Auto Title Loans In Dallas Tx

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xDallas, situated in the heart of Texas, USA, boasts a lively atmosphere and robust economy. Known for its cultural diversity and rich history, the city offers an array of attractions, from top-notch dining to entertainment venues. Additionally, Dallas features numerous parks and outdoor recreational spaces, perfect for leisure activities and family outings. With a dynamic job market and thriving business scene, Dallas is a hub of opportunity for residents and visitors alike.

Auto Title Loans In Dallas Tx: Quick Look

If you’re in Dallas, Texas, USA, and considering a loan, check out the article “Auto Title Loans In Dallas Tx,” which reviews the top five auto title loan lenders in the USA. Keep reading to learn about their features.

Many people seek loans when they need money for different reasons. It could be for a single or multiple purposes. Loans are borrowed from lenders based on certain terms and conditions. Auto title loans enable individuals to utilize their vehicle titles as security to secure loans. By making monthly payments over time, the loan can be paid off, and the automobile becomes completely owned again.

Top 5 Auto Title Loans In Dallas Tx Providers

5 Best Auto Title Loans In Dallas Tx Providers

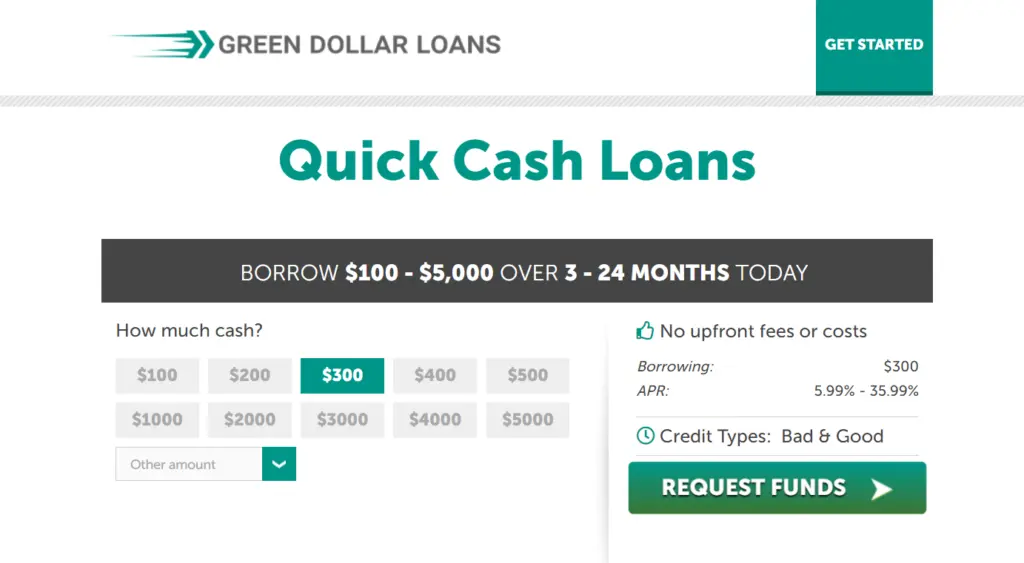

1. Green Dollar Loans

Ready to take charge of your financial future? Join forces with Green Dollar Loans for speedy and efficient financial assistance. At Green Dollar Loans, our dedicated team is devoted to assisting you in finding the ideal loan solution customized to your specific needs. Bid farewell to financial concerns and welcome a brighter tomorrow with us by your side.

Highlights:

- Experience a hassle-free application process with Green Dollar Loans, ensuring convenience.

- Utilizes your automobile’s value to swiftly access cash with a straightforward loan process.

- Advanced security measures protect your personal information, guaranteeing privacy.

- Access multiple lenders with ease, simplifying the borrowing process.

Eligibility:

- Applicants must be 18 years of age or older.

- Minimum monthly income requirement of $1,000.

- Documentation such as Proof of Address, Income, and Identification is mandatory.

Loan Details:

- Borrow amounts range from $100 to $5,000, with flexible rates tailored to individual needs.

- Swift approval within 24 to 48 hours, ensuring timely access to funds.

Application Procedure:

- Visit greendollarloans.net to start your application.

- Complete the application form accurately and submit it.

- Upon approval, funds will be disbursed within 2 business days.

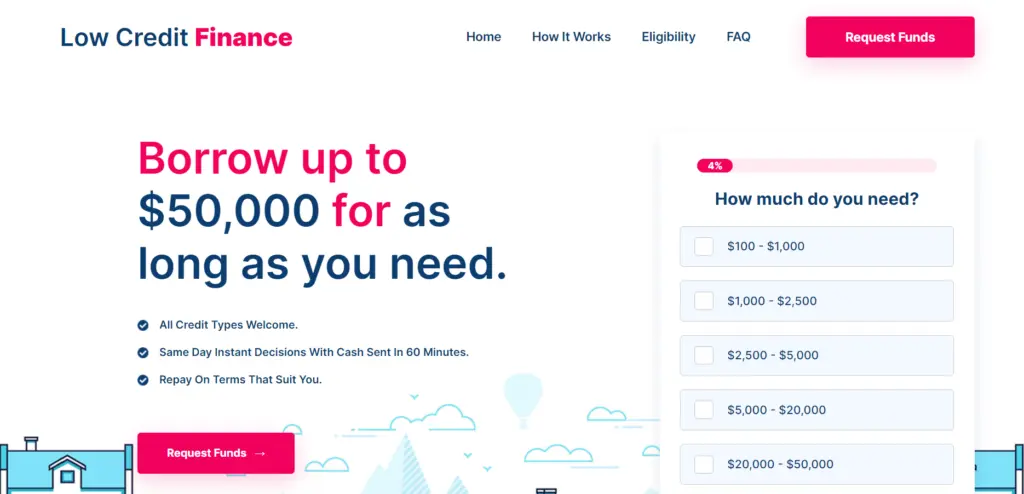

2. Low Credit Finance

Don’t let financial challenges slow you down. Partner with Low Credit Finance for quick and reliable financial solutions. Our straightforward process and competitive rates make borrowing a breeze. Seize command of your financial journey and open doors to endless opportunities with Low Credit Finance at your service.

Highlights:

- Enjoy a seamless application process with Low Credit Finance, designed for ease of use.

- Experience transparency and ease as you access cash quickly using your car’s value.

- Stringent security measures protect your data, ensuring confidentiality.

- Get access to multiple lenders effortlessly with a single click, simplifying the borrowing process.

Eligibility:

- A minimum monthly income of $1000 is required.

- At least 90 days of employment or proof of stable alternative income.

- Applicants must be at least 18 years old and either US citizens or permanent residents.

- Additionally, valid email addresses, work, and home phone numbers are required for the application process.

Loan Details:

- Loan amounts range from $100 to $50,000, with the Auto Title Loans In Dallas Tx rate typically determined by the lender based on the loan amount.

- Approval time varies depending on the loan value.

Application Procedure:

- Website: lowcreditfinance.com

- You must complete an online application and await approval.

- Following approval, you can anticipate the transfer of funds within two days.

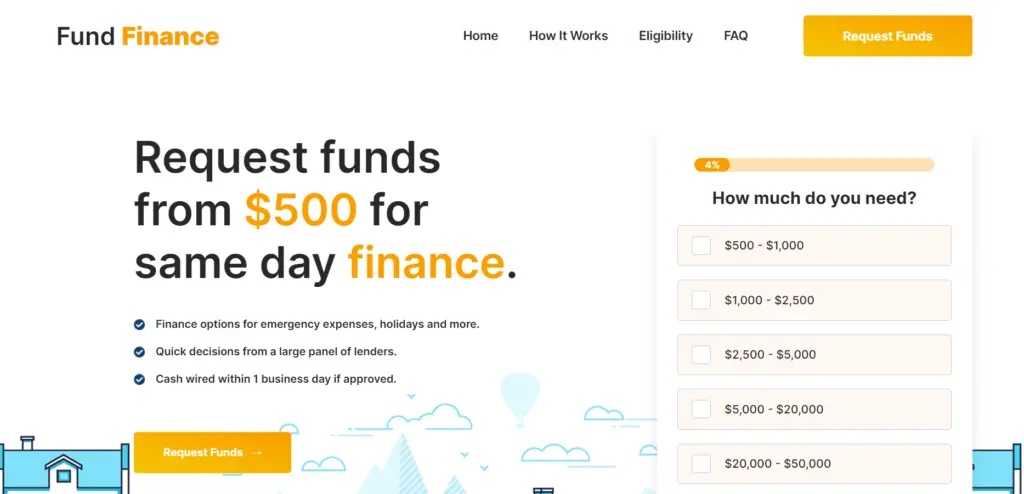

3. Fund Finance

Need money now? Look no further than Fund Finance for instant financial relief. Experience financial stability and certainty with Fund Finance, where our efficient platform seamlessly links you with reputable lenders. Bid farewell to financial uncertainty as we provide swift access to the funds you require, empowering you to tackle any financial challenge with confidence.

Highlights:

- Experience a hassle-free application process with Viva Payday Loans, ensuring convenience.

- Advanced security measures protect your personal information, guaranteeing privacy.

- Navigate the platform effortlessly to access comprehensive solutions and transparent terms for your borrowing needs.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- During the application process, you’ll need to submit supporting documents like proof of address, proof of income, and a valid ID.

Loan Details:

- The loan offerings range from $500 to $50,000.

- Carefully consider the interest rates provided by the lender while applying.

- Penalties apply for delayed or missed payments.

Application Procedure:

- Website: fundfinance.net.

- You must complete an online application and await approval.

- Following approval, you can anticipate the transfer of funds within two days.

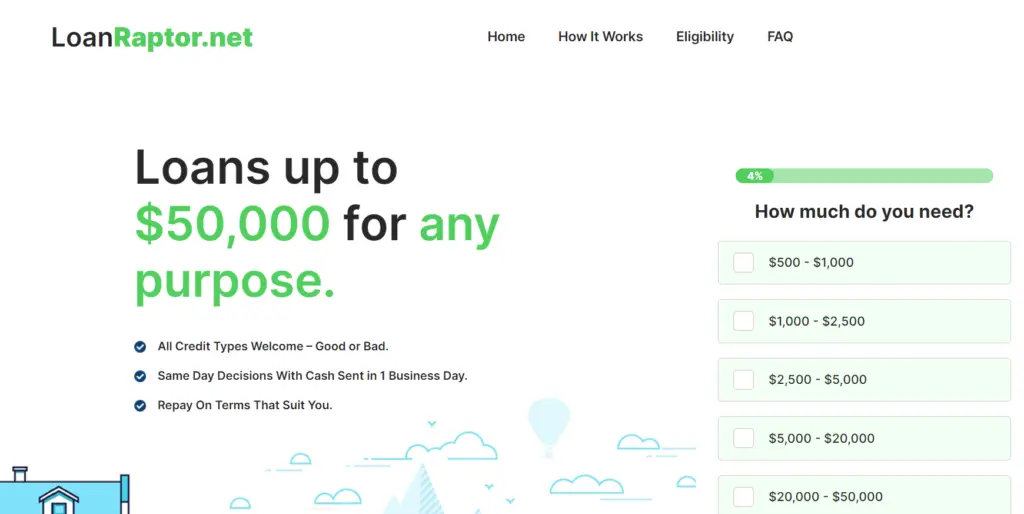

4. Loan Raptor

Don’t let financial hurdles hold you back from reaching your goals. With Loan Raptor, you can blast through obstacles and achieve financial success. Our streamlined process and personalized loan options make borrowing simple and stress-free. Begin your path to a brighter future today by teaming up with Loan Raptor.

Highlights:

- Exhibits financial prowess through flexible Auto Title Loans In Dallas Tx at competitive rates.

- Guarantees personalized lending experiences with dedicated one-to-one service.

- Tailors services to prioritize customer needs, ensuring a seamless and satisfactory journey.

Eligibility:

- Age Verification: Must be 18 years or older.

- Income Requirement: Minimum monthly income of $1,000.

- Documentation Needed: Provide proof of address, proof of income, and valid identification for verification.

Loan Details:

- Loan Amount Range: Borrow anywhere between $500 and $50,000.

- Loan Rate Determination: The interest rate is set by the lender and depends on the loan amount.

- Approval Time Variation: Approval time varies based on the loan value.

Application Procedure:

- Website: loanraptor.net.

- Complete Application Form: Locate the application form and follow the provided instructions.

- Upon approval, anticipate receiving the funds in your account within the following 48 hours.

5. 50k Loans

Facing unexpected expenses? Let 50k Loans be your financial lifeline. Our lightning-fast approval process and competitive rates ensure you get the funds you need without delay. Bid farewell to financial worries and welcome tranquility with 50k Loans as your trusted companion.

Highlights:

- Experience simplicity and transparency in borrowing as you utilize your car’s value for cash.

- Borrowers can leverage their vehicle’s title as collateral, tapping into a valuable financial asset.

- Get access to comprehensive solutions and transparent terms through our simplified application process.

Eligibility:

- Age Verification: Must be 18 years or older.

- Income Requirement: Minimum monthly income of $1,000.

- Documentation Needed: Provide proof of address, proof of income, and valid identification for verification.

Loan Details:

- Loan Amount Range: Borrow anywhere between $500 and $50,000.

- Loan Rate Determination: The interest rate is set by the lender and depends on the loan amount.

- Approval Time Variation: Approval time varies based on the loan value.

Application Procedure:

- Website: 50kloans.com.

- Locate the application form and follow the provided instructions.

- Upon approval, anticipate receiving the funds in your account within the following 48 hours.

How To Finalize Your Auto Title Loans In Dallas Tx Transaction?

1. Thoroughly Review the Agreement:

Before committing to an Auto Title Loans In Dallas Tx, ensure you understand its terms, conditions, and associated fees. Take the time to carefully review the agreement and seek clarification if needed.

2. Sign the Agreement:

Once you’re satisfied with the terms, proceed to sign the agreement. Your electronic signature confirms your acceptance of the terms, making the loan arrangement official.

3. Follow Disbursement Instructions:

After signing, follow the provided instructions for a smooth disbursement process. Funds will be promptly transferred to your designated account, providing access to the loan amount as needed.

The entire process may last for a day or two, and Auto Title Loans In Dallas Tx borrowers are expected to wait patiently for the funds to be disbursed.

Conclusion:

To conclude, Auto Title Loans In Dallas Tx is one of the easy options for the citizens of Dallas Tx without compromising on any assets other than your automobile. For quick and immediate relief of stress owing to financial imbalance, consider approaching any one of the leading 5 lenders mentioned in this article and choose your freedom!

FAQs:

Q1. Why should I consider Auto Title Loans In Dallas Tx?

A1. Auto Title Loans In Dallas Tx offer a convenient solution for individuals facing unexpected expenses or financial emergencies by using automobiles as collateral.

Q2. What factors should borrowers in Auto Title Loans In Dallas Tx consider when choosing Auto Title Loans?

A2. Borrowers in Dallas Tx should consider interest rates, repayment terms, and the lender’s reputation when choosing online payday loans. Additionally, evaluating the loan amount, fees, and the transparency of the application process is crucial.

Q3. Can I avail of an Auto Title Loan in Dallas Tx if I have bad credit?

A3. Certainly! The five leading lenders suggested in this article also consider customers with bad and poor credit since only your automobile is here used as collateral. Hence, do not worry about your credit, but do make efforts to clear your debts at the earliest and improve your credit.