Online Payday Loans In Texas

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xTexas the Lone State is an economically vital state rich in culture and so are the lives of its people. In the robust economy of Texas, its people often found themselves with short-term financial needs.

In the bustling urban centers of Texas, we have compiled the Best Online Payday Loans In Texas that every Texan needs. Here are the best online payday loans in Texas that are specially designed for the credit needs of the people of Texas.

5 Best Online Payday Loans In Texas: Lenders

Top 5 Best Online Payday Loans Provider

1. Low Credit Finance

Low Credit Finance is a platform that is as inclusive as Texas in its approach. Its online payday loan options are inclusive and accessible. Their major focus is on affordability to provide relief to the people of Texas.

Highlights:

- Affordable rates

- Inclusive approach

- No hidden charges

Eligibility Criteria:

- Individuals applying for our services must be a minimum of eighteen years old.

- Applicants are required to furnish a verified identity card during the application process, contributing to the security and authentication of their personal information.

- These services are exclusively available to individuals who hold American citizenship.

Application Process:

- Visit the official website of Low Credit Finance and submit the online application form.

- Upload your details as requested and specify an amount you want to borrow. Your loan request will be sent to multiple lenders for further review.

- After a lender approaches your loan request, you will be sent an offer. Go through the loan offer carefully before accepting the agreement.

2. Jungle Finance

In the vast, dynamic land of Texas, Jungle Finance is a reliable choice to guide your finances. With the innovative features of their online payday loans, Jungle Finance provides swift fund access to the people of Texas with convenience.

Highlights:

- Easy process

- Advanced features

- Active customer support

Eligibility Criteria:

- Prospective applicants must confirm their citizenship status, specifying that they are legal residents of the United States.

- The applicants must be above the age of eighteen.

- Applicants must have an active bank account under their name.

Application Process:

- Complete the form on Jungle Finance and upload your information.

- Your profile will be analyzed by the lenders

- After your application is approved, you can transfer the money into your account.

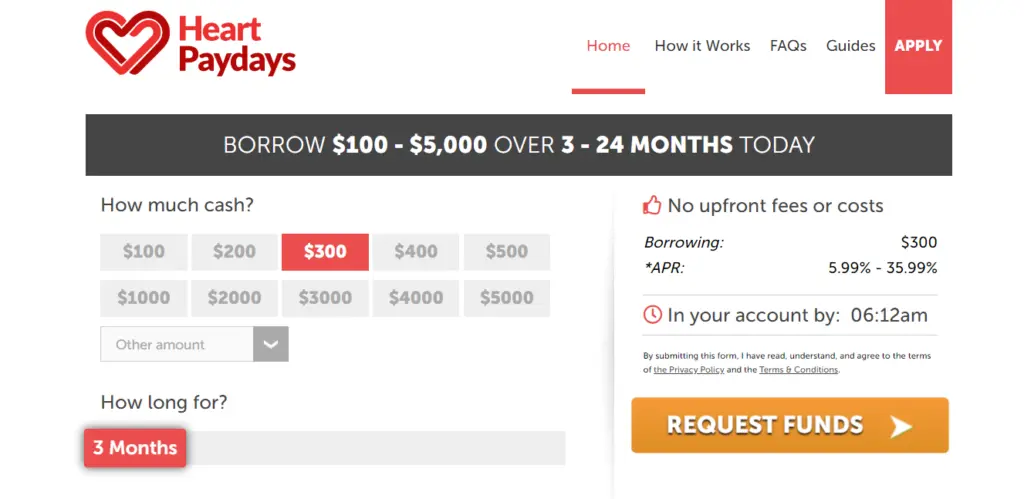

3. Heart Paydays

Just like the steady beat of the heart, steady financial solutions often need funds as quickly as your heart beats. Heart Paydays understands this concern and that’s why they offer quick online payday loans in Texas. Their platform has a streamlined application process where you can receive approvals within a business day or two.

Highlights:

- Swift fund access

- Approvals within hours

- Quick application process

Eligibility Criteria:

- Individuals are obligated to furnish credible proof of their income.

- Only individuals holding American citizenship are eligible to apply for these services.

- Applicants must be aged eighteen or above to be considered eligible.

Application Process:

- Contact Heart Paydays using their official website.

- Await the lender’s decision on your loan application.

- Once your application is approved, you can request the disbursement of funds directly into your account.

4. 50K Loans

50K Loans is a place for people who are looking for a little more in Texas. This platform provides funds for diverse needs ranging from fixing your car to having medical expenses. Their services resonate with the needs of the people of Texas.

Highlights:

- Large amount loans

- Secure transactions

- No extra charges

Eligibility Criteria:

- During the application process, applicants must present a verified address of communication.

- Only applicants above eighteen can avail of these services.

- Applicants are required to present valid proof of American citizenship.

Application Process:

- Fill out a quick form on the website of 50K Loans.

- Choose a loan amount as per your requirements.

- After a lender approves your application, you will receive the money within hours.

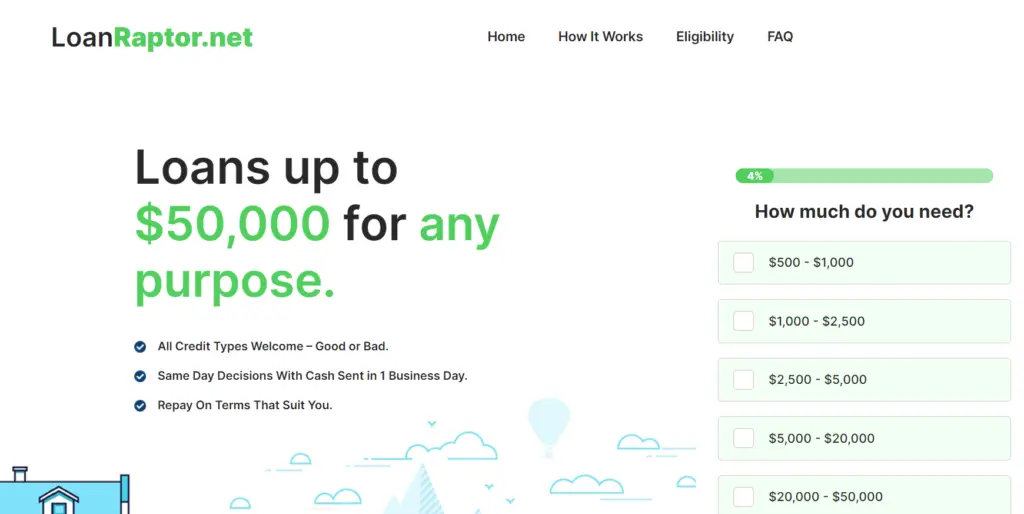

5. Loan Raptor

When financial situations need swift assistance, there comes Loan Raptor flying in Texas to provide relief to its people. Its platform offers the facility of quick approvals within the same business day to aid your urgent fund needs.

Highlights:

- Seamless borrowing

- Funds disbursement within the same day

- Swift approvals

Eligibility Criteria:

- Applicants must be eighteen or above in age.

- Applicants must be permanent residents of the USA.

- As part of the application process, applicants are required to provide verifiable proof of income.

Application Process:

- Fill in the required details on Loan Raptor’s official website form.

- Once submitted, await the lender’s assessment of your profile and the subsequent issuance of a loan offer.

- Carefully review the terms presented in the loan offer before proceeding to access the funds, if you find them acceptable.

How to deal with repayment challenges

Repaying the online payday plans requires responsible planning. At times, things can go unexpectedly wrong and you may end up with nothing in your hands. But as you know late repayments can lower your credit score you need to be prepared.

1. Understand and explore the repayment schedule

Have a thorough discussion with your lender about the consequences of late repayments. Some lenders impose penalties of varying rates. Explore alternative options you can use in tough situations when you fail to repay the installments.

2. Plan your finances

Prepare a realistic financial plan for your income and expenses. Look for the expenses you can cut down to save more to make safety funds for emergency use.

3. Seek financial counseling

There are many websites available online that provide financial advice free of cost. You can seek help from these websites or other available financial tools to assist you in managing your financial conditions.

4. Don’t Rollover loans

Do not get caught in the trap of rolling over loans. This may look like a temporary solution, but it is most likely to turn into a long-term debt trap which will be very difficult to escape later.

5. Choose wisely

Choosing your lender wisely is a very important aspect of your borrowing experience. Select a lender that offers terms synching with your financial conditions. You can also look for lenders who offer the facility of extending the repayment timeline if you fail to repay on time.

Always remember communication is the key. Openly communicate with your lender about the repayment terms and options before entering into the loan agreement.

Conclusion:

In wrapping up our exploration into the world of the finest Best Online Payday Loans In Texas, it’s evident that these financial tools, when used judiciously, can offer swift and convenient relief during times of urgent need. However, successfully navigating this landscape demands vigilance, responsibility, and a clear understanding of the associated terms.

Texans seeking online payday loans should prioritize lenders known for transparent practices, reasonable terms, and adherence to state regulations. Recognizing the diverse financial needs across the expansive state of Texas, borrowers must carefully select lenders that align with their unique circumstances.

Ultimately, the most reliable online payday loans in Texas are those that address immediate needs without compromising long-term financial well-being. While online payday loans can serve as crucial support for unexpected expenses, it’s paramount to approach them as short-term solutions. By remaining informed and exercising financial prudence, Texans can confidently navigate the online lending space, accessing the assistance they need while safeguarding their financial health for the future.

FAQs:

Q1. Is my personal information safe with online payday loans?

A1. Choose lenders who use encrypted security systems to safeguard your sensitive data.

Q2. How can I avoid online scams in payday loans?

A2. Always look for verified lenders who are licensed by the state to participate in the lending business.

Q3. I have a bad credit score can I get an online payday loan in Texas?

A3. All the above-mentioned lenders offer loans with bad credit in Texas. For more guidance on yoal profile, you can contact the lenders directly.

Disclaimer: The information provided in this article regarding the best online payday loans in Texas is intended solely for general informational purposes and should not be considered financial advice. It is strongly recommended that readers conduct their ownearch or seek personalized financial guidance tailored to their specific situations.

While every effort has been made to ensure the accuracy and relevance of the information, it is important to recognize that the financial industry is dynamic, and regulations may undechangeerefore, readers are advised to verify the current laws and regulations governing Best Online Payday Loans In Texas before making any financial decisions.

This disclaimer emphasizes that the information is for general informational purposes and encourages readers to conduct their research or seek personalized financial guidance. It is advisable to verify the current laws and regulations governing Best Online Payday Loans In Texas before making any financial decisions.