Auto Title Loans In Arkansas

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xArkansas, located in the southern USA, has diverse landscapes like mountains and plains. It’s a famous and celebrated state for its natural beauty, parks, and rivers. Arkansas also has a rich history, including Native American heritage and Civil Rights contributions to the nation. The state’s economy mainly relies on agriculture, manufacturing, and tourism. The people of Arkansas have several reasons to commute across the state to explore the divine beauty and historic culture.

Many people seeking loans are those who need assistance in lending money to meet a certain requirement. The requirement can be simple and for a single purpose or it can be complex and for a multiple purpose. Whatever the need may be, loans are acquired to meet those needs with certain specified terms and conditions laid by lenders.

Auto Title Loans In Arkansas are introduced so that people needing of money can use their automobile titles as collateral to receive money from lenders. With monthly payments made over the period, and the loan completed, the automobile can be free of bond and completely yours again!

If you are a citizen of Arkansas, USA, and are planning to obtain a loan, read this article “Auto Title Loans In Arkansas” which will enable you to choose the best from the top five leading lenders of auto title loans in the USA. continue reading as we highlight the features of auto loans in this article.

5 Best Auto Title Loans In Arkansas Providers

Top 5 Auto Title Loans In Arkansas Providers

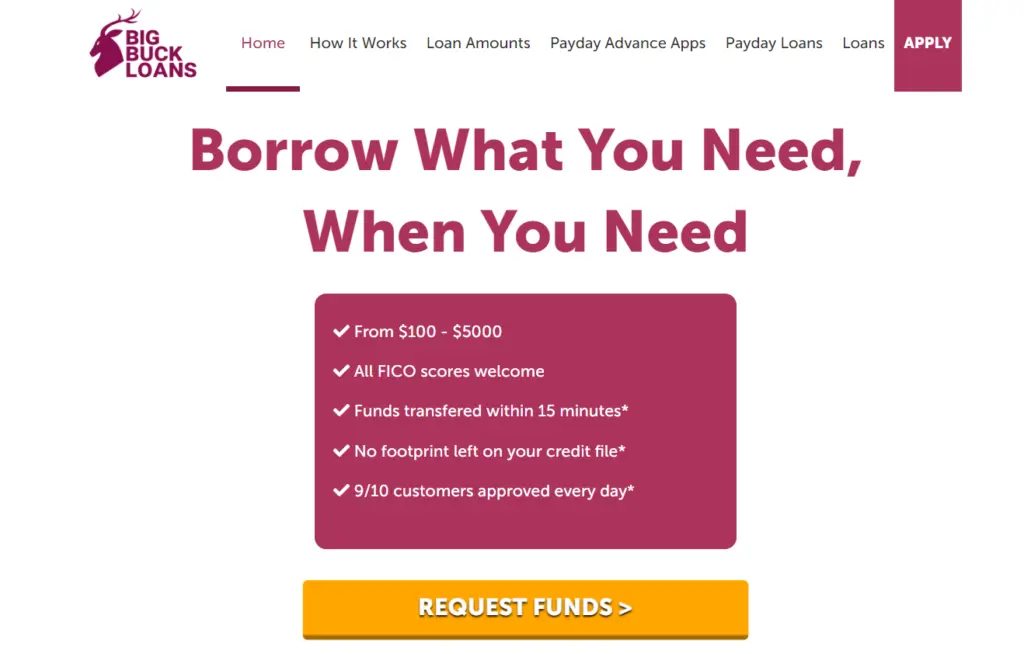

1. Big Buck Loans

Seeking swift financial solutions? Partner with Big Buck Loans to alleviate financial strain and regain control of your expenses. Experience seamless borrowing with Big Buck Loans. Our platform simplifies the lending process, connecting you with reputable lenders effortlessly. Bid farewell to financial stress and embrace peace of mind with Big Buck Loans as your trusted financial partner.

Highlights:

- Users enjoy the convenience of accessing multiple lenders with just a single click.

- Assures a stress-free search and application process for users.

- Maintains a strong focus on data security to protect users’ personal information from breaches or unauthorized access.

Eligibility:

- Satisfy age verification (18 and above).

- Minimum monthly income of $1,000.

- Only US Citizens of Arkansas can apply.

- Be able to provide documentation (Proof of Address, Proof of Income, & Valid Identification) for verification.

Loan Details:

- Borrow amounts range from $100 to $5,000, with negotiable loan rates determined by individual lenders.

- Experience swift approval within 24 to 48 hours, ensuring a timely and efficient process for your financial needs.

Application Procedure:

- Visit the website: bigbuckloans.net.

- Look for the application form and complete the necessary steps instructed.

- If approved, within the next 2 business days you will get the funds disbursed into your account.

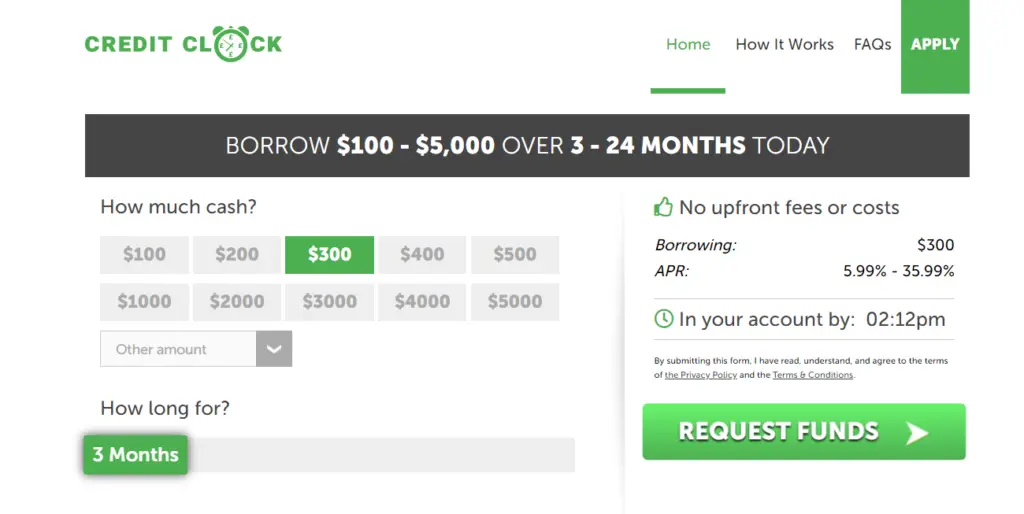

2. Credit Clock

Don’t let financial setbacks hold you back any longer. Team up with Credit Clock to access quick and reliable financial assistance. Empower yourself financially with Credit Clock. Our extensive network of lenders provides personalized solutions for individuals of every credit background. Start shaping your financial future today with Credit Clock as your reliable companion.

Highlights:

- Navigates effortlessly to access comprehensive solutions and transparent terms for your borrowing needs.

- Ensures a seamless search and application process for users thereby reducing stress.

- Ensures robust security measures to safeguard users’ sensitive information from unauthorized access.

- Offers the convenience of accessing multiple lenders with just a single click, streamlining the borrowing experience.

Eligibility:

- Must be at least 18 years old for age verification.

- Requires a minimum monthly income of $1,000.

- Only US Citizens of Arkansas can apply.

- Documentation such as Proof of Address, Proof of Income, and Valid Identification is necessary for verification.

Loan Details:

- Borrow amounts range from $100 to $5,000 with negotiable loan rates determined by individual lenders.

- Experience swift approval within 24 to 48 hours, ensuring a timely process for your financial needs.

Application Procedure:

- Visit the website: creditclock.net to begin the application process.

- Fill out the application form as instructed.

- If approved, funds will be disbursed into your account within the next 2 business days.

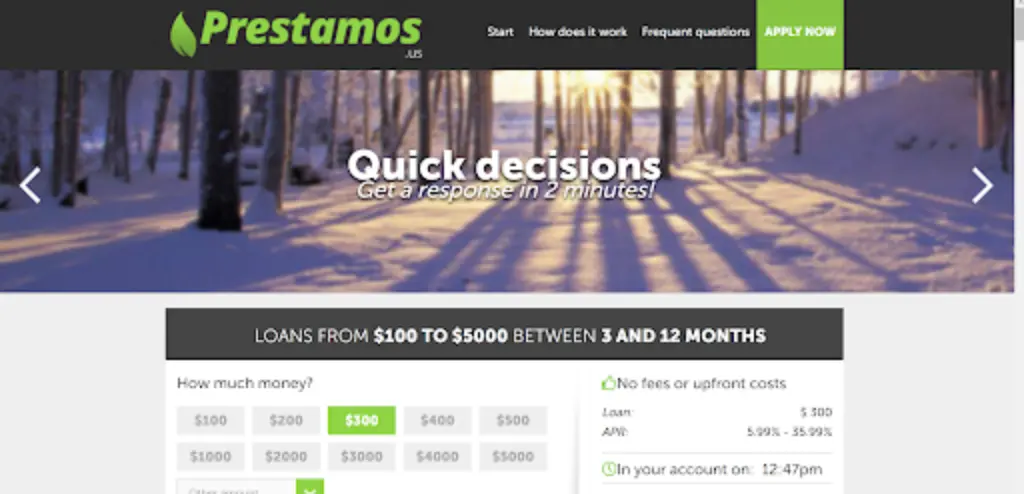

3. Prestamos USA

Tired of waiting for financial relief? Accelerate your journey to financial stability with Prestamos USA. Experience seamless application processes and rapid approvals with Prestamos USA, ensuring timely access to the funds you require. Bid farewell to financial worries and welcome a brighter future with Prestamos USA at your side.

Highlights:

- Access comprehensive solutions and transparent terms through our simplified application process.

- The seamless application process sees to it that the applicant has a stress-free borrowing experience.

- Rigorous security measures protect your data, ensuring confidentiality.

Eligibility:

- Applicants must be 18 years or older.

- A minimum monthly income of $1,000 is required.

- Only US Citizens of Arkansas can apply.

- Documentation such as Proof of Address, Income, and Identification is mandatory to obtain a loan from this lender.

Loan Details:

- Borrow amounts range from $100 to $5,000, with negotiable rates.

- Swift approval within 24 to 48 hours, ensuring prompt access to funds.

Application Procedure:

- Visit prestamos.us to begin your application.

- Complete the application form accurately.

- Upon approval, funds will be disbursed within 2 business days.

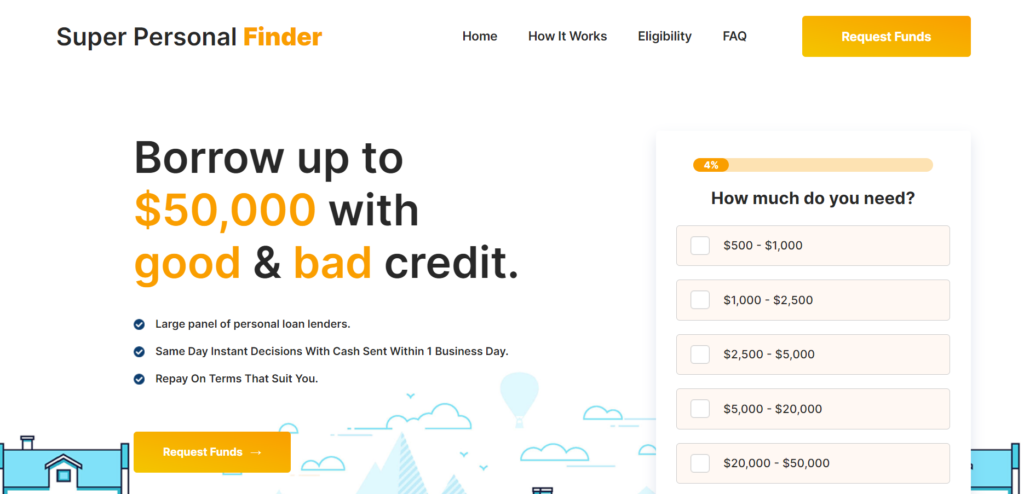

4. Super Personal Finder

Need cash in a hurry? Turn to Super Personal Finder for swift and dependable financial aid. Our committed team endeavors to connect you with the ideal loan option, customized to suit your requirements. Don’t let financial emergencies slow you down–power through with Super Personal Finder by your side.

Highlights:

- Experience simplicity and transparency in borrowing as you utilize your automobile’s value for cash.

- Specialized in online short-term loans starting at $500.

- Guarantees rapid delivery to address immediate financial requirements.

- Vouches 100% protection of personal data.

Eligibility:

- Satisfy age verification (18 and above).

- Minimum monthly income of $1,000.

- Only US Citizens of Arkansas can apply.

- Be able to provide documentation (Proof of Address, Proof of Income, & Valid Identification) for verification.

Loan Details:

- Loan available for all budgets from $500 to $50,000 with 3 to 34 months of pay.

- The loan rate is generally lender-determined based on the loan sum.

- As per loan value which is determined upon evaluating your automobile, approval time varies.

Application Procedure:

- Go to superpersonalfinder.com.

- Look out for the application form and complete the necessary steps instructed.

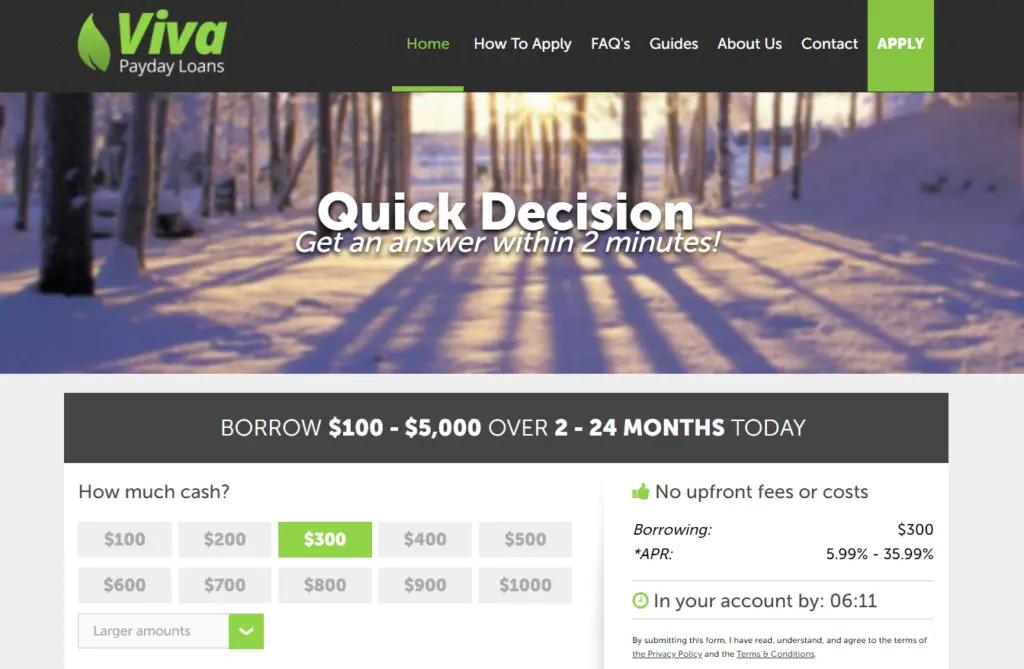

5. Viva Payday Loans

Struggling to make ends meet? Partner instantly with Viva Payday Loans for fast and flexible financial solutions. Take charge of your financial future with Viva Payday Loans. Our user-friendly platform links you with leading lenders, helping you secure the ideal loan that aligns with your budget. Start your path to financial independence today.

Highlights:

- Vouches for strain-free search and application process.

- Designed for swift processing, it guarantees prompt fund disbursement upon approval.

- Streamline your borrowing experience with our user-friendly platform and transparent terms.

- Provides the comfort of accessing multiple lenders at a single click.

Eligibility:

- Satisfy age verification (18 and above).

- Minimum monthly income of $1,000.

- Only US Citizens of Arkansas can apply.

- Be able to provide documentation (Proof of Address, Proof of Income, & Valid Identification) for verification.

Loan Details:

- Anywhere between $100 and $5,000.

- The loan rate is generally lender-determined based on the loan sum.

- As per the loan value fixed by the lender post evaluating your automobile, approval time may vary.

Application Procedure:

- Go to vivapaydayloans.com.

- Look for the application form and complete the necessary steps instructed.

- Same-day decisions with cash sent in 1 business day.

Why Are Auto Title Loans In Arkansas Considered Advantageous?

One of the primary benefits of obtaining an auto title loan is that you are still in possession of your automobile while you only use it to obtain collateral for your loan. Doing so will let you expedite your processing of the loan and thereafter sanction.

Yet another key factor is that since your car serves as collateral, your credit score holds less significance in the application process. Hence, regardless of your credit score, even if you have a poor one, you can still be eligible to avail auto title loan. In this scenario, your automobile plays a better role than just being an automobile and acts as a source of money.

Conclusion:

To conclude, it is highly recommended to avail of Auto Title Loans In Arkansas from the above-mentioned five topmost lenders in Arkansas, US. Understanding the interest rate of auto title loans, and its influence on monthly payments is essential when considering a loan. If you are trapped in a tight financial crisis, make the right decision of availing auto title loans today.

FAQS:

Q1. Is Auto Title Loans in Arkansas easy to avail?

A1. Auto Title Loans in Arkansas are easy to avail. These loans are designed for immediate financial needs and often have minimal eligibility requirements compared to other types of loans. Additionally, lenders usually provide quick approval and disbursement of funds after evaluating the condition and worth of your automobile

Q2. I have bad credit. Am I eligible for an auto title loan?

A2. Auto Title Loans in Arkansas use your car as collateral, and it does not look for your credit as a backup. Hence do not worry about your bad credit.

Q3. What factors are taken into account when determining my eligibility for a loan?

A3. Elements such as your credit score, income, employment history, and debt-to-income ratio are typically assessed to decide if you qualify for a loan.