$20000 Quick Loan No Credit Check

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xA $20000 Quick Loan No Credit Check can be a lifesaver in an emergency. But traditional lenders might not be the answer if your credit score could be better. This guide explores alternative loan options that might consider your situation beyond a credit score.

We will explore lenders who focus on factors like income, employment history, and bank statements to determine eligibility. By the end, you will be equipped to find the right lender for a fast and secure loan with no credit check.

Top 5 Options for $20000 Quick Loan No Credit Check

Best 5 Options for Quick Loan No Credit Check

1. Loan Raptor

Loanraptor.net can help you quickly and simply get the money you need. They provide $500 to $50,000 personal loans with an easy application procedure. They are a well-liked option for consumers because of their extensive network of lenders and effective online approval process. Each loan arrangement is customised for you based on your credit history and specific circumstances.

Highlights:

- Borrow between $500 and $50,000 to cover your personal needs.

- Suitable for borrowers with all credit types, offering competitive rates.

- Receive your loan within one business day after approval.

Loan details:

- Loan Amount: $500 to $50,000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility Requirements:

- Maintain a regular job with a minimum monthly income of $1000.

- Possess a steady source of income, such as employment.

- Must be at least 18 years old.

- Be a legal citizen of the United States.

Application Process:

- Fill out the easy loan request form on Loanraptor.net.

- The platform connects you with a suitable lender who might require additional verification for approval.

- The lender will provide the exact loan details, including interest rates and repayment terms.

- The loan amount is often deposited electronically into your bank account upon approval.

2. 50k Loans

50k Loans is different from your ordinary lender. It is a respected community partner dedicated to fostering local economic development, providing quality loans, and revitalising residents. 50k Loans achieves this by giving exceptional loan options at competitive rates.

Highlights:

- 50k Loans offers a variety of loan products and investment opportunities, along with valuable business consulting services to help you achieve your goals.

- Their loans help you overcome traditional capital limitations, fueling your business growth.

- Their loans feature flexible repayment plans with manageable installments, making it easier to manage your debt.

Loan details:

- Loan Amount: $500 to $50,000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility:

- A valid checking account in good standing

- Proof of employment, including a minimum of two recent pay stubs and a job verification letter

- A valid government-issued ID

- To be at least 18 years old

Application Process:

- Before applying, carefully review the loan terms outlined on 50k Loans.

- Complete a short and simple online loan application by entering the necessary personal data.

- After quickly examining your application, they provide you with a final loan offer.

- Your authorized loan money will be instantly paid into your active checking account within 24 hours of your acceptance of the offer.

3. 24M Loan

Need a financial boost? Look only as far as 24m Loan, a reliable and transparent loan lender-connecting platform. We understand unexpected expenses can happen and aim to simplify the loan process for you.

Through 24M Loan, you can access various loan options, including cash advances and installment loans, all conveniently available online. Our user-friendly platform allows you to find suitable lenders with flexible repayment terms, even if you have less-than-perfect credit.

Highlights:

- Apply for a loan in minutes and receive a decision fast.

- They connect you with lenders who offer loan options that may not require a traditional credit check.

- Access cash advances or installment loans to fit your specific needs.

Loan Details:

- Loan Amounts: $500 to $50,000

- Repayment Options: 3 to 24 months

- Interest Rates: 5.99% to 35.99% APR (Annual Percentage Rate)

Eligibility Requirements:

- Be at least 18 years old

- Have a verifiable source of income

- Possess a valid checking account for receiving and repaying the loan

Application Process:

- Visit the 24M loan website and complete the quick online application.

- Get matched with a suitable lender and review their loan offer.

- If the terms align with your needs, carefully review and sign the loan agreement.

- Upon approval, receive your loan funds quickly.

4. Super Personal Finder

Do you need assistance getting a $20000 Quick Loan No Credit Check since your credit isn’t perfect? Super Personal Finder is able to assist! They link clients with lenders that provide loans that are appropriate for their requirements. With an emphasis on security and transparency, the platform is easy to use and made to streamline the loan application process for both lenders and borrowers.

Highlights:

- They act as a bridge, connecting you with lenders who fit your credit situation well.

- Collaborating with lenders, they offer repayment plans that work for your budget.

- There are no hidden fees for using Super Personal Finder’s’ platform.

- They consider applications regardless of credit score.

Loan Details:

- Loan Amount: $500 to $50,000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility Requirements:

- Be at least 18 years old

- Have a valid checking account in the US or Canada

- Have a functional cell phone number and email address

- Have a government-issued ID

- Demonstrate a reliable source of income

Application Process:

- Fill out the online application on Super Personal Finder’s website.

- Provide any documents requested by the lender you’re matched with.

- Examine the loan agreement carefully and sign it if it is accepted.

- Get your money upon successful loan approval.

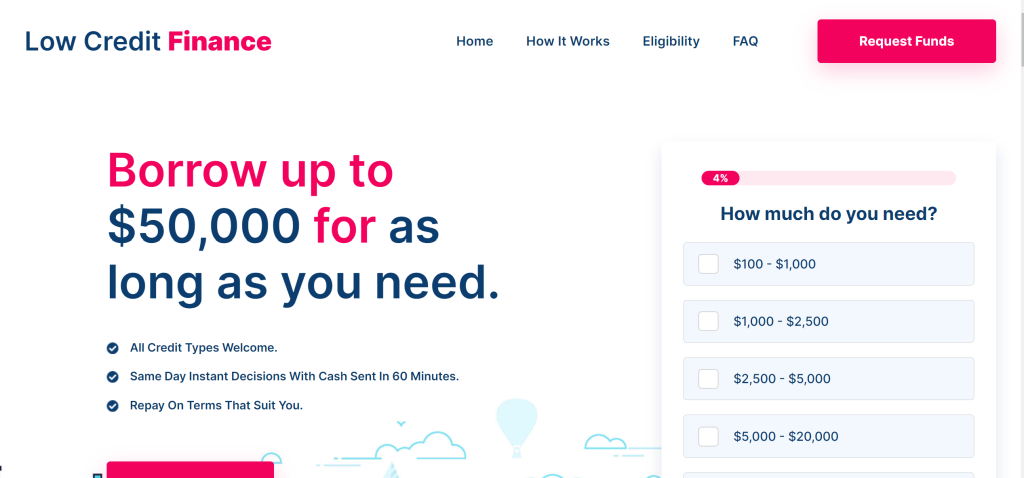

5. Low Credit Finance

For consumers with poor credit, Low Credit Finance provides an alternative to traditional lenders. Their technology links you with a network of lenders rather than just one, improving your chances of finding a suitable fit. The application procedure is meant to be simple and quick.

Highlights:

- Submit a quick and simple online application.

- Receive a swift response to your loan request.

- There are no hidden platform fees – you only pay the interest rate your lender sets.

- Offering loan approvals based on various eligibility factors.

Loan Details:

- Borrow between $100 and $50,000.

- Repay your loan within 3 to 48 months.

- Interest rates range from 5.99% to 35.99%, set by your chosen lender.

Eligibility Requirements:

- Be at least 18 years old.

- Have a steady income stream exceeding $1,000 per month.

- Possess fair credit.

Application Process:

- Complete a quick online loan request form on Low Credit Finance.

- The lender reviews your application.

- Electronically sign the loan agreement provided by your chosen lender.

- Receive your loan funds.

- Repay the loan amount on your next payday.

Getting a $20000 Quick Loan with No Credit Check

While the specific process might differ slightly between lenders, securing a personal loan with fair credit is generally straightforward. Here’s a simplified breakdown:

1. Know Your Score

It is important to know your credit score. It assists you in comprehending the types of loans and interest rates that you may be eligible for. Look for mistakes on your credit report and file a dispute if needed.

2. Quick and Easy Application

Many lenders, including the lenders mentioned earlier, offer quick and easy online applications.

3. Soft Credit Checks for Pre-qualification

Some lenders use soft credit checks to assess your eligibility. These checks don’t affect your credit score, making them ideal for those with fair credit who are cautious of further damaging their score.

Conclusion:

$20000 Quick Loan No Credit Check. This guide optimises your search by emphasising important features of personal loans for applicants with fair credit. With information about each lender that is easily accessible, you may evaluate your alternatives and select the one that best meets your requirements.

FAQs:

Q1. Easiest Loan to Get with Bad Credit?

Obtaining a personal loan with bad credit shouldn’t be too difficult with the lenders mentioned earlier.

Q2. Approval Chances for a $20,000 Loan?

For larger loans ($20,000 or more), a higher credit score (ideally 600 or above) might be necessary for approval and securing the best interest rates.