Personal Loans In FintechZoom

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xIn today’s fintech era, the world is evolving around the financial realm and individuals have been demanding better tech solutions regarding financial matters. Personal Loans In FintechZoom has become the easiest solution for those seeking urgent money. FintechZoom comes with multiple benefits with the digital revolution in banking services. Therefore, individuals these days opt for FintechZoom when borrowing loans or using the application for other financial matters. However, every sparkling app has limitations, and thus individuals acquire the urge to find alternatives.

There are other smarter solutions for individuals seeking financial assistance in the digital realm. There are online platforms that can compete with Personal Loans In FintechZoom in matters related to finance and banking. We will be discussing over here some of the best applications that work on online mode, pricing first-class experience to its customers associated with finance.

These applications are truly a game-changer for your loan requirements. You can use the applications below to make better financial decisions and achieve your goals.

5 Best Personal Loans Providers against FintechZoom

Top 5 Lenders Of Personal Loans In FintechZoom

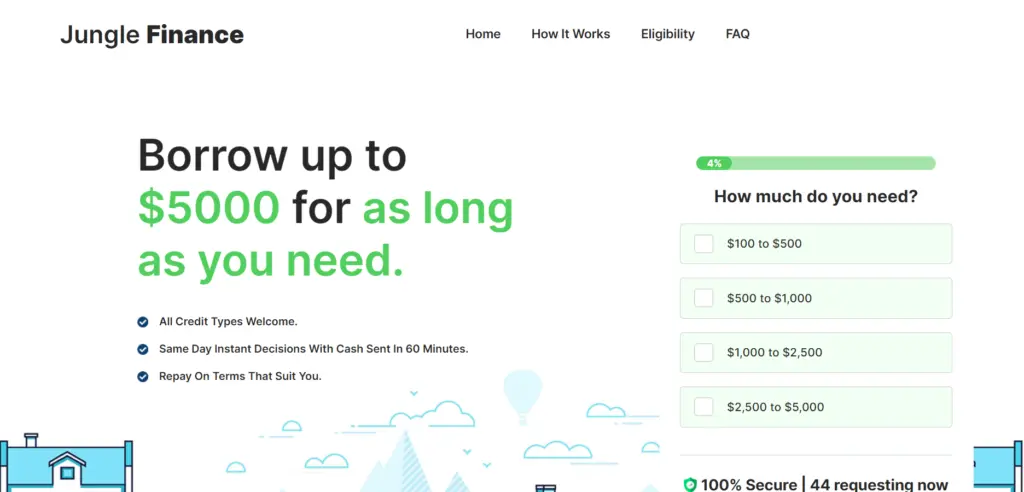

1. Jungle Finance

Personal loans are easy to borrow because of their less complicated paperwork and usage of loan amount norms. Unlike business loans, personal loans are offered to individuals without setting any sort of restriction for the usage of the loan amount. It could be either used for educational or medical purposes. The usage of personal loan amounts depends on the borrower. The same notion is visible in the personal loan that is offered by Jungle Finance. The approval process takes hardly around 2 days through the platform for personal loan requests.

Jungle Finance has educational content on its website page with free access to its customers. The informative content helps customers to gain comprehensive knowledge of financial matters at their best. Through adequate knowledge, an individual becomes capable of making better decisions for managing their budget and other financial matters.

Eligibility:

- The phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount ranges from $100–$5,000.

- The lender fixes the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link junglefinance.com

- The application form needs to be filled up.

- Funds transfer takes place on the same business day.

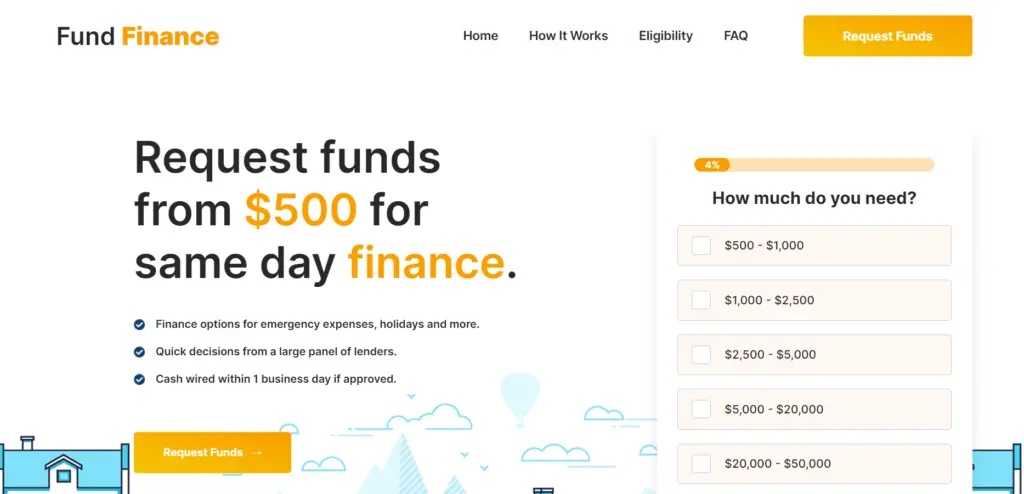

2. Fund Finance

Fund Finance helps customers seeking personal loans to meet the best of financiers across the world. These financiers are highly knowledgeable in financial matters. Therefore, apart from connecting with these financiers for loan requests, individuals can also take valuable suggestions on handling finance. This platform offers access to an easy-to-use interface to its customers for completion of the application form for Personal loans In FintechZoom. There is a wide range of amounts that one can choose from regarding personal loans.

This online financial platform also holds a customer service team that is supportive and helpful. For instance, if any layperson is finding it difficult to understand a matter in the application form, the team of service stands along throughout to resolve it. The best feature of the platform is the 24*7 customer service. Unlike traditional banks, customers do not have to wait for limited hours for banking services.

Eligibility:

- The phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- The loan amount covers amounts from $500–$50,000.

- The lender fixes the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link fundfinance.net

- The application form needs to be filled up.

- Funds transfer takes place on the same business day.

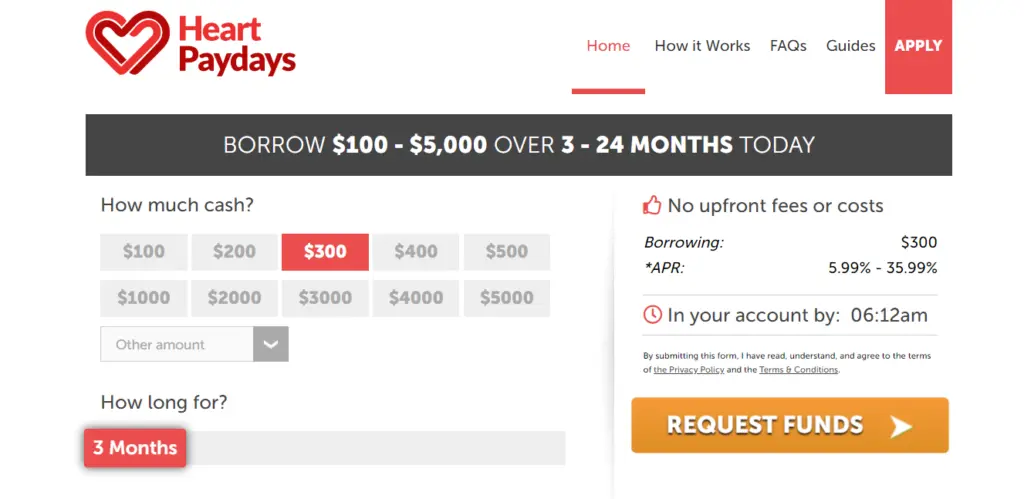

3. Heart Paydays

Heart Paydays is another platform that stands on the top rank against for providing Personal loans in FintechZoom. This platform offers all its premium features to its customers for free. Unlike traditional or standard banking platforms, this application welcomes all FICO score individuals. It means even if you have a very low credit score, you can still apply for a bad credit personal loan from this application.

Heart Paydays helps customers to gain knowledge on personal loan terms and conditions, payment structure, interest rates, and more through its educational content on the website. This platform has a bad credit loan option for individuals who want to improve their credit score by repaying the bad credit personal loan on time.

Eligibility:

- The phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- The loan amount covers around $100 to $5,000.

- Lenders fix the interest rate.

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link Heartpaydays.com

- The application form needs to be filled up.

- Funds transfer takes place on the same business day.

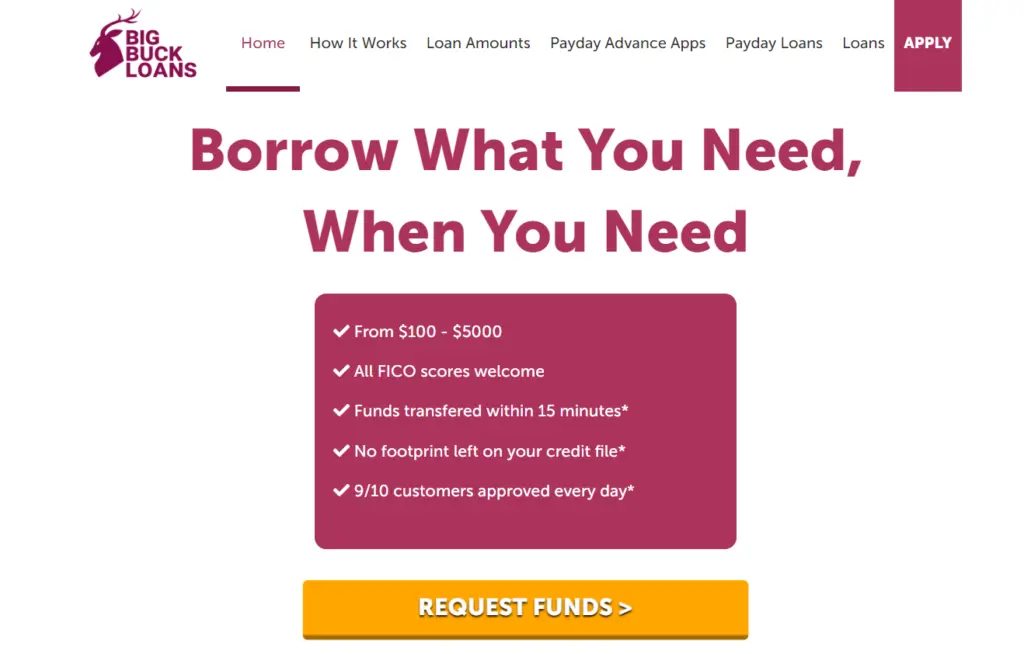

4. Big Buck Loans

Big Buck Loans is a platform in this fintech era that enhances your knowledge regarding finance through better content on the website. This financial platform offers a range of personal loan options for all credit score individuals. You can also check out its range of financier’s contacts for free. You can connect with the lenders to discuss your loan request and term plan along with the rate of interest. Moreover, gain some financial help through the financiers regarding the maintenance of the budget.

This financial application also has technical tools like credit check which allows you to check your credit score from time to time. It allows you to improve your score through suggestions mentioned in the monthly credit score report. Moreover, a bad credit loan allows you to improve your score by paying the amount strictly on time without skipping any payment on the due date.

Eligibility:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- The loan amount covers around $100 to $5,000.

- Lenders fix the interest rate.

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Go to the website through the link bigbuckloans.net

- The application form needs to be filled up.

- Funds transfer takes place on the same business day.

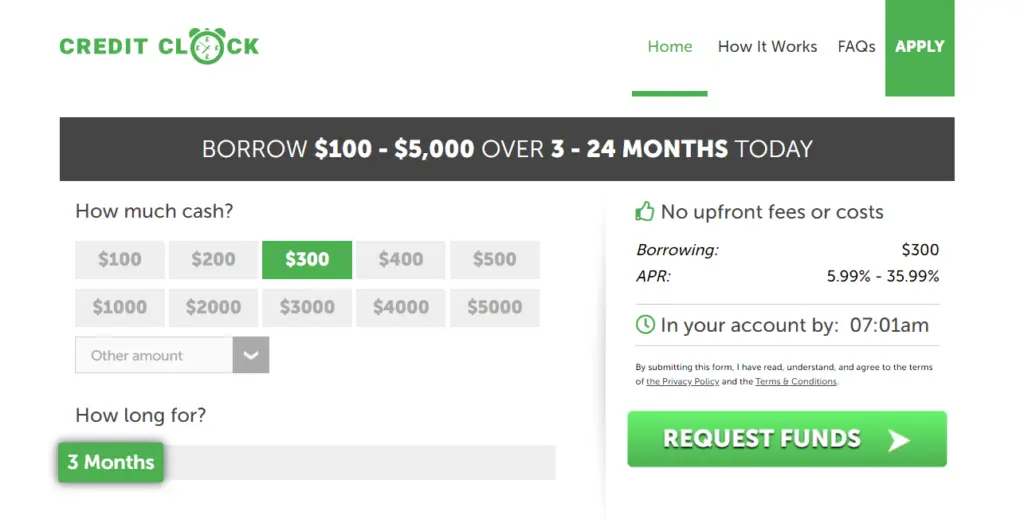

5. Credit Clock

Credit Clock is also a great competitor of FintechZoom for its technical tools. Personal loans in FintechZoom allows users to achieve their financial goals by offering a budget calculator. However, if you want to use a budget calculator for free, then Credit Clock is the right platform for you. This online platform helps you to keep track of your expenses and income in a better manner.

You can also try your hands on the credit score checker of Credit Clock for free. Any individual would love to choose a platform that offers the same features but for free. The website of Credit Clock runs from the funds received from financiers. Financiers pay funds because of the service this platform offers to them by connecting Personal loans in FintechZoom seekers to lenders. Credit Clock has a wide range of loan amounts available for individuals to choose from.

Eligibility:

- Active phone number.

- Bank account number that is active.

- Identification proof is a must to have a document.

Details on loan acceptance:

- The loan amount covers amounts from $500–$50,000.

- The lender fixes the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link creditclock.net

- The application form needs to be filled up.

- Funds transfer takes place on the same business day.

Personal Loans from Platforms like FintechZoom: How Technology Helps?

There is a significant contribution of technology in delivering swift and smooth lending of money for customers through platforms like Personal Loans in FintechZoom. Let us find out how technology helps:

- Technology advancement in loan lending has improved through the smooth application process. It helps platforms to speed up the loading process and offers a user-friendly interface.

- Advanced data analytics is used in fintech platforms like Personal loans in FintechZoom, is an online application that helps borrowers by offering a great deal. The algorithms help in understanding the borrower’s financial history before offering any deal.

- With the help of technology, lenders using online platforms can provide instant approval. It takes less time to read the agreement through voice-over options. Moreover, lenders can understand the history of the borrowers through reports designed by data analytics.

- Moreover, technology has helped customers to access an online platform anytime and from anywhere. This is the prime benefit of technology in financial online platforms so far.

Conclusion:

Personal loans in FintechZoom is a chosen platform for all financial requirements that customers of the digital world hold. However, it is significantly important to explore the alternatives to understand which platform has the best deal on personal loans for you. Moreover, while one platform might offer you something related to your financial matters, one may not. Therefore, before choosing a financial partner for assistance, make sure you are aware of what service related to personal loans is your priority.

FAQs:

Q1. Can I use a personal loan amount for medical purposes?

A1. The personal loan works as its name suggests. You can use the loan amount taken as a personal loan for any reason, may it be a medical emergency.

Q2. How long does it take online loan providers to approve personal loans?

A2. The approval of a personal loan completely depends upon the lender who offers you the loan. However, the general period for approval of a personal loan is within 48 hours.

Q3. Does a personal loan affect my credit score?

A3. Yes, personal loans affect your credit score in both a negative and positive manner. If you pay the amount on time your score will improve or vice versa.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Readers are advised to conduct their research and consult with a qualified financial advisor before making any financial decisions. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any financial institution. Any action taken by the reader based on the information provided is at their own risk.