Auto Title Loans Phoenix AZ

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xFinding yourself in a financial bind can be incredibly stressful, especially when unexpected expenses arise and you need cash fast. Auto title loans in Phoenix AZ might be the lifeline you need in such situations. These loans offer a way to leverage the value of your vehicle to secure quick funds

Auto title loans are short-term, secured loans that use your vehicle’s title as collateral. This means you hand over the title of your car to the lender in exchange for a loan. The loan amount is typically a percentage of your vehicle’s current market value, and you can continue driving your car while repaying the loan.

Top 5 Auto Title Loans Phoenix AZ Providers

Best 5 Auto Title Loans Phoenix AZ Providers

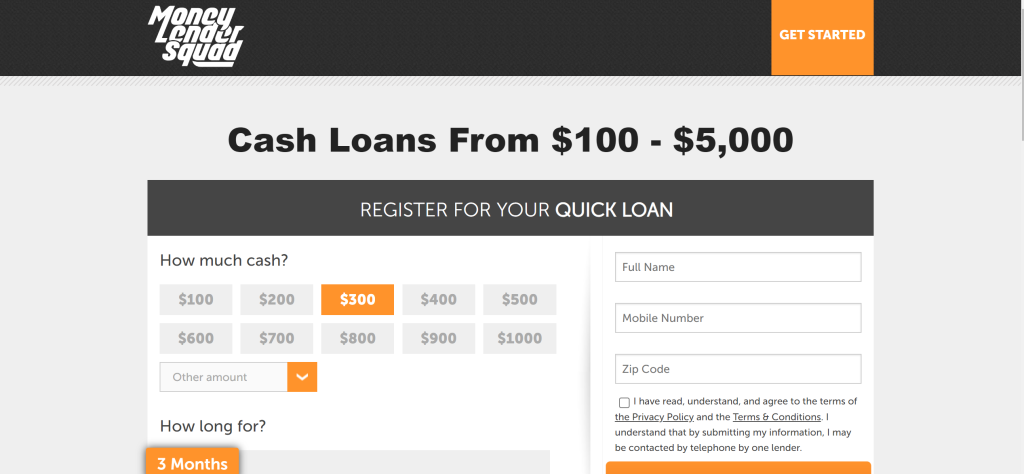

1. Money Lender Squad

Debates about which of the many loan options on the market to choose from can be extremely stressful and anxious. Therefore, Money Lender Squad distinguishes itself on the internet, where a plethora of web pages exist, with its uniqueness and creditworthiness.

Credit in the range of $100 to $5,000 is available in this. That is one of the website’s finest traits. We can also provide some clarity on the website’s payback procedure, which stipulates that it will take 61 days at the very least and 90 days at the most—a considerable period of time given the sum.

Highlights:

- The website is open for all credits.

- Can get $100 to $5000.

- No hidden or up-front costs apply.

- The APR can go from 5.99% to 35.99%.

- The period of repayment for loans range from 61 to ninety days in maximum.

How Does It Work?

- You can explore the official website as well- moneylendersquad.com

- Decide on a loan amount: It offers up to 24 months of loans from $100 to $5000.

- Fill out the Quick Loan Application: Make sure the loan amount and repayment plan you choose are appropriate in order to avoid loan default.

- Receive Your Wired Money: If the lender accepts your application, you will get your loan the same business day.

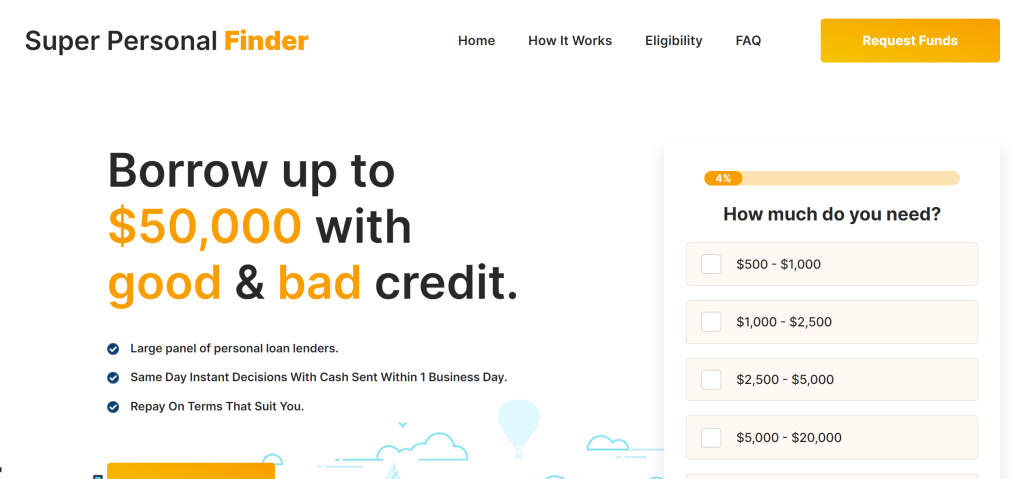

2. Super Personal Finder

In Super Personal Finder Customers can find immediate auto loans with the help of the website’s extensive information. The greatest part about this website is that there are no expenditures associated with it, nor does it require any additional documentation.

They lend large sums of money, up to $50,000, so that a person can select from the available options with ease. It provides a straightforward application form to complete in order to begin the process of matching you with the best lender. It then establishes a connection between you and the financier of your choosing.

Highlights:

- There are many auto loan lenders on its panel.

- Quick decisions are made the same day and sent with cash within one business day.

- There is not much documentation involved in the application process, and there are no extra fees.

- A loan of $500 to $50,000, based on your requirements.

- The annualised percentage rate ranges from 5.99% to 35.99%.

How Does It Work?

- You are able to access the official website-superpersonalfinder.com

- Pick a loan amount: Choose the amount you need; it might be anywhere from $500 to $50,000.

- Apply with an application: Fill out the quick form on the website to finish your request.

- Obtain a loan: If the lender accepts your application, you will get your loan the same business day.

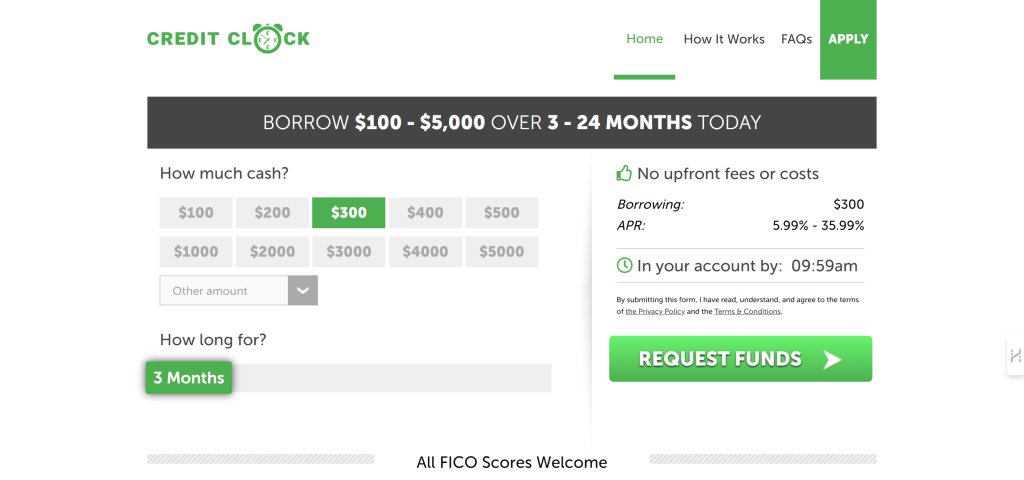

3. Credit Clock

If you are worried about auto loans and where to get them then Credit Clock is the one of the places you can stay and by filling a simple and swift form that might ask about identification and other things, you can easily get auto loans related to your query.

Ideally, you may obtain money for as low as $100 to $5,000, while this service eases your brain and muscle so you can repay the money you obtained. The lenders that are supported by Credit Clock usually give a maximum of six months to pay, not just one or two. Additionally, there is never any waiting involved while using Credit Clock when asking for a mortgage.

Highlights:

- Money up to $100 to $5000.

- There aren’t any buried or undeclared expenditures.

- The annualized percentage rate ranges from 5.99% to 35.99%.

- Same-day payment and prompt selection.

How Does It Work?

- You are able to access the official website- creditclock.net

- Pick a loan amount: It provides loans in amounts between $100 and $5,000 for a maximum of 24 months.

- Fill out the Short Loan Application: Make sure the loan amount and repayment plan you choose are appropriate in order to avoid loan default.

- Receive Your Wired Money: If the lender accepts your application, you will get your loan the same business day.

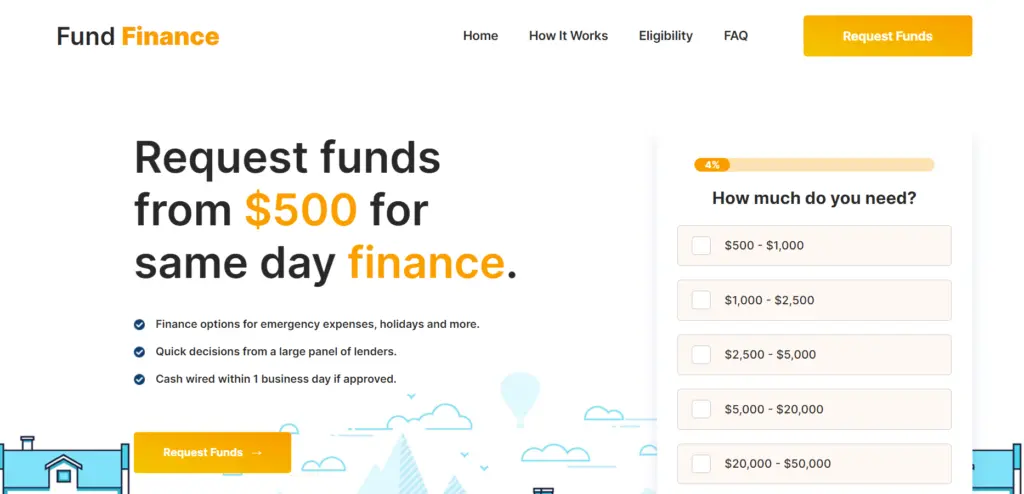

4. Fund Finance

In Fund Finance, customers can get a range of services, including auto loans. Customers can choose the best auto loans to suit their circumstances by using the company’s in-house loan matching technology. It is important to note that this site does not collect a fee for any request made on it before discovering how the website is funded.

It’s crucial to keep in mind that not all financial institutions or loan options are available online in this particular scenario. It is important to remember that no offer made to you through this website represents the best deal possible. Constantly consider the possibilities and make an independent, well-informed decision.

Highlights:

- It provides financial possibilities for Auto loans.

- Following a single work day, dollars get transferred if approved.

- $500–$50,000 loan amount ranges offered.

- The annualised percentage rate ranges from 5.99% to 35.99%.

How Does It Work?

- You are able to access the official website.- fundfinance.net

- Pick a loan amount: Choose the amount you need; it might be anywhere from $500 to $50,000.

- Utilize an application to apply: Fill out the quick form on the website to finish your request.

- Get a loan: If the lender accepts your application, you will get your loan the same business day.

5. Big Buck Loans

If you are in a financial dilemma asking yourself some thriving question related to auto loans, Big Buck Loans can provide absurd amounts based on a person’s needs. As described the website is open for all scores, and the repayment procedure seems simple enough to understand.

Big Buck Loans will help you every step of the way, whether you’re planning an impending need for auto loans and need to know how to borrow money quickly or an emergency or unforeseen expense has caught you off guard. The website has one’s back all the time.

Highlights:

- It is open for all FICO scores.

- To repay it, seek off a $100–$5,000 mortgage and spread the payment over three–24 months.

- Nothing is still listed on your credit history.

- The APR ranges from 5.99% to 35.99%.

- Decisions made quickly, with money sent the same day in less than 16 minutes.

How Does It Work?

- You are able to access the official website.- bigbuckloans.net

- Decide on a loan amount.: It offers loans for a maximum of 24 months in sums ranging from $100 to $5,000.

- Complete the Short Loan Form: To prevent loan default, validate that the borrowing quantity and payback schedule you select are suitable.

- It’ll investigate the Loan Market: It has a list of lenders that work with Big Buck Loans. Following your completion of the application, we will go across the market to find lenders that provide the kind of loan you’re looking for.

- Get Your Money: If the lender accepts your application, you will get your loan the same business day.

Why Choose Auto Title Loans Phoenix AZ

Auto Title Loans Phoenix AZ are a desirable choice for people who are having financial difficulties because they provide a number of benefits:

- Facilitated Access to Funds: The rapidity at which you can get money is one of the main benefits of auto title loans. In Phoenix, auto title loan lenders often provide same-day approval, allowing borrowers to access cash quickly in times of need.

- No Credit Check: Unlike traditional loans that require a good credit score, auto title loans typically do not involve a credit check. This opens them up to people with bad credit or no credit history.

- Use of Collateral: One can get a loan without having to give up driving a vehicle by utilizing the title as collateral that are involved. This means you can continue using your vehicle for personal or professional purposes while repaying the loan.

Drawbacks of Auto Title Loans Phoenix AZ

Even though Auto Title Loans Phoenix AZ provide instant access to funds, there are a number of serious disadvantages and hazards that consumers should thoroughly weigh before applying for a loan. Here are some key drawbacks of auto title loans:

- High Interest Rates: Automobile loan titles are a costly type of borrowing since they frequently have outrageous interest rates. The annual percentage rates (APRs) for auto title loans can range from 25% to 300% or more, significantly higher than traditional loans.

- Short Repayment Periods: Auto title loans typically have short repayment periods, often ranging from 15 to 30 days. Due to the short repayment period, borrowers may find it difficult to pay back the loan in full, which could result in rollovers and additional costs.

- Possession Hazard: Auto title loans are backed by the borrower’s car, so if they are not repaid, the lender may take control of the car. For borrowers and their families, losing access to a key means of transportation can have dire repercussions.

- Hidden Fees and Charges: In addition to high interest rates, auto title loans may come with various fees and charges that can add to the overall cost of the loan. These costs could include, among other things, origination, late payment, and repossession fees.

Conclusion

Auto Title Loans Phoenix AZ, can be a lifeline in urgent financial situations, but they come with high risks. It can assist you in making an informed choice if you are aware of the terms, hazards, and available options. Always consider your ability to repay and explore all possible options before committing to an auto title loan.

FAQs

Q1. If I haven’t paid off my car entirely, can I still get an auto title loan?

Yes, but you must have significant equity in your vehicle, and the lender might pay off the balance as part of the loan.

Q2. How fast can I get the money from an auto title loan?

After an application is approved, a lot of lenders can deliver money in less than a day. However, it only depends on the specific lender.

Q3. When a loan is not repaid on schedule, what happens?

The same as any other loan, if you can’t repay on time, you risk late fees and eventually repossession of your vehicle.