Online Payday Loans In Louisiana

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xIn the heart of Louisiana lies the majestic Mississippi River, where every resident of the city wants to enjoy listening to jazz music. But with big cities come big expenses. That’s when the jazz music stops and the sound of your empty bank account starts.

But don’t worry, you can switch back with the help of these Online Payday Loans In Louisiana.

5 Best Lenders For Online Payday Loans In Louisiana

Top 5 Lenders Of Online Payday Loans In Louisiana

1. Jungle Finance

If you are looking for more than a lender in Louisiana, then Jungle Finance is just the right choice for you. Because they not only offer credit services but work together with you to manage your financial well-being. The Jungle Finance offers payday loans customized as per your financial conditions.

Highlights:

- Flexible repayments

- Client-centric approach

- Free financial consultations

Eligibility Criteria:

- Prospective applicants must be above the age of eighteen years.

- Applicants must hold citizenship in the United States.

- Documents illustrating proof of income are required.

Application Process:

- Submit your details on the official website Jungle Finance.

- Upload the required documents.

- Wait for the lender to send you an offer.

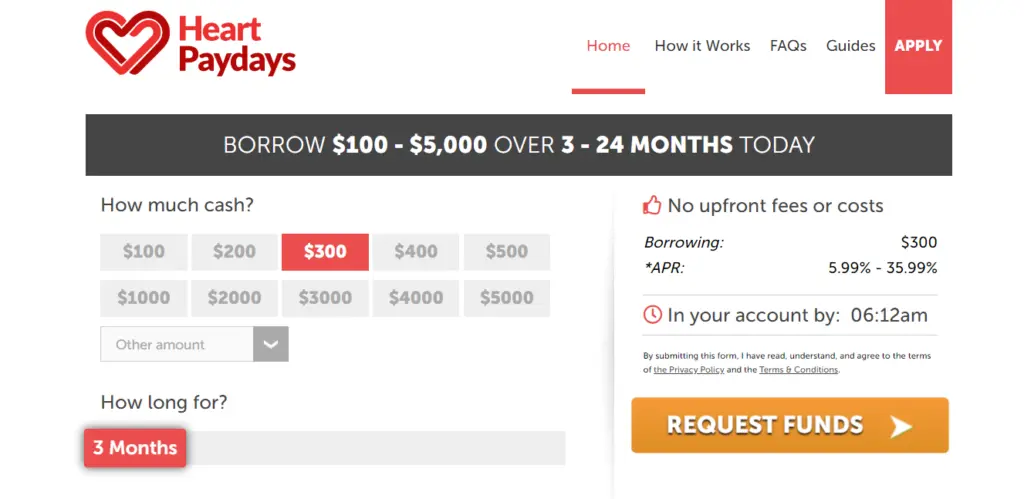

2. Heart Paydays

Just like the jazz music in Louisiana, unexpected expenses never stop. Sudden needs for funds can arise anywhere and anytime. Heart Paydays is committed to serving you the financial assistance you want within a heartbeat.

Highlights:

- Enjoy swift approvals

- Prompt fund disbursements

- Seamless application

Eligibility Criteria:

- You must be older than eighteen years.

- These services are exclusive to American citizens.

- Applicants need to provide details of their banking account under their name.

Application Process:

- Create your profile on the page of Heart Paydays.

- Choose a loan amount and repayment tenure in accordance with your budget.

- Once you are approved, you can transfer funds into your account.

3. 50K Loans

The people of Louisiana have visions as high as its buildings. These visions need the extra support that the 50K Loans provide. Its payday loans help the people of Louisiana to overcome short-term financial challenges effortlessly, giving them confidence and feeling empowered.

Highlights:

- Effortless process

- Transparent terms

- Versatile services

Eligibility Criteria:

- The age eligibility is eighteen years or above.

- You must be either a citizen or a permanent resident of the United States.

- Applicants are required to submit a valid identity proof.

Application Process:

- Send your details to 50K Loans through their online website.

- Submit your details and requirements.

- You will be notified after you are approved.

4. Loan Raptor

Constraints of funds often make people fold their wings and settle for cheaper options. But with the payday loans of Loan Raptor, the people of Louisiana can fly as high as they want in the unlimited sky of Louisiana. Online Payday Loans In Louisiana, as they provide world-class services at affordable rates.

Highlights:

- Minimal documentation documentation

- Advanced features

- Competitive rates

Eligibility Criteria:

- These services can only be available to those above eighteen years.

- It’s available only for legal residents of America.

- A verified address is required to be submitted.

Application Process:

- Complete the online application form for Loan Raptor.

- Specify a loan amount you wish to borrow.

- Wait to hear from lenders and choose an offer.

5. 24M Loans

When you see frauds everywhere, It is never easy to trust online platforms. There comes 24M Loans, a platform you can trust. They use encrypted security features to protect your sensitive information from online fishing, and all the lenders of 24M Loans are verified.

Highlights:

- No hidden charges

- Encrypted security

- Verified lenders

Eligibility Criteria:

- The minimum required age is eighteen years.

- You must possess legal citizenship of America.

- Applicants must provide income proof.

Application Process:

- Submit the inquiry form on the online page of 24M Loans.

- Your details will be sent to lenders for further analysis.

- Lenders will contact you after you are approved.

All the lenders, above- mentioned platforms offer you the best Online Payday Loans In Louisiana. For further details about the services of these lenders you can contact them directly at their respective websites.

How to compare online payday loans

Get the best online payday loans In Louisiana by carefully comparing all the available options. Here are a few tips to help you compare and decide what suits your needs the most.

1. Interest rates

Compare the offered interest rates of all the available options because the interest rate is a major factor in the borrowing process.

2. Additional charges

Have a clear discussion regarding all the extra costs and fees such as late repayment costs, service charges, or organization fees.

3. Repayment schedule

Look for a loan that offers repayment tenure as per your financial conditions so that you can manage your finances easily and avoid late repayments.

4. Online reviews

Do thorough research about the lender’s reputation. Read the online customer reviews to understand the lender’s operating manners. Always go with a verified lender.

5. Customer service

The borrowing process is very stressful, and you will have tons of doubts. Check out the lender’s customer support and choose a lender that offers an active support system to make your borrowing journey easy.

6. Security and privacy

Providing your sensitive financial data to lenders makes you vulnerable to scams and fraud. Inquire the lenders about the security measures they take to protect borrower’s data.

Conclusion

From the lively streets of New Orleans to the serene bayous, the financial landscape demands solutions that are not just accessible, but also transparent and fair. Each lender highlighted in this guide brings its unique strengths to the forefront, catering to various preferences and circumstances. In the realm of best online payday loans in Louisiana, Louisiana residents seek not only financial solutions but trustworthy partners who understand their unique needs.

As we conclude our exploration of the best online Online Payday Loans In Louisiana, it becomes clear that selecting the right lender is a crucial decision in your financial journey. As you contemplate your choices, consider not only the immediate financial relief but also the long-term implications of your decision. Online Payday Loans In Louisiana is one that not only provides prompt access to funds but also upholds ethical lending practices, ensuring your financial well-being.

Whether it’s the competitive rates, transparent terms, or excellent customer service, each lender showcased here underscores the commitment to addressing the diverse financial needs of Louisiana residents. Your financial journey is distinctive, and the right payday loan can be a stepping stone toward achieving your goals.

Remember to conduct thorough research, fully comprehend the terms, and only borrow what you can comfortably repay. Financial empowerment arises from making informed decisions, and with the right best online payday loans in Louisiana, you can navigate the twists and turns of your financial path with confidence.

FAQs:

Q1. Can I apply to multiple lenders at the same time in Louisiana?

A1. It is not recommended to apply to multiple lenders at the same time as it may negatively affect your credit score due to multiple credit checks in a short period.

Q2. What to do if I can’t pay my payday loan on time in Louisiana?

A2. Many lenders either levy penalty charges or extend repayment time. Connect to your lender to figure out a mutual solution.

Q3. Can I get a payday loan with bad credit in Louisiana?

A3. Yes, it is possible to get a payday loan with bad credit in Louisiana. Although, It may come at high rates.

Disclaimer : The details shared in this article about best online payday loans in Louisiana are meant for general information purposes only. While our goal is to offer accurate and up-to-date information, it’s essential to acknowledge that the financial industry is subject to continuous changes in regulations. Readers are strongly urged to conduct independent research and seek personalized financial advice tailored to their specific circumstances.

It is crucial to recognize that the content presented does not constitute financial advice and decisions regarding online payday loans should be made after careful consideration of individual situations. Financial products and services can differ, and readers should verify details directly with the respective lenders or financial institutions.

The author and publisher of this article expressly disclaim any responsibility for actions taken by readers based on the information provided. Financial choices are inherently personal, and the information presented here is not intended as a substitute for professional guidance.

Readers are urged to consult directly with financial advisors or lenders for personalized advice tailored to their unique needs. In a financial landscape that is constantly evolving, it is advisable to stay well-informed about any alterations in regulations or industry practices.

This article serves as a guide, and readers should exercise diligence and caution when navigating the intricacies of the financial market. To maintain your financial well-being it is important to borrow responsibly and read carefully. Always go through the loan agreement in detail before entering into any legal arrangement to avoid any unpleasant surprises in the future.