Online Payday Loans in California

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xIn the serene coasts of California lie the best online payday loans to cater to your financial needs. Just like the diverse landscapes and varied lifestyle of California the needs of its people are also varied. That’s why we have a list of lenders offering customized payday loans for the diverse credit needs of the people of California.

Let’s discuss their features and services in detail so that you can choose online payday loan for you. Here is a list of the best online payday loans in California.

5 Best Online Payday Loans Providers In California

Top 5 Lenders For Online Payday Loans in California

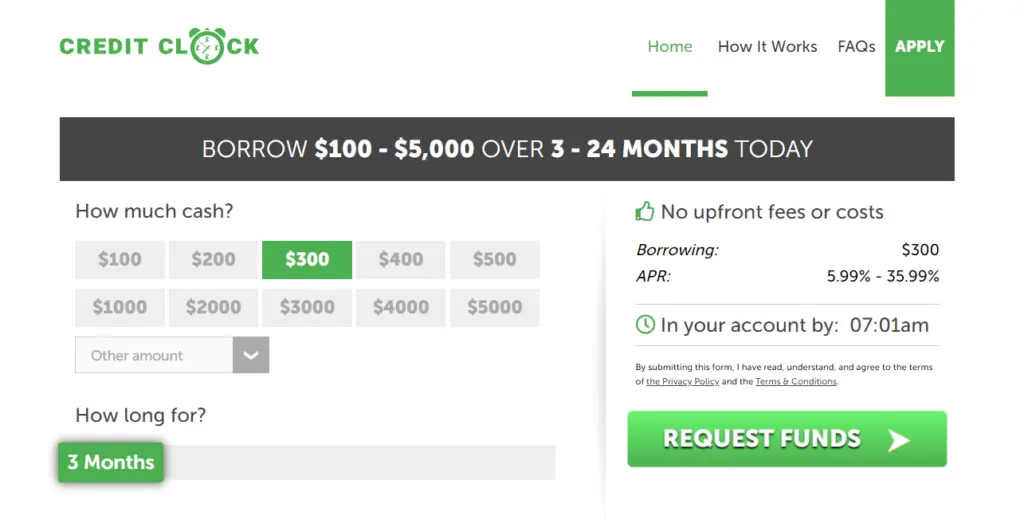

1. Credit Clock

The online payday loan offers of Credit Clock are designed to synchronize with the financial situations of the citizens of California. Online Payday Loans in California With their seamless application process and user-friendly interface, they stand out in this Golden State. Credit Clocks is a reliable platform offering efficient solutions with transparent terms.

Highlights:

- User-friendly interface

- Responsive support team

- Transparent terms

Eligibility Criteria:

- Applicants must be above the age of 18.

- Applicants must be American citizens.

- Applicants must have income proof.

Application Process:

- Submit your inquiry form on the official website of Credit Clock.

- Upload the documents as requested.

- Wait for the lender’s decision on your request.

2. Prestamos USA

The services of Prestamos USA live up to its name by catering to the diverse financial needs of California. Prestamos USA offers efficient and accessible options. Online Payday Loans in California, Their platform is committed to providing tailored services ,promptly and on time for Californians.

Highlights:

- Tailored solutions

- Accessible services

- Quick approvals

Eligibility Criteria:

- Applicants must be at least eighteen in age to avail of these services.

- Applicants must be permanent residents of America.

- Applicants must provide their income details.

Application Process:

- Upload your details at the official site of Prestamos USA.

- Your application will be assessed by the lenders.

- Lenders will send you an offer after your request is approved.

3. Money Lender Squad

California is an expensive city for sure, but the Money Lender Squad provides affordable financial solutions to its people. Their platform provides short-term loans at competitive interest rates to reduce the burden of repayment amount on your shoulders. In the challenges of the financial world, Money Lender Squad offers reliable solutions for the people of California.

Highlights:

- Reliable solutions

- Affordable rates

- Easy application process

Eligibility Criteria:

- Only those above the age of eighteen years are eligible.

- You must be either a permanent resident or a citizen of the USA.

- You must have a checking bank account under your name.

Application Process:

- Submit your details on the Money Lender Squad’s webpage.

- Your loan application will be processed by the team.

- You can transfer funds into your account after you are approved.

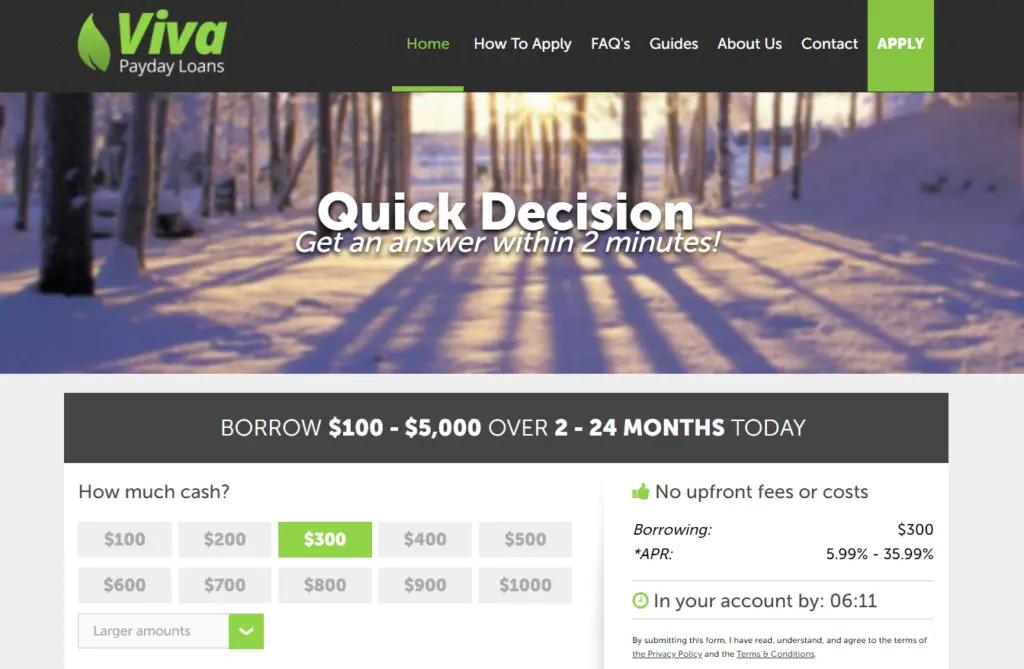

4. Viva Payday Loans

Viva Payday Loans understands the fast-paced lifestyle of the people of California, and that’s why they provide quick loan approvals. If you are stuck in a situation that needs immediate financial assistance, then Viva Payday Loans is your financial partner that offers swift approvals and fund disbursements.

Highlights:

- Swift approvals

- Fast fund disbursements

- Streamlined application

Eligibility Criteria:

- The minimum age requirement is eighteen.

- You must have American citizenship.

- You must have a valid identity proof

Application Process:

- Complete an inquiry form on the website of Viva Payday Loans.

- Specify a loan amount you wish to borrow.

- Disburse the money into your account after you are approved.

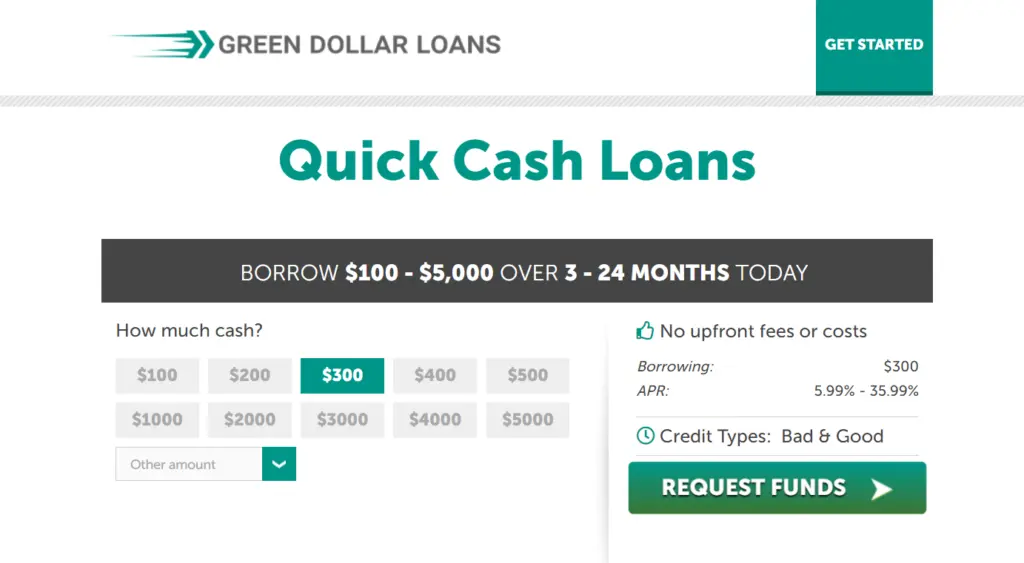

5. Green Dollar Loans

The Green Dollar Loans offers a variety of services such as financial solutions, credit tools, and plans along with online payday loans in California. They also help you in analyzing your credit profile to build a good credit score. Their platform takes care of all your needs to support you plan a better financial future.

Highlights:

- Advanced services

- Credit building opportunities

- No extra charges

Eligibility Criteria:

- You must be either eighteen or above in age.

- Only the citizens of the USA can avail of these services.

- The applicants must provide the verified address.

Application Process:

- Create a profile on Green Dollar Loans.

- Upload your documents and request a loan amount.

- You will be notified after you are approved.

All the above-mentioned lending platforms offer the best online payday loans for the residents of California.

How to choose the best online payday loan in California?

Choosing the best online payday loan in California carefully considers various factors before making such an important decision. Here are some tips you can follow to choose the best online payday loan in California.

1. Compare lenders

Go through all the available lenders in California. Lenders vary in their styles and terms of operating. Compare their offered services and choose the one that caters to your requirements.

2. Understand loan rates

Negotiate interest rates with the lenders. Also, check for any extra or hidden charges that might be levied into your loan agreement.

3. Repayment schedule

Assess the repayment terms with your lender to create a schedule that suits your financial schedule. Get the details about any penalties for missed or late repayment.

4. Customer reviews

Check the lender’s online reviews and feedback to gain insight into their reliability. This will help you avoid fraudulence.

5. Transparency

Ask your lender to clearly state the loan agreement such as repayment terms, interest rates, and potential penalties. Transparency is an important aspect of financial decisions.

6. Customer support

Look for a lender with active customer support because the borrowing process can be very hard, and you may require a lot of assistance with your doubts. You can use these tips to make an informed borrowing decision.

Conclusion

In conclusion, as we wrap up our exploration of online payday loans in California, it becomes evident that selecting the right lending option necessitates a thoughtful and discerning approach. Throughout our investigation into lending choices tailored for the Golden State, the above-mentioned platforms have emerged, providing a compass for borrowers seeking the most suitable solutions. These best online payday loans in California stand out due to lenders who openly communicate about interest rates, fees, and repayment terms.

Throughout this discussion, several key themes have emerged, underscoring the importance of transparency, compliance with regulations, and a careful assessment of associated costs. Given the dynamic nature of the online lending landscape, borrowers should remain vigilant about changes in regulations and industry practices.

In essence, the most commendable online payday loans in California transcend the mere act of fund provision, they embody a commitment to responsible lending practices, customer contentment, and deep comprehension of borrowers’ needs.

As you venture into the realm of the best online payday loans in California, let these considerations serve as your compass, guiding you toward a borrowing experience that is not only expeditious and convenient but also congruent with your financial well-being.

FAQs:

Q1. Are online payday loans legal in the state of California?

A1. Yes, online payday loans are legal in the state of California and are subject to the state’s legal regulations. Always choose a legally verified lender.

Q2. What will happen if I miss my repayment?

A2. Late or missed repayments can adversely affect your credit score. Some lenders might also impose penalties. Refer to your lender for the penalty details.

Q3. Are online payday loans suitable for the long-term financial future in California?

A3. Online payday loans offer solutions to short-term financial needs. For long-term financial solutions, seek guidance from a finance expert.

Disclaimer: The content presented in this article regarding best online payday loans in California is intended for general informational purposes only and should not be construed as financial advice. Readers are strongly encouraged to seek personalized financial advice based on their circumstances before making any financial decisions.

Efforts have been made to ensure the accuracy and timeliness of the information, but the financial industry is subject to changes in regulations and lending practices. Readers are urged to verify specific details with relevant authorities and lenders, as the information provided may become outdated.

While the article covers various aspects of online payday loans in California, including eligibility criteria, loan amounts, repayment terms, and alternatives, individual experiences may differ. The suitability of payday loans depends on specific financial situations. References or links to third-party websites or lenders do not guarantee the accuracy of the information provided on those platforms. Readers should exercise caution and conduct their due diligence when interacting with external websites or lenders.

In summary, this discussion aims to equip readers with knowledge, but it should not replace tailored financial advice. The onus is on individuals to make informed decisions that align with their financial realities. For personalized and in-depth guidance, consulting with qualified financial professionals is highly recommended.