immediate expenses

Eligibility Criteria:

- Candidates have to be Alpharetta residents.

- Age must be at least 18.

- Verification of stable income should be presented.

- An open bank account in their name at the time of loan.

Loan Details:

- The loan amount is between $1,000 and $50,000.

- Loan Rate: Competetive Rate offered

- Approval Time: Depends on the lender.

Procedure:

- Complete the online form.

- You get matched with suitable lenders depending on the information provided.

- Lenders will examine the application and make the final decision.

- Once approved, you will get cash immediately into your bank account.

2. LoanRaptor

LoanRaptor.net is a company that specialises in providing personal injury lawsuit loans in Alpharetta, focusing on providing financial assistance to plaintiffs. These loans are designed to cover living expenses, medical bills, and other costs while the plaintiff awaits the resolution of their case.

LoanRaptor.net’s service is accessible and easy to apply, with a streamlined process that requires basic information about the case and the plaintiff’s financial needs. Once an application is submitted, the company evaluates the case’s potential for success, determining the amount of funding the plaintiff may be eligible for. Personal injury lawsuit loans are typically non-recourse, meaning repayment is contingent upon the plaintiff winning their case.

Upon approval, funds are disbursed quickly, allowing the plaintiff to address their immediate financial needs without delay. LoanRaptor.net maintains communication with the plaintiff and their legal team throughout the case to ensure they are prepared to assist with any additional funding needs.

Highlights:

- LoanRaptor.net offers fast, accessible personal injury lawsuit loans in Alpharetta.

- Covers living and medical expenses during case resolution.

- A streamlined application process requires basic information.

- Funds are disbursed promptly upon approval.

Eligibility Criteria:

- Candidates have to be Alpharetta residents.

- Age must be at least 18.

- Verification of stable income should be presented.

- An open bank account in their name at the time of loan.

Loan Details:

- Loan Amount: Subject to change dependent on specific conditions and lender guidelines

- Loan Rate: Reasonably priced rates are provided.

- Approval Time: Quicker processing in exchange for prompt support.

Procedure:

- Fill out the application form available online.

- The platform matches with suitable lenders based on the provided information.

- After considering your application, lenders decide.

- Funds will be deposited straight into your savings account if authorised.

3. 24MLoans

24MLoans.com is a company that specialises in providing financial assistance to individuals involved in personal injury lawsuits. These loans are designed to help plaintiffs cover living expenses, medical bills, and other costs while they await the resolution of their case.

The company offers a straightforward application process, often completed online or over the phone, requiring basic information about the case and the plaintiff’s financial needs. Once submitted, 24MLoans.com evaluates the case’s potential for success, determining the amount of funding the plaintiff may be eligible for. Personal injury lawsuit loans in Alpharetta are typically non-recourse, meaning repayment is contingent upon the plaintiff winning their case.

Funds are typically disbursed quickly, often within a few days, allowing plaintiffs to address their immediate financial needs without delay. 24MLoans.com maintains communication with the plaintiff and their legal team throughout the case to ensure they are prepared to assist with any additional funding needs.

Highlights:

- 24MLoans.com offers quick aid for living expenses and medical bills during lawsuits.

- Apply online or by phone with basic details about your case and finances.

- Receive funds within days of approval for timely support.

- Stay connected with 24MLoans.com for continuous assistance during your case.

Eligibility Criteria:

- Candidates have to be Alpharetta residents.

- Age must be at least 18.

- Verification of stable income should be presented.

- An open bank account in their name at the time of the loan.

Loan Details:

- Loan Amount: This can vary based on lender policies and individual circumstances.

- Loan Rate: Reasonably priced rates are provided.

- Approval Time: Quick Approvals

Procedure:

- Fill out the online application.

- The software finds the ideal lender for you.

- Lenders decide after the final examination process

- After approval, you can receive funds directly into your account.

4. Super Personal Finder

SuperPersonalFinder.com is a company that specialises in providing financial assistance to individuals involved in personal injury lawsuits in Alpharetta. These loans are designed to help plaintiffs cover living expenses, medical bills, and other costs while they await the resolution of their case.

The company offers a straightforward application process, which can be completed online or over the phone, and requires basic information about the case and the plaintiff’s financial needs. Once submitted, SuperPersonalFinder.com evaluates the case to determine the amount of funding the plaintiff may be eligible for. Personal injury lawsuit loans in Alpharetta are typically non-recourse, meaning repayment is contingent upon the plaintiff winning their case.

Upon approval, funds are typically disbursed quickly, allowing plaintiffs to address immediate financial needs without delay. SuperPersonalFinder.com maintains communication with the plaintiff and their legal team throughout the case to ensure they are prepared to assist with any additional funding needs.

Highlights:

- SuperPersonalFinder.com provides quick financial help for Alpharetta’s personal injury cases.

- Apply online or by phone with basic case and financial details.

- Get money fast, typically within days of approval.

- Stay connected for ongoing assistance throughout your case.

Eligibility Criteria:

- Candidates have to be Alpharetta residents.

- Age must be at least 18.

- Verification of stable income should be presented.

- An open bank account in their name at the time of loan.

Loan Details:

- Loan Amount: This may differ depending on specific conditions and lender guidelines.

- Loan Rate: Competitive rates

- Approval Time: Fast Approval rate.

Procedure:

- Complete the online application.

- The portal connects candidates with qualified lenders.

- After a careful analysis, lenders have the final say.

- Get money directly into your bank account if it’s authorised.

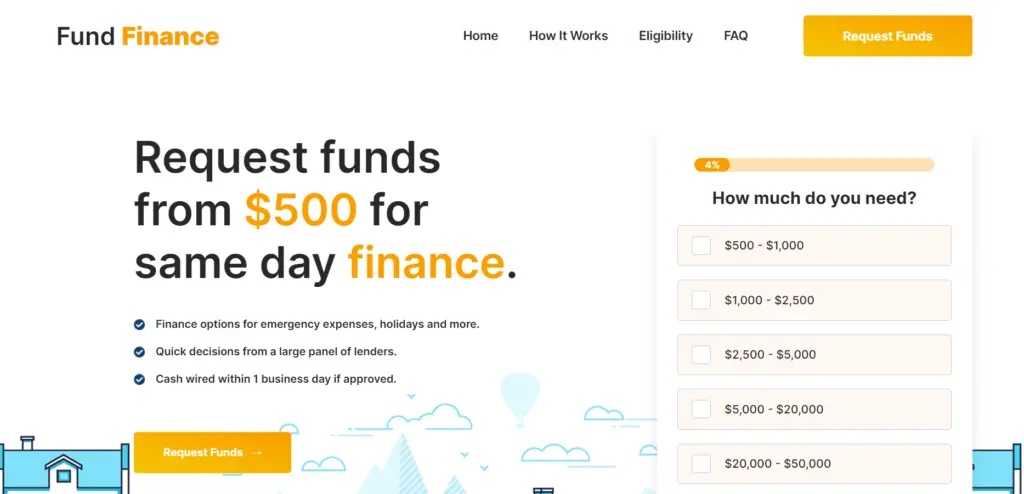

5. FundFinance

FundFinance.net, a non-recognized entity, specialises in providing financial assistance to individuals involved in Personal injury lawsuit loans in Alpharetta . These loans are designed to cover living expenses, medical bills, and other costs while the plaintiff awaits the resolution of their case.

FundFinance.net’s service is accessible and easy to apply, with a straightforward application process that can be completed online or over the phone. The company evaluates the case’s potential for success, determining the amount of funding the plaintiff may be eligible for.

Personal injury lawsuit loans are non-recourse, meaning repayment is contingent upon the plaintiff winning their case. FundFinance.net disburses funds quickly, often within a few days, allowing plaintiffs to address immediate financial needs without delay. Throughout the case, FundFinance.net maintains communication with the plaintiff and their legal team to ensure they are prepared to assist with any additional funding needs.

Highlights:

- FundFinance.net offers quick financial help for Alpharetta’s personal injury cases.

- Apply online or by phone with basic case and financial details.

- Get money fast, typically within days of approval.

- Stay connected for ongoing assistance throughout your case.

Eligibility Criteria:

- Candidates have to be Alpharetta residents.

- Age must be at least 18.

- Verification of stable income should be presented.

- At the time of financing, an active bank account in their name.

Loan Details:

- Loan Amount: Subject to individual circumstances and lender rules.

- Loan Rate: Competitive rates

- Approval Time: Fast Approval Rate

Procedure:

- Complete the online application form.

- The platform then matches applicants with the available loan options.

- After a thorough examination, the lender has the final say in granting.

- Funds are transferred immediately to the borrower’s bank account upon approval.

Eligibility Criteria for Personal Injury Lawsuit Loans in Alpharetta

Following are the eligibility criteria needed to avail of a Personal injury lawsuit loans in Alpharetta . If anyone is planning to avail loans from any of the above-mentioned lenders make sure to check the eligibility criteria before going through with the loan process.

- Residency: In order for applicants to be considered for personal loans from local lenders, they must reside in Alpharetta.

- Age: For a personal loan to be approved, borrowers must be at least eighteen years old.

- Income: Lenders usually expect applicants to provide a steady source of income as proof that they can repay the loan.

- Credit History: While consumers with less-than-perfect credit may still be considered by some lenders, loan terms and eligibility may be affected by a solid credit history.

- Debt-to-Income Ratio: Lenders use the debt-to-income ratio to assess a borrower’s ability to responsibly manage additional debt.The loan application process.

- Employment Status: In order to demonstrate their financial stability, candidates must submit documentation of their employment or a stable income.

- Collateral: Depending on the lending company and loan size, a car or other piece of property may be required as collateral to secure the loan.

- Documentation: Typically, as part of the application process, candidates must provide identification, proof of domicile, income verification, and other relevant documentation.

- Legal Capacity: In order to sign a loan agreement, borrowers must be able to act lawfully; they cannot be incapacitated or in any other way unable to sign.

Conclusion:

In conclusion Personal Injury Lawsuit loans In Alpharetta , Alpharetta residents in need of loans can apply to any of the aforementioned lenders to meet their financial requirements. With streamlined application processes, swift funding, and a commitment to supporting plaintiffs throughout their legal journey, these lenders offer vital assistance during challenging times.

Whether covering medical expenses, living costs, or other necessities while awaiting case resolution, individuals can find reliable support from these reputable institutions. By partnering with lenders specialising in personal injury loans, plaintiffs can navigate their legal battles with greater ease and confidence, knowing that financial assistance is readily available to help them pursue justice.

FAQs:

Q1. Are lawsuit loans worth it?

A1. Yes, they are worth it. Choose from lenders like 50kLoans.com, LoanRaptor.net, 24MLoans.com, SuperPersonalFinder.com, and FundFinance.net for personal lawsuit loans.

Q2. Can I get a loan if I have a settlement?

A2. Yes, if you are in the middle of a lawsuit, you can definitely get a loan against your settlement amount.

Q3. Which is the best settlement loan company?

A3. The best settlement loan company is 50kLoans, along with the other 4 loans mentioned in this article.

Q4. What is the interest rate on settlement loans?

A4. The interest rate on settlement loans depends solely on the lender but can be around 60 percent per annum.

Disclaimer: Rather than acting as direct lenders, the aforementioned platforms are loan-matching businesses that link borrowers with possible lenders. While they facilitate the borrower-lender connection process, they do not guarantee loan approval, as various factors, such as creditworthiness and lender requirements, influence loan availability and approval.

The information is not meant to be financial advice; rather, it is only meant to be informative. It is strongly recommended that readers seek personalised guidance from a professional financial advisor to address their specific financial concerns. Additionally, eligibility for the loans mentioned is limited to US citizens.