Auto Title Loans In Las Vegas

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xDo you think you have been through all your options for financial aid and are still not able to find one with your bad credit score? Think again. Welcome to our finding “the best ones for you” page, designed by our team of experts to deliver only the most authentic and honest information.

Bad credits are often the biggest obstacle in finding a personal loan from traditional banks. But what if this credit check is not mandatory? Yes, it is possible. Car or Auto title loans in Las Vegas are a way of financial help where lenders do not check the credit score of borrowers and instead focus on the car placed as a mortgage.

This post shall take you to a detailed discussion of Auto Title Loans In Las Vegas and their availability with different borrower needs and demands. It’s time to explore!

Top 7 Auto Title Loans In Las Vegas

We have compiled our list with the best 7 Auto title loans in Las Vegas for our readers. All 7 of these organisations are perfect achievers of excellent customer service and reverting to customers’ needs. Let’s take a look at them.

Our 7 Best Picks of Auto Title Loans In Las Vegas

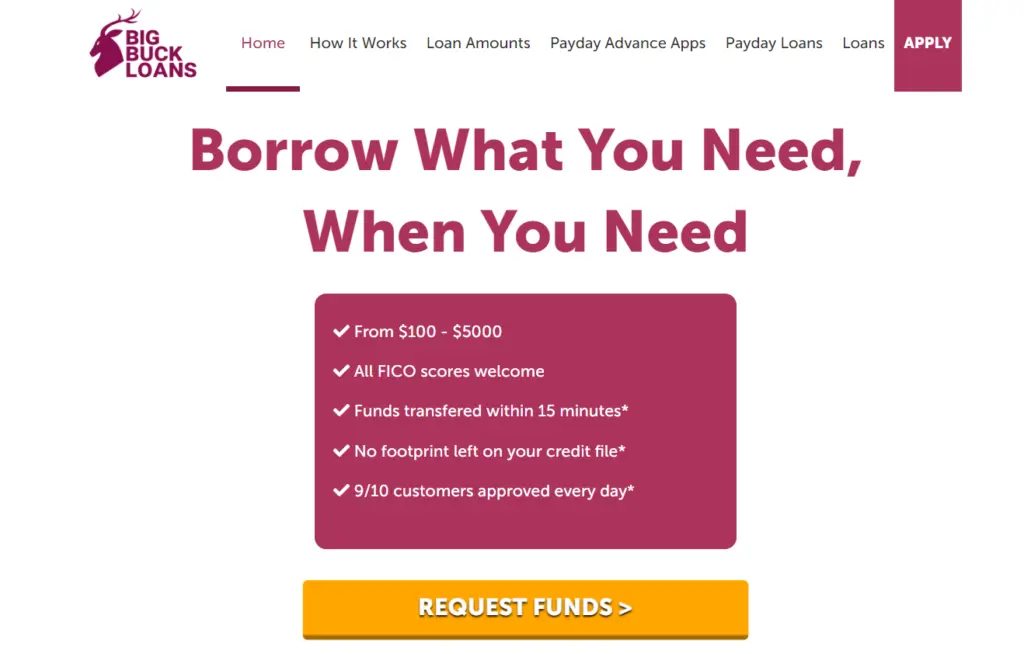

1. Big Buck Loans

Big Buck Loans is an amazing opportunity to cater to individuals lacking a perfect score for a car title loan. The company provides a network of financial lenders that links borrowers looking for short-term loans with payday loan lenders. They give customers access to a variety of loans with amounts ranging from $100 to $5000 and interest rates that vary from 5.99% to 35.99%.

This expected fee can depend heavily on the loan amount, the borrower’s income, and the length of the payback period. For borrowing a car loan at Big Buck customers only need to complete the entire application procedure online, saving time and hassle by eliminating the need for faxes or documentation.

Borrowers who use Big Buck Loans for their lending needs can make use of a free loan matching service. Such opportunities make Big Buck loans our best recommendation to our readers. The online borrow money app website is free to visit for people to explore and learn their options.

Loan Features:

- Loan amounts: From $100 – $5000

- APR: From 5.99% to 35.99%.

- Loan term: 3 to 24 months

- Funding time: 15 to 60 minutes, or 24 hours at maximum delay.

- Credit check: All types of credits are accepted.

- Income Requirement: At least $1000 per month

Eligibility:

- The age requirement of at least eighteen is obligated

- You must own a valid US bank account and be a citizen or resident.

- They must prove that they make at least $1000 each month.

- Need to be able to pay back the loan

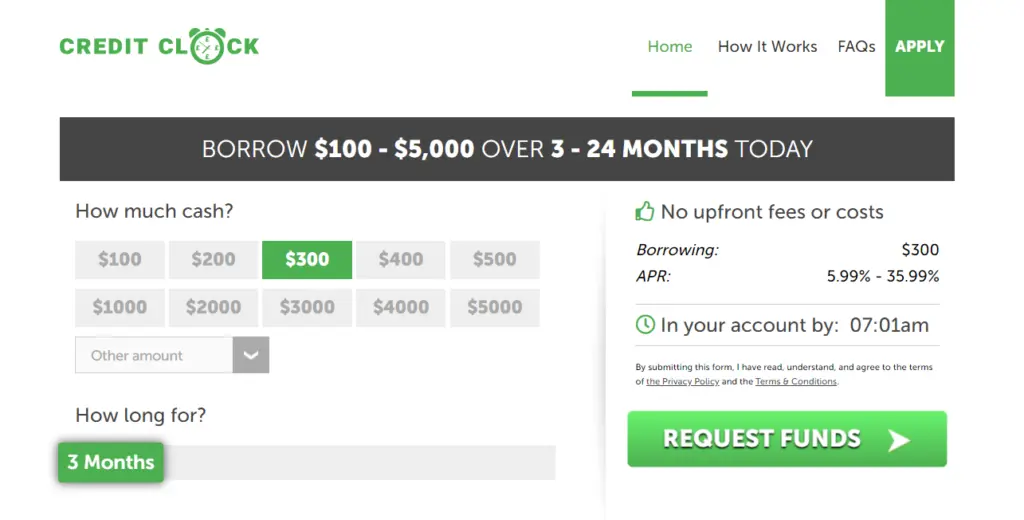

2. Credit Clock

Credit Clock is a reputable name in providing the best of bad credit loans with quick approvals, quick payouts of funds, cheap interest rates, and round-the-clock services. They are an easy choice for people with poor credit who require personal it is possible. Car or Auto title loans in Las Vegas are a way of financial help where lenders do not check the credit score of borrowers and instead focus on the car placed as a mortgage. because they have a $5,000 lending capability. Credit Clock facilitates convenient access to loans without requiring in-person visits and guarantees fair exchange services.

Credit Clock is a more accessible lending alternative for people with bad credit scores because it does not require stringent background checks. The platform ensures that borrowers obtain their funds swiftly following the application procedure by boasting fast approvals and payments.

Credit Clock stands out with its regulated lending methods, low borrowing rates, lack of hidden costs, and simple application process. Borrowers are also guaranteed the legality and affordability of the loans they offer because of their membership in the Online Lenders Alliance (OLA).

Loan Features:

- Loan amounts: $100 – $5,000

- APR: 5.99% to 35.99%

- Loan term: 3 – 24 months

- Funding time: 60 minutes or 24 hours

- Credit check: Bad credits accepted

- Income Requirement: $1000 or above per month.

Eligibility:

- Every candidate must show a legitimate form of identification.

- They must be at least eighteen years old.

- They must have a functional mobile phone number and an active bank account.

- They must have a consistent monthly income of at least $1000.

- Candidates must submit evidence of their income.

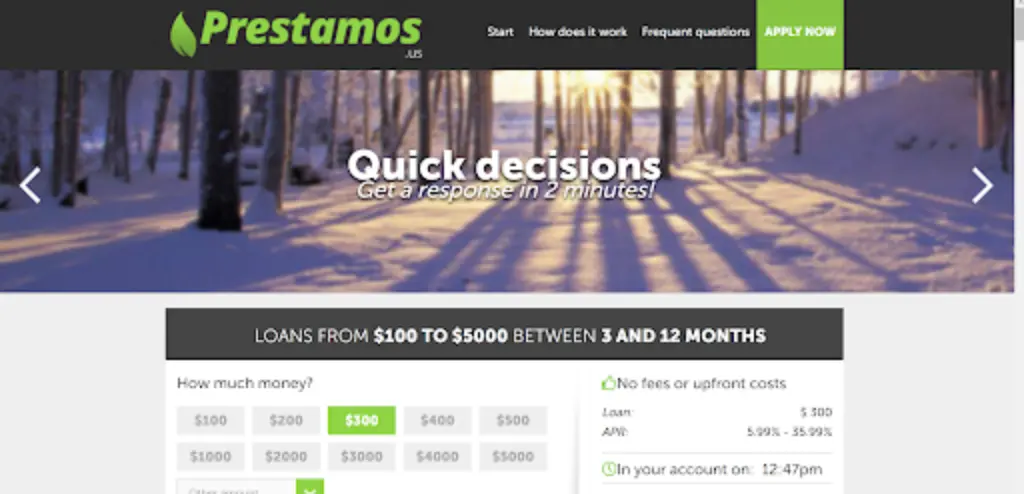

3. Prestamos USA

Prestamos USA is a dependable and most looked-for financial services company when in need of big cash loans. They provide car title loans and other needed urgent loans to both people and businesses with a huge range of lending choices. Mortgage loans, personal loans, business working capital, equipment financing, cash advances, and commercial property refinancing are among their areas of expertise. Prestamos USA wants to help customers get the money they need to grow their companies or quickly take care of their financial obligations.

The company is quite notable to one’s eye, but one most noteworthy aspect of Prestamos USA is their rapid and effective loan approval procedure. Even those without a very strong and progressive credit history may be eligible for a cash advance based on business income in as little as 24 hours. They accept applications from all 50 states in the United States and serve a broad range of industries.

Loan Features:

- Loan amounts: $20,000 and $500,000

- APR: 8.99% to 29.49%

- Loan term: 2 to 7 years

- Funding time: 24 hours

- Credit check: 680+ Experian

- Income Requirement: Annual Income $75,000+

Eligibility:

- Candidates must fulfil the requirements for income eligibility.

- Candidates must consent to use the home as their primary residence, occupied by them.

- Candidates must be citizens of the United States.

- Must be of legal age 18 or above.

- Qualify the set standards of credit score.

4. Money Lender Squad

Money Lender Squad is an exceptional financial services organisation to help people with serious financial crises. The company promises to provide a range of loan choices designed to satisfy different needs and tastes. Payday loans with short terms, instalment loans, and personal loans are some of these alternatives. The organisation places a high priority on its consumers’ financial well-being by offering reliable and easily accessible financial support via a reliable online platform.

Loans from Money Lender Squad include maturities of three to six months and annual percentage rates (APRs) that don’t go above 35.99%. They are experts in providing payday loans that are quickly authorised. Their it is possible. Car or Auto title loans in Las Vegas are a way of financial help where lenders do not check the credit score of borrowers and instead focus on the car placed as a mortgage. are guaranteed with cheap interest rates and easy access to funds up to $1000. Money Lender Squad thus distinguishes itself by its dedication to providing customised financial solutions that smoothly meet the demands of its clients.

Loan Features:

- Loan amounts: From $100 – $5,000

- APR: 5.99%–35.99%

- Loan term: 12 months to 5 years

- Funding time: 24 weeks to 1 week

- Credit check: Not applicable

- Income Requirement: $1000 or more per month

Eligibility:

- Applicants need to be at least eighteen.

- They need to have a current checking account.

- They must present their official identity and evidence of income.

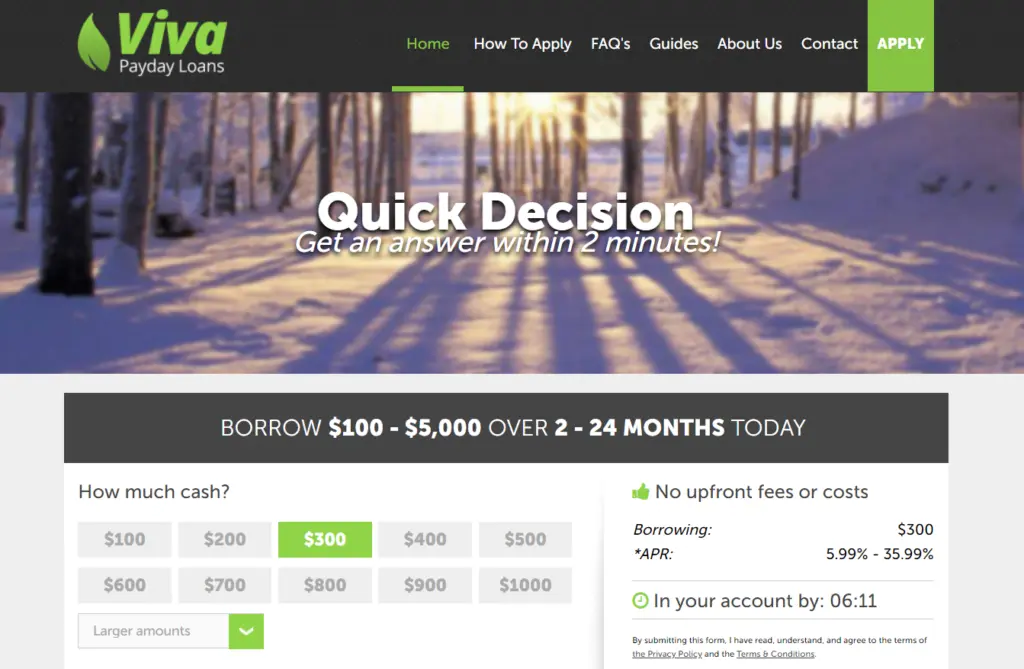

5. Viva Payday Loans

Viva Payday Loan is a famous and most often looked-for online loan lending association that caters to a wide range of financial needs for people who can’t include a perfect credit history in their loan requests. Payday loans, instalment loans, and personal loans are just a few of the loan alternatives available on the internet lending platform Viva Payday Loans. Their goal is to offer quick and easily accessible financial support to people.

Borrowers can apply for loans on the platform for amounts between $100 and $5,000. This loan value is charged with maximum annual percentage rates of 35.99% and timeframes of three to six months for repayment. This flexibility in terms and quantities of Auto title loans in Las Vegas can assist borrowers in selecting a solution that best meets their financial requirements.

Loan Features:

- Loan amounts: $100 to $5000

- APR: 5.99% to 35.99%

- Loan term: 3 to 12 months

- Funding time: 15 minutes or 24 hours

- Credit check: Not Applicable

- Income Requirement: $1000 per month

Eligibility:

- At least 18 years old

- Be able to provide proof of your income.

- Have three to six months’ worth of bank statements available.

- Be able to provide details of all existing liabilities.

- Possesses proof of nationality.

- Qualify income requirement.

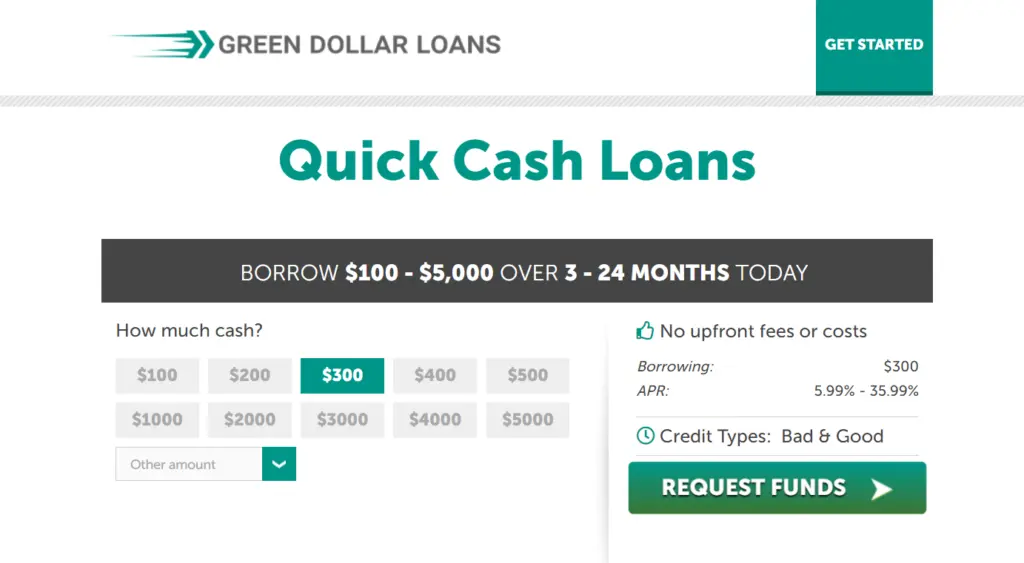

6. Green Dollar Loans

Green Dollar Loans is the most trustworthy online loan-finding website. The organisation places a strong emphasis on openness and consumer protection by giving clear information regarding loan terms, repayment plans, and interest rates to help borrowers make educated decisions about their financial obligations. The platform is a dependable choice for anyone looking for quick access to short-term financial solutions due to its commitment to accessibility and client care in emergencies.

The website provides a user-friendly application process that enables anyone to apply for loans with amounts between $100 and $5,000 and repayment terms between three and twenty-four months. Green Dollar’s website has an easy application process and can be finished from the comfort of one’s home.

Loan Features:

- Loan amounts: $100 to $5000

- APR: 5.99% – 35.99%

- Loan term: 3 to 24 months

- Funding time: 1 or 2 business days

- Credit check: May or may not perform credit checks

- Income Requirement: $1000 or more per month

Eligibility:

- Have at least eighteen years old.

- Possess a reliable source of income.

- Present identification and proof of residency.

- Have a bank account that can be used to receive the loan.

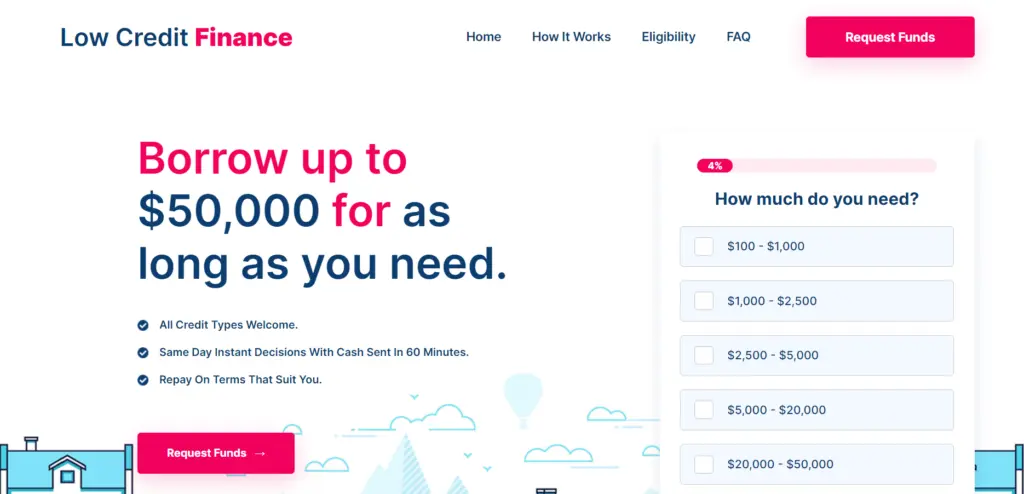

7. Low Credit Finance

Low Credit Finance is our last choice for the best car auto title loans in Las Vegas. The company, like other suggestions, also focuses on offering financial assistance to people with bad credit scores that are lower than the ones already discussed. They provide loans that are specifically designed to satisfy the demands of borrowers who might have been rejected by traditional lenders.

Low Credit Finance offers loans with flexible payback terms and swift decisions, guaranteeing prompt access to funds. Borrowers are expected to gradually raise their credit score by repaying their debts on schedule. Low Credit Finance considers each applicant individually, concentrating on their present financial status and capacity to repay the loan. They stand out from other lenders thanks to their customer-centric philosophy.

Loan Features:

- Loan amounts: $100 to $ $5,000

- APR:5.99% to 35.99%

- Loan term: 3 to 24 months

- Funding time: 1-2 days

- Credit check: Not applicable

- Income Requirement: $1000+ per month

Eligibility:

- At least eighteen years old

- Evidence of a steady source of income of at least $1,000 per month.

- Evidence of residency.

- An active US bank account with direct deposit.

What is an Auto Title Loan?

Auto title loans are often confused with personal loans. People borrowing such loans must have a thorough understanding of what they are stepping into. Thus, we must first know what exactly an Auto tile loan is. An auto title loans in Las Vegas is a secured loan in which the borrower pledges their vehicle title as security. This loan is sometimes also referred to as a car title loan. Borrowers must permit a lender to place a lien on their vehicle title and temporarily give up the hard copy of the title in exchange for a loan amount.

These loans usually have higher interest rates and are shorter in duration when compared to other lending sources. Lenders typically consider the worth and state of the car being used as collateral instead of looking up borrowers’ credit histories. Using cars as collateral for quick loans can be the best option for individuals with bad credit. The loans in these cases shall be quickly funded and easily transferred on the discussed terms and conditions.

People with poor credit can get immediate cash by pledging their car as security with auto title loans. These loans mostly depend on the value of the car being used as security, not so much on credit history. Loans up to $20,000 are usually available to borrowers, and the application process is quicker than for regular bank loans. The funds are also disbursed frequently on the same day. Bad credit borrowers can get loans from lenders like Big Buck Loans and Viva Payday Loans, which provide high approval rates and the option to keep driving while making loan repayments.

How to Apply For an Auto Title Loans in Las Vegas?

1. Online Application

Filling out an online application on the lender’s website is the first step in applying for an auto title loans in Las Vegas. This step shall entail providing evidence of income, vehicle details, and personal information.

2. Required Documents

The following paperwork must be submitted along with your loan request to quickly catch the lender’s eye.

- A clean vehicle title in your name

- Current vehicle registration and insurance

- A valid driver’s license

- Proof of income, such as a recent pay stub or bank statement

- Proof of Nevada residency, like a utility bill

3. Loan Approval and Disbursement

The loan amount is normally between 30-50% of the car’s value and is decided by the lender after evaluating the borrower’s vehicle. If the loan is accepted, the borrower can get the money from the loan fast—typically in 15 to 30 minutes.

4. Refinancing Option

Some lenders may offer the option to refinance an existing auto title loan to get better terms.

Benefits of an Online Auto Title Lender

1. Fast Approval and Funding

Online auto title loans can give you access to money quickly. They can frequently be approved and funded in 15 to 30 minutes. They are, therefore, desirable to borrowers who are experiencing financial difficulties.

2. Convenient Application Process

Online auto title loans in Las Vegas applications are made to be quick and easy to complete. The initial application can be completed online by borrowers, negating the need to physically visit the venue. Lenders could also give the borrower the choice to have a representative visit their location to verify documents.

3. No Credit Check Required

Online auto title loans in Las Vegas lenders normally do not run credit checks on their applicants before approving them, in contrast to traditional lenders. The value of the car being used as collateral forms the basis of the loan.

4. Retain Possession of Vehicle

The borrower can continue to drive their car while making loan repayments with an online auto title loan. The lender does not take ownership of the vehicle. Instead, they merely impose a lien on the title.

5. Private and Straightforward Process

When borrowers use the online application and document verification process instead of going to a physical lender site, they may have a more private and efficient experience.

Factors to Consider With Auto Title Loans

1. Instant Cash Access

Auto title loans offer quick access to cash in times of urgent financial need. They are a convenient option for those requiring immediate funds. Thus, it better be fast.

2. Loan Processing Time

These loans have minimal processing requirements. They have approval and funding often taking less than an hour, and providing a swift solution for financial emergencies.

3. Vehicle Ownership and Usage

Borrowers should be able to retain ownership and full use of their vehicles while repaying the loan. This vehicle should be used solely as collateral and not confiscated by the lender.

4. Credit Score and Guarantor

Auto title loans should not require a good credit score or a guarantor. They should be accessible to individuals with poor credit histories.

5. Repayment Terms

Most auto title lenders offer flexible repayment schemes to facilitate timely repayment without causing inconvenience to the borrower.

6. High Fees and Interest Rates

Auto title loans come with steep borrowing costs. They often are charged with high-interest rates that can lead to significant financial burdens if not repaid promptly.

7. Risk of Vehicle Repossession

Failure to repay the loan can result in the lender repossessing the borrower’s vehicle. This may lead to the potential loss of an essential asset.

8. Alternatives and Considerations

Borrowers should explore alternative options like credit cards, personal loans, or payday alternative loans before opting for an auto title loan. They may offer lower costs and less risk of losing assets.

Conclusion:

This was our final best suggestion for auto title loans in Las Vegas that borrowers can trust and use. auto title loans in Las Vegas sure can offer instant access to funds, particularly for borrowers with bad credit records for people in dire need of money.

The application process, as discussed in the post, is quick and easy, and money can be ready in as little as 15 to 30 minutes. Lenders here determine the loan amount based on the value of the borrower’s car rather than placing a significant emphasis on credit ratings.

Thus we encourage our audience to take part in this conventional means of financial aid when in need to keep personal matters personal. These online organisations keep borrowers’ provided data safe and free from judgments thus, they can get help of exactly what they require.

Frequently Asked Questions:

Q1. Does Nevada do title loans?

A1. Yes, there are many legalised and trustworthy title loan providers available in Nevada, among which the best ones are discussed in the article above.

Q2. Who uses title loans the most?

A2. Borrowers with bad credit and instant cash repayment tendencies often prefer title loans as they require the least paperwork and physical visits.

Q3. Does Arizona do title loans?

A3. There are online loan lending organisations available in Arizona for quick and easy title loans.

Q4. Can you have more than one title loan in AZ?

A4. It is not legal to have two title loans outstanding on the same car at the same time in AZ. It is against Arizona law for someone to have two title loans on the same car at the same time.

Q5. How many different loans can you have at once?

A5. Arizona does allow for multiple “registration loans” on different vehicles. Borrowers can have up to 5 registration loans at the same time, as long as each loan is on a different registered vehicle.