Auto Title Loans In Wisconsin

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xNestled in the heart of the United States, Wisconsin stands out for its diverse landscapes, cultural richness, and economic dynamism. Renowned as “America’s Dairyland,” the state boasts picturesque rural expanses, which include rolling hills and serene lakes–altogether providing a scenic backdrop for outdoor enthusiasts.

Wisconsin’s economy is fuelled by manufacturing and technology and plays a pivotal role nationally. The state’s festivals, sports culture, and welcoming communities contribute to its distinct identity.

Auto Title Loans In Wisconsin: Quick Look

Auto Title Loans In Wisconsin, the need for auto loans is paramount as residents navigate the state’s diverse terrains and expansive landscapes. Owning a reliable vehicle in Wisconsin becomes an essential commodity for transportation to work, exploring the countryside, and accessing recreational areas.

Besides this, one may seek out loans for various reasons such as to buy a home, to attend to medical needs, for weddings, to take up a new course, etc. Auto title loans play a pivotal role in ensuring accessibility and mobility, as you step forward make collateral with your vehicle, and acquire a specific loan. The lenders upon assessing the value of your vehicle used as collateral will release the funds.

In this article on “Auto Title Loans In Wisconsin”, we will be highlighting on the most successful five auto title loan lenders who are notable for their extensive financial services for the public of Wisconsin.

Top 5 Lenders Of Auto Title Loans In Wisconsin

5 Best Lenders Of Auto Title Loans In Wisconsin

1. Jungle Finance

Trust in Jungle Finance, where immediate approval and a quick response meet your urgent needs. With no paperwork, your fast credit amount is ready to ease your worries instantly. No need to wait anymore–Jungle Finance is here to help!

Highlights:

- An intuitive platform design that simplifies the loan application for a seamless experience.

- Appreciated for quick approval turnaround, user-friendly interface, transparent fee structure.

- Swift processing for timely access to funds, reducing waiting times.

Eligibility:

- In order to apply, the borrower must be 18 years or older.

- Possess monthly income of $1,000 and more.

- Ensure you provide supporting documentation, including proof of address and income, along with a valid ID.

Loan Details:

- Jungle Finance offers loans ranging from $100 to $5,000.

- Interest rates apply.

- Discuss with the lender to grasp the timeline for the approval of the loan amount.

- Keep in mind that penalties may accrue for delayed or missed payments.

Application Procedure:

- Visit junglefinance.com to submit your online application.

- Await the approval process.

- Following approval, anticipate the transfer of funds within the next couple of days.

2. Big Buck Loans

Experience worry-free lending with Big Buck Loans–immediate approval, quick responses, and no paperwork. Your fast credit is just a click away, ensuring you don’t have to wait in times of urgency. Big Buck Loans is determined and committed to help you through every financial challenge.

Highlights:

- A responsive support team ready to assist borrowers throughout the loan process.

- Widely accepted for flexible repayment options, responsive customer support,transparent communication.

- All FICO scores are welcomed.

- Tailored solutions for diverse financial situations, providing borrowers with repayment flexibility.

Eligibility:

- Earn $1000 every month in income.

- Applicable only for the US nationals and legal residents only.

- 18+ years.

- Functioning US Bank account.

Loan Details:

- As much as $100 to $1,000 can be availed.

- Stay informed of the interest rates which are determined by the lender.

- Late or missed payments may result in penalties.

Application Procedure:

- Go to bigbuckloans.net.

- Submit your application online and await approval.

- Transfer of money happens usually within 15 minutes.

3. Viva Payday Loans

At Viva Payday Loans, we prioritize your peace of mind by offering, quick response, immediate approval, and no paperwork. Say goodbye to waiting; your Viva Payday Loans is ready to assist you promptly. Rely on Viva Payday Loans as your trusted companion, guiding you through your financial journey with ease.

Highlights:

- Offering a variety of loan options to address diverse financial needs and situations.

- Acclaimed for user-friendly interface transparent policies diverse loan options

- A simple and user-friendly platform, guaranteeing a stress-free borrowing experience.

Eligibility:

- Be qualified to earn $1000 as monthly income.

- Be a US national or legal resident to avail loan.

- Ensure you are 18+.

Loan Details:

- Viva Payday Loans is open to provide loans from $100 to a maximum of $5,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Keep in mind that penalties may accumulate for delayed or missed payments.

Application Procedure:

- Reach out to vivapaydayloans.com.

- Complete an online application and await approval.

- You can await transfer of money within 2 days.

4. Prestamos USA

No need to worry anymore with Prestamos USA delivering funds instantaneously! Our trustworthy services offer quick responses, immediate approval, and no paperwork. Your fast credit is within reach, eliminating the waiting period for financial relief.

Highlights:

- Tailoring loan options to individual needs in a way that financial plans align with unique circumstances.

- Prioritizes clarity in terms, fees, and repayment.

- Fosters trust and understanding for borrowers.

- Noted for flexible solutions, transparent processes, and quick approvals.

Eligibility:

- Be 18+ to apply.

- A mandatory income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Available to offer loans ranging from $100 to $5,000.

- Exercise caution regarding the interest rates fixed by the lender during the application process.

- Fees rack up on late or any missed payments.

Application Procedure:

- Reach out to prestamos.us.

- Complete an online application and look for approval.

- You can await transfer of money within 2 days.

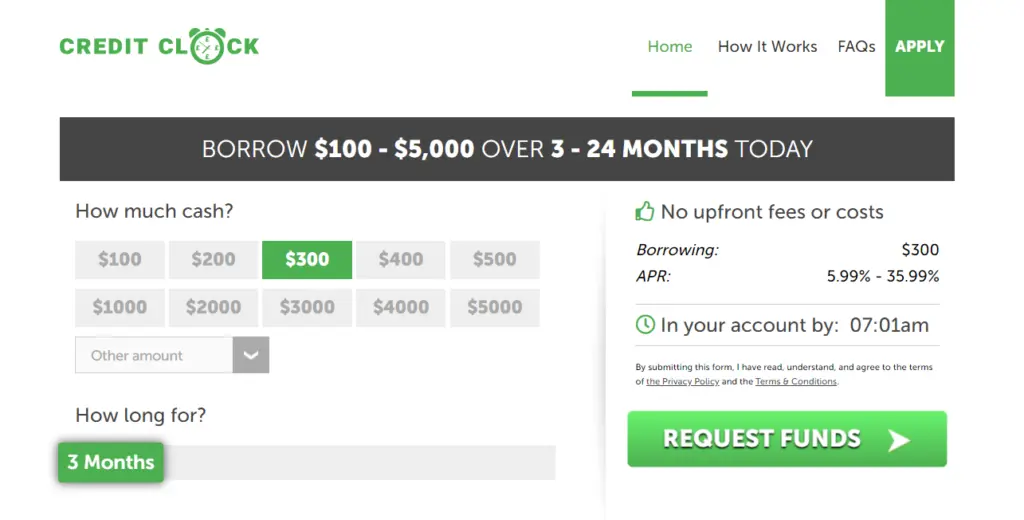

5. Credit Clock

Turn to Credit Clock for reliable and swift financial solutions. Immediate approval, quick responses, and no paperwork ensure a hassle-free experience. No need to wait – your fast credit is ready to address your financial concerns and provide assistance when you need it most.

Highlights:

- Sustains continuous and timely communication, ensuring borrowers remain well-informed at every phase of the loan process.

- Guarantees prompt and responsive interactions, providing borrowers with updates and information throughout the entire Wisconsin Auto Title Loans journey.

- Renowned for customized solutions, timely responses, financial guidance

- Tailoring loan options to individual needs, providing personalized financial assistance.

Eligibility:

- Eligible applicants should be 18 years or older, possessing a monthly income of $1000 or higher.

- Required documentation includes proof of address and income, along with a valid ID.

Loan Details:

- Open to offering Auto Title Loans In Wisconsin ranging from $100 to $5,000.

- Exercise caution regarding the interest rates established by the lender during the application process.

- Discuss the approval timeline directly with the lender.

- Keep in mind that penalties may accumulate for delayed or missed payments.

Application Procedure:

- Visit creditclock.net.

- Submit your online application and await approval.

- Expect the money to be transferred within 2 days.

Tips To Avail Wisconsin Auto Title Loans

- Autocheck your eligibility as denoted by the specific lender.

- Read all the loan terms and policies stated by the lenders.

- Seek for assistance from lenders or financial advisors before making a decision.

- Get clarity over jargons and other foreign expressions stated in the agreement.

- Calculate and devise a financial plan prior to borrowing a loan.

- Ensure there is a clear presentation of fees and charges, promoting transparency in financial transactions.

- Analyze your ability for repayment.

Conclusion:

With the information gathered from this article on Auto Title Loans In Wisconsin, as a reader you would have got a detailed knowledge on the ways each lender works. You may choose your desired lender and get connected with them for any further details. All the five lenders mentioned in the article are affirmative about providing loans irrespective of your credit history. It is suggested that as a borrower you must maintain financial honesty while you apply for auto title loans.

FAQs:

Q1. How will my funds be delivered?

A1. Normally, your auto loan funds will be electronically transferred into your account via electronic transfer by the following business day. Expect a seamless and efficient process, ensuring quick access to your funds. Rest assured, the above-mentioned lenders’ electronic transfer system is designed for swift transactions, allowing you to use your funds without unnecessary delays.

Q2. What factors are taken into account when determining my eligibility for a loan?

A2. Elements like your credit score, income, employment history, and debt-to-income ratio are typically assessed to decide if you qualify for a loan. A higher credit score and a steady income often enhance your likelihood of approval.

Q3. How does my credit affect my eligibility for getting auto title loans?

A3. Auto Title Loans In Wisconsin are minimally influenced by your credit. These loans are secured by your vehicle’s title, making credit history less significant. Lenders prioritize the value of your vehicle and your repayment ability. Despite bad or even poor credit, you can still qualify, offering a practical solution for individuals encountering financial difficulties.

Disclaimer: The loan websites reviewed are loan matching services, not direct lenders; therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from any financial advisor if you need financial assistance. Loans are available for the US residents only.