Online Payday Loans In Mississippi

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xEver feel like your budget is tighter than expected? Well, do not worry! Online payday loans in Mississippi are here to help during difficult times. These loans are different from old-fashioned loans. They are fast digital options, available quickly when unexpected bills arrive. Whether you live in Jackson or on the Gulf Coast, online payday loans In Mississippi can assist when unplanned expenses demanding your attention.

So if your wallet is looking emptier than usual, don’t worry! These online payday loans in Mississippi in can provide quick assistance to help you get back on track financially. These temporary loans aim to support you until your next paycheck arrives so you can pay for necessities in the interim. Just be sure to borrow only what you need and can reasonably repay once your situation improves.

Top 5 Options Of Online Payday Loans In Mississippi

5 Best Options Of Online Payday Loans In Mississippi

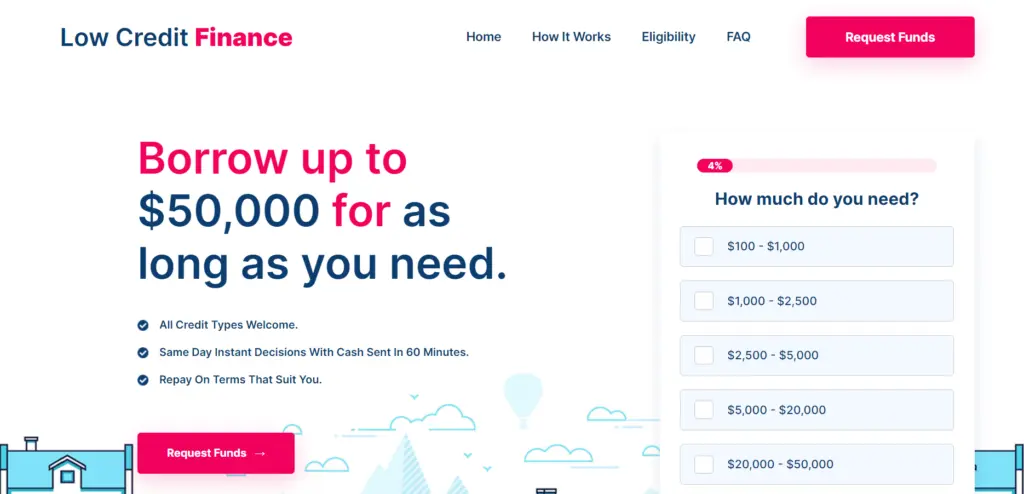

1. Low Credit Finance

Struggling with money? Don’t worry, assistance is here! Low Credit Finance can help those facing financial difficulties. Whether you’ve got extremely good credit or a score that wishes paintings, we’re prepared to assist you. You can get entry to up to $50,000 online payday loans in Mississippi fast way to fast approval choices. And the best information?

We welcome all credit score levels on the grounds that we believe everyone deserves financial flexibility. No more stressing over piles of paperwork or hidden fees; with us, it is easy. So what are you awaiting? Dive into the low-strain, high-praise international of Low Credit Finance and wave goodbye to money problems.

Highlight Points:

- Borrow as much as $50,000: Unlock the ability to secure a tremendous quantity, tailoring the loan to your particular needs.

- All Credit Types Welcome: Whether your credit score rating resembles a hovering eagle or a tadpole, Low Credit Finance embraces all credit score sorts with open hands.

- Same Day Instant Decisions: Experience the fun of rapid decision-making, with coins zipping into your account within 60 mins of approval.

- Repay On Terms That Suit You: No extra one-size-fits-all. Craft a repayment plan that aligns together with your financial comfort and timeline.

- APR Rates Range: Benefit from competitive APR fees starting from 5.99% to a maximum of 35.99%, catering to certified clients.

Eligibility:

- Open to Mississippi Residents: Exclusive to the vibrant community of Mississippi, ensuring local accessibility.

- 18 Years and Above: Applicants must be at least 18 years old to qualify for Low Credit Finance payday loans.

- Verifiable Income: A steady source of income is a key requirement, demonstrating your ability to repay the loan.

- Active Bank Account: Having an active bank account is crucial for the seamless transfer of funds.

Application Process:

- Select Loan Amount: Determine your financial needs and select a loan amount ranging from $100 to an impressive $50,000.

- Complete Quick Application: Engage in a swift two-minute application process, filling out a user-friendly form to provide the necessary details.

- Approval and Loan Disbursement: If your application passes the lender’s scrutiny, rejoice! You’ll receive approval on the same working day, and the loan amount will be swiftly deposited into your account.

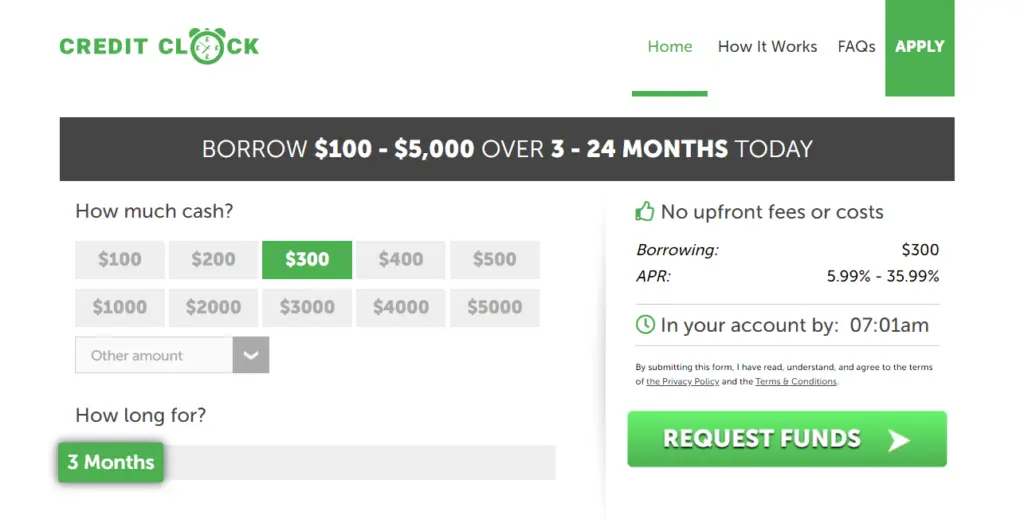

2. Credit Clock

Money can be tough to control from paycheck to paycheck. A small financial enhancement can help when unexpected crises arise. That’s where brief term loans are available for the duration of money crunches. You need money to get through until your next payday but do not want a massive loan. Credit Clock is right here to help with convenient online payday loans in Mississippi without an awful lot of trouble. Best of all, interest prices as little as 5.99% to 35.99% mean they won’t bury you in debt like a few lenders.

So if payments have you pressured, loosen up – Credit Clock is here to smoothly tide you over until payday without extra stress to your wallet. Their tribal loans offer remedy while emergencies strike between pay periods. No more annoying approximately masking fees till your next check arrives.

Highlight Points:

- Quick Help With Money: Short-term online payday loans in Mississippi offer quick admission to small sums of coins, perfect for bridging the space among pay durations and handling sudden fees.

- Low Interest: Unlike regular quick-term loans, Credit Clock offers hobby charges ranging from 5.99% to 35.99%offering a lower-priced borrowing alternative.

- Same Day Approval and Funds: Experience the benefit of approval and loan funds on the same day, ensuring you get the money you need precisely whilst you need it.

- Flexible Loan Amounts: With loan quantities starting from $100 to $5000, borrowers can regulate their loans to their precise monetary desires, whether or not large or small.

Eligibility:

- Valid ID: All applicants ought to gift a legitimate form of identification to qualify for online payday loans in Mississippi.

- Age Requirement: Applicants must be at least 18 years old to be eligible for payday loans.

- Active Bank Account and Mobile Phone: A functioning bank account and mobile phone wide variety are important for the mortgage utility procedure.

- Steady Income: Applicants should demonstrate a consistent income of at least $one thousand in line with month to qualify for online payday loans in Mississippi.

- Proof of Income: Providing evidence of income is mandatory to confirm the borrower’s capability to repay the mortgage.

Application Process:

- Determine Loan Amount: Decide on the amount of cash you need to borrow to meet your financial obligations.

- Submit Personal Details: Fill out the online application form with your personal information, ensuring accuracy and completeness.

- Await Application Feedback: Sit back and relax while Credit Clock processes your application. You’ll receive pre-approval feedback within minutes.

- Sign Loan Agreement and Receive Funds: Once approved, review and sign the loan agreement. Upon completion, the loan amount will be swiftly deposited into your designated bank account.

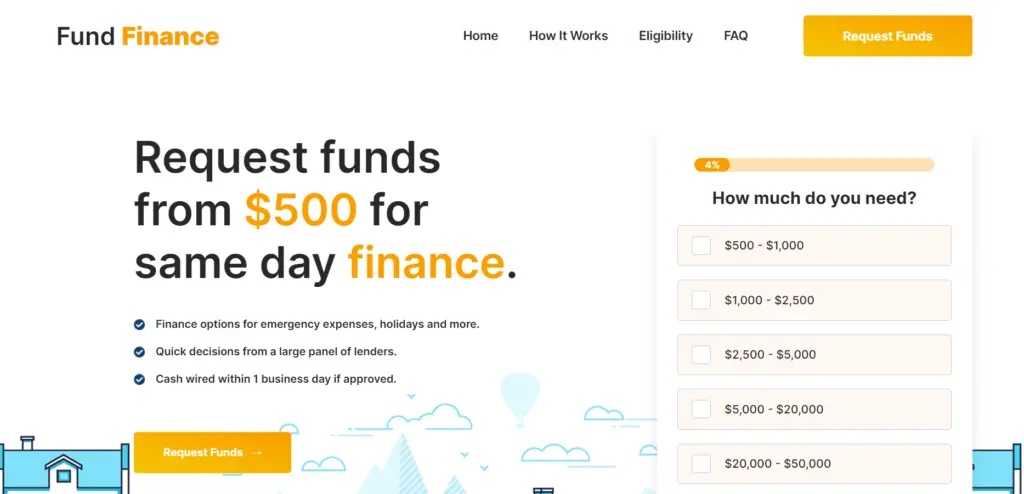

3. Fund Finance

From unexpected costs to that lengthy-awaited holiday trip, once in a while financial savings simply aren’t sufficient. That’s in which Quick Cash steps in like a monetary helper, offering assistance to the ones needing cash rapidly. Whether dealing with an upcoming invoice or making plans for a closing-minute adventure, Quick Cash has your back with on line quick-time period loans beginning at $500, sent right away.

With lenders geared up to decide speedy and money stressed out inside one business day, money issues may be over earlier than you can say " hassle solved" So why fear when Quick Cash is here to trade your worried feelings for happy ones?

Highlight Points:

- Quick Access to Funds: Obtain equal-day finance beginning from $500, ideal for addressing emergency charges or protecting unexpected payments.

- Competitive APR Rates: Enjoy APR fees starting from 5.99% to 35.99%, making sure low-cost borrowing alternatives for qualified clients in Mississippi.

- Simple Application Process: Experience problem-loose borrowing with Fund Finance‘s streamlined online utility method, designed to offer fast get right of entry to price range without the need for widespread paperwork.

- Large Network of Lenders: Benefit from a massive network of creditors and opportunity options, ensuring debtors find the appropriate financial solution tailor-made to their specific desires and circumstances in Mississippi.

Eligibility:

- Residency: Applicants must live in Mississippi to qualify for payday loans online through Fund Finance.

- Age Requirement: Borrowers must be at least 18 years old to be eligible for online payday loans in Mississippi. Bank Account: Having an active bank account is needed for easy money transfer when the loan is approved.

- Steady Income: Applicants should show a regular income source, earning at least $1000 per month minimum to qualify for payday loans.

- Valid ID: All applicants must provide valid identification to confirm their identity and eligibility for online payday loans in Mississippi.

Application Process:

- Submit Online Form: Complete the net request form by way of giving actual private and financial information wished for the procedure.

- Receive Decision: Expect to get a quick desire for your loan ask, allowing you to go forward with sureness.

- Loan Approval and Receiving Funds: If authorized via a lender, borrowers can foresee the rapid approval and getting off the price range, typically within one workday, making certain short access to the requested loan amount.

- Repayment Terms: Upon getting the loan, debtors have to observe the agreed reimbursement conditions, making sure well-timed reimbursement to stay away from any feasible penalties or fees.

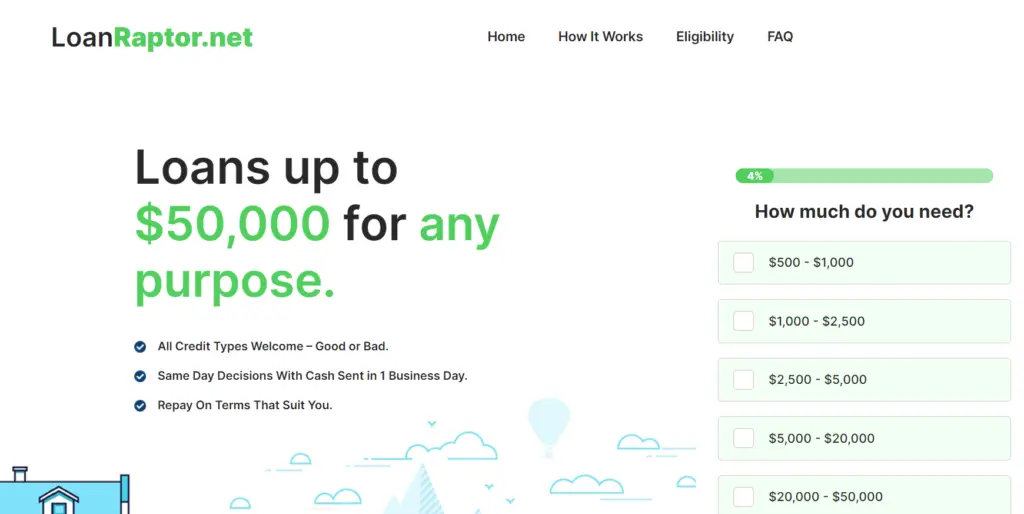

4. Loan Raptor

Loan Raptor is a helpful choice for those navigating tight money situations. Imagine if loans of as much as $50,000 were available online, regardless of your credit score score – whether you’re just having fun or struggling, Loan Raptor welcomes all. Decisions can be made the same day, and cash sent to assist in just one business day, faster than saving may have ever been.

Plus, you control the schedule for repayment, as Loan Raptor believes letting you decide works remarkably. It’s not just about online payday loans in Mississippi; it’s a financial partner ready when needed most, to ensure certain you come out winning your money challenges!

Highlight Points:

- Generous Loan Amounts: Loan Raptor offers loans as much as $50,000 for any purpose, providing adequate financial aid for various needs and aspirations.

- Inclusive Credit Policy: Whether your credit is as pristine as a freshly polished diamond or has some tough edges, Loan Raptor welcomes all credit score sorts, making sure nobody receives left behind.

- Fast Decision and Disbursement: Experience the ease of equal-day choices and coins despatched within one commercial enterprise day, imparting speedy access to price range whilst wanted most.

- Flexible Repayment Terms: With Loan Raptor, borrowers can repay their loans on terms that suit their individual financial situations, making sure of a pressure-unfastened borrowing experience.

Eligibility:

- Residency: Applicants have to be residents of Mississippi to qualify for online payday loans through Loan Raptor.

- Age Requirement: Borrowers need to be at least 18 years old to be eligible for online payday loans in Mississippi.

- Active Bank Account: Possession of a lively bank account is important for the seamless transfer of price range upon mortgage approval.

- Steady Income: Applicants must show a steady income source, with a minimum monthly earnings of at least one thousand to qualify for payday loans.

- Valid Identification: All applicants should provide a legitimate form of identity to affirm their identification and eligibility for online payday loans in Mississippi.

Application Process:

- Complete Online Form: Fill out the online loan request form with accurate personal and financial information to kickstart the application process.

- Receive Decision: Expect to receive an almost instant decision on your loan application, allowing you to move forward with confidence.

- Loan Approval and Disbursement: If approved by a lender, borrowers can anticipate the swift approval and disbursement of funds, typically within one business day, ensuring quick access to the requested loan amount.

- Repayment Terms: Upon receiving the loan, borrowers must adhere to the agreed-upon repayment terms, ensuring timely repayment to avoid any potential penalties or fees.

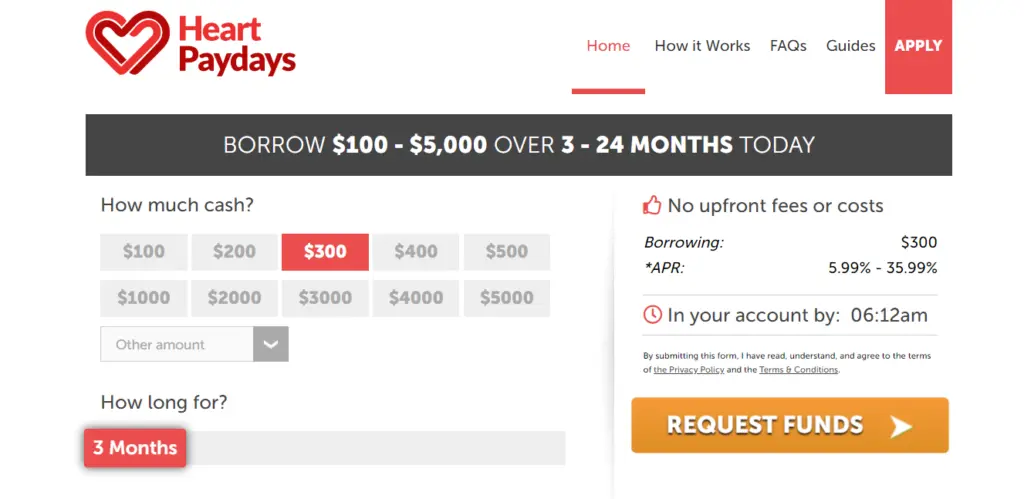

5. Heart Paydays

Heart Paydays helps Mississippi citizens get brief money when unexpected charges stand up however regular loans aren’t possible. Imagine needing coins however conventional lenders appear a ways away. Don’t fear – Heartwork Paydays gives online payday loans Mississippi just for Mississippi locals.

These special loans blend ease and flexibility, letting debtors pay back in elements over time. Rates may additionally fluctuate a few, but Heartwork Paydays makes applying strain-free like Mississippi dust pie, helping parents feel sure dealing with a price range.

Highlight Points:

- Payday Loans: Heart Paydays gives online payday loans in Mississippi tailor-made especially for Mississippi citizens, taking into account conceivable reimbursement in installments over the years.

- Flexible Loan Amounts: Borrowers can request loan amounts of as much as $5000, imparting the power to deal with various financial wishes and emergencies.

- Simple Application Process: With a trustworthy software shape, applying for an online payday loans in Mississippi through Heart Paydays is a breeze, making sure a problem-free revel for borrowers.

- Quick Approval and Disbursement: Experience speedy approval and disbursement of mortgage quantities, with notifications touchdown for your inbox within hours or an afternoon, making sure fast get admission to funds when wanted most.

Eligibility:

- Age Requirement: Applicants need to be 18 years or older to qualify for online payday loans in Mississippi through Heart Paydays.

- Mobile Phone Connection: Possession of a valid cell telephone connection is required for conversation functions for the duration of the application technique.

- Email Address: Applicants need to have an active electronic mail address to receive notifications and correspondence from Heart Paydays.

- United States Bank Account: Borrowers have to maintain a financial institution account inside the United States for the seamless transfer of loan finances.

Application Process:

- Decide Loan Amount: Choose the favored loan amount that aligns with your monetary dreams and repayment skills.

- Complete Application Form: Fill out a brief and smooth application shape supplied through Heart Paydays, detailing the mortgage amount and desired terms.

- Wait for Decision: After filing the utility, wait for Heart Paydays to check and system your request, which may additionally encompass credit checks by using the manner of outside creditors in their network.

- Loan Approval: Upon approval, get a hold notification from Heart Paydays concerning the approval of your loan quantity, with a price range commonly credited to your account within hours or a day, offering fast access the an awful lot of wanted coins.

Navigating Financial Challenges with Online Payday Loans in Mississippi

In rural Mississippi, wherein cash troubles can appear without warning, short online payday loans in Mississippi can help folks who need cash rapidly. Trusted lenders like Low Credit Finance, Credit Clock, Fund Finance, Loan Raptor, and Heart Paydays make dealing with financial problems less complicated than before. They provide options like more time to pay back or decrease in relaxation quotes.

These online payday loan groups welcome all kinds of humans, regardless of their credit score history. So if unexpected costs all at once purpose cash worries, relaxation clean understanding online payday loans in Mississippi are available to offer assistance.

Key Points:

- Reputable lenders like Low Credit Finance, Credit Clock, Fund Finance, Loan Raptor, and Heart Paydays provide online payday loans in Mississippi.

- Flexible reimbursement terms and competitive hobby charges cater to humans of all credit score rating types.

- Quick approval tactics and identical-day disbursement make certain activate get the right of entry to to masses-wanted price range.

- Navigating economic annoying conditions turns into greater feasible with online payday loans in Mississippi.

Conclusion:

Among the numerous monetary options to be had, online payday loans in Mississippi can assist reliably in times of brief cash need. Reputable creditors like Low Credit Finance, Credit Clock, Fund Finance, Loan Raptor, and Heart Paydays provide bendy terms, aggressive rates, and rapid approval processes, making it less difficult to address monetary challenges. The next time you face a good situation, remember that assistance is only a click away through online payday loans in Mississippi.

FAQs:

Q1. Are online payday loans in Mississippi secure to apply?

A1. Online Payday loans in Mississippi may be ok to use if you’re careful. Loans from legitimate agencies like those recommended above should not motive issues. However, it is important most effectively borrow what you need and can repay. Only get loans from lenders you accept as true with.

Q2. What if I actually have bad credit? Can I nevertheless qualify for an online payday loan?

A2. Absolutely! Many online payday mortgage companies, together with Low Credit Finance and Loan Raptor, welcome borrowers with all credit kinds, along with people with less-than-best credit ratings.

Q3. How speedy can I anticipate getting hold of finances after applying for an internet payday mortgage?

A3. The turnaround time varies depending on the lender and their approval process. However, maximum creditors strive to provide equal-day approval and disbursement, making sure you get the budget you want right away.

Disclaimer: The information provided in this blog is for educational and informational purposes only. It does not constitute financial advice, and readers are encouraged to conduct their own research or consult with a qualified financial advisor before making any financial decisions. While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the content contained herein. Any reliance you place on such information is therefore strictly at your own risk. We shall not be liable for any loss or damage arising from the use of the information provided in this blog.