Online Payday Loans In Oregon

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xFeeling the pinch financially? Never mind that shindig if a quick relief is what you seeking. Online payday loans in Oregon can come to the rescue as your financial saviour. You won’t feel like you are jumping through hoops to get your money or that you’ve discovered a stuffy bank. Online payday loans in Oregon is the up-to-date ‘cool cats’ in the lending biz.

Money needed to repair a ride that just chose to be the insufferable trombone reminiscent of rust? Pow! Luckily, the internet has fast money advances. The invoice given to you by your doctor has you feeling dizzy. Bam! It is a type of online loan that bails you out when there is no other way.

Be like this cozy financial armrest, you block your desire for a treat until your next paycheck comes and sashays in. It’s very fast and very easy, and the entire thing is completed online. No need to look for the best clothing, pretend that everything is fine, and say your sorrows to the stranger sitting right in front of you. Just press the button and ‘ke-shing!’ The money is in your bank account. Get cash on your phone to lead the present or face a wild windy future.

Top 5 Lenders Of Online Payday Loans In Oregon

5 Best Lenders Of Online Payday Loans In Oregon

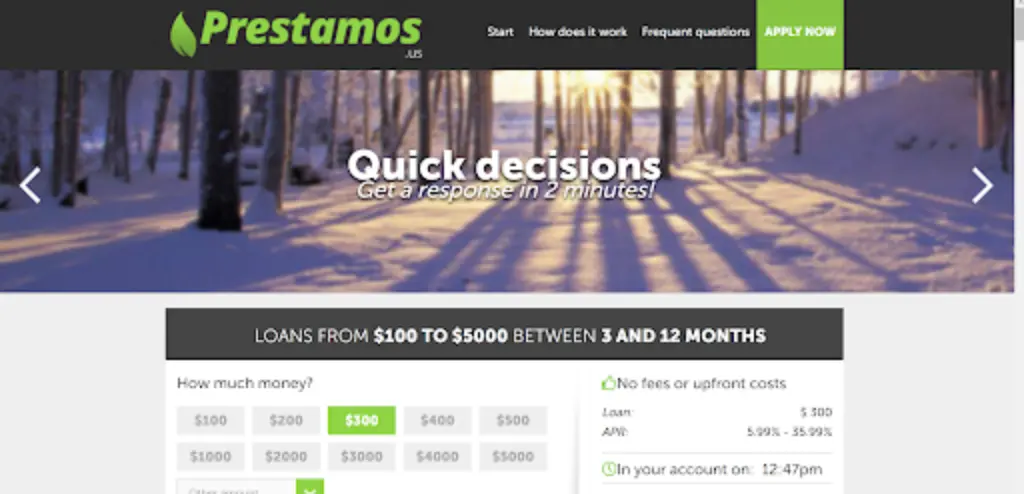

1. Prestamos US

Want to secure online payday loans Oregon? Look no further than Prestamos US. Offering loans ranging from $100 to $5000 with repayment terms between 3 and 12 months, Prestamos US provides a quick and convenient solution to your financial needs. Their online loans offer a simple application process and quick approval, so you can get the money you need when you need it, whether you’re dealing with unforeseen bills or just need a little more cash to help you through.

Prestamos US welcomes all FICO ratings, making their loans available to a huge variety of candidates. The online utility system is easy and easy, requiring fundamental private statistics and documentation. With a quick turnaround time, you may assume to get hold of a selection for your mortgage application in minutes, permitting you to get entry to your funds within 24 hours. So why wait? Apply now and experience the convenience of online payday loans Oregon with Prestamos US.

Key Highlights:

- Small loans beginning at $100 and extending to $5000 are available.

- You can take 3 months up to a full year to repay the funds. Annual percentage rates vary significantly – from quite good at 5.99% to rather high at 35.99%.

- All credit scores are accepted for consideration.

- The online application process is swift and simple. Money will reach your bank account within one business day.

Eligibility Criteria:

- Must be of legal age (18+)

- Provide valid identification (SSN, ITIN, passport, or Consular Registration)

- Have a valid bank account

- Proof of monthly income or employment

- Have an email and personal telephone number

Application Process:

- Go to the Prestamos US website and click on the “APPLY NOW” button.

- Have all required documents ready, including identification, income verification, and banking information.

- Select the loan amount and repayment term using the loan calculator tool.

- Fill out the online application form with your personal information.

- Submit the form and await a decision from the panel of lenders.

- If approved, receive your funds within 24 hours and use them as needed.

2. Money Lender Squad

With loan sizes ranging from $100 to $5,000 and terms of 3 to 6 months, Money Lender Squad offers a quick and easy solution to your financing needs. Their easy-to-use online application form only takes 2 minutes to fill out, ensuring that you can get the funding you need without any hassle. In addition, based on the credit and affordability assessment decisions made by the lenders, you can be assured that you will be treated fairly and transparently throughout the process.

The Money Lending team understands that everyone’s financial situation is unique, which is why they offer loans with an APR of over 35.99%. Their commitment to responsible lending means you can borrow with confidence, knowing you won’t be hit with exorbitant interest rates. Additionally, Money Lending Squad makes it simpler for you to receive the money you need, when you need it, by offering flexible repayment options and a simple way to recover your loan.

Key Highlights:

- Short-term cash loans which are $100- $5,000 in amount.

- The quick 2-minute application process

- Interest on loans with annual percentage rates not exceeding 35.99%.

- Flexible payment terms from 3 to 6 months enable us to cover the resulting expenses promptly.

- Transparent evaluations of credit solvency and capacity to obtain a loan.

- Easy collection of funds whenever the approval is obtained through remittance of funds.

Eligibility Criteria:

- Must be a resident of Oregon

- Provide valid identification and proof of income

- Must have a valid bank account for loan disbursement

- Credit checks may be performed by lenders

- APR and loan terms may vary depending on lender approval

Application Process:

- Fill in the 2-minute application form on the Money Lender Squad website.

- Review and confirm loan terms with your lender.

- Upon approval, collect your loan funds quickly and conveniently.

- Enjoy peace of mind knowing you have access to quick cash whenever you need it with Money Lender Squad.

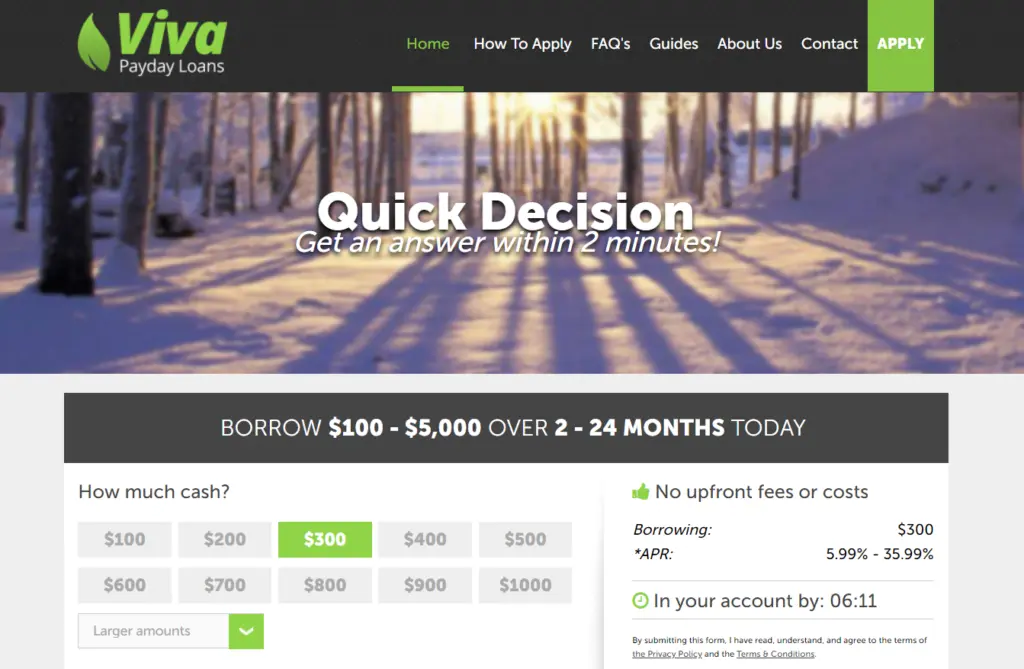

3. Viva Payday Loans

Viva Payday Loans has a broad assortment of loan types for you to choose from and, this way, helps you to address your short-term budget deficits most comfortably. Whether you have a pressing short-term need or a larger expense that requires a rollover plan, Viva Payday Loans offers you a comprehensive range of online payday loans in Oregon to ensure you are covered. They have a user-friendly application process so it is easy to apply for and with quick approval times, you can just have the funds you need for the time being.

Viva Payday Loans realizes that its customers can fall victim to unexpected financial emergencies that may be experienced by anyone, which is why it provides loans to people irrespective of their credit scores. If you have good credit, bad credit, or no credit at all, you will find Viva Payday Loans useful. The fact that among their other provisions, they also facilitate easy applications is an additional benefit, ensuring that you submit your application with the confidence of a high chance of approval.

Key Highlights:

- A variety of loan choices offered

- Easy and quick online application procedure

- Loans to people with different credit ratings

- Adaptable repayment plans

- Competitive prices

- Simple eligibility criteria

Eligibility Criteria:

- Must be a resident of Oregon

- Must be at least 18 years old

- Must have a regular source of income

- Must have an active bank account

Application Process:

- Visit the Viva online Payday Loans in Oregon website and complete the online application form.

- Provide basic personal information as well as income facts.

- Submit your application and wait for approval.

- Once approved, go over the loan terms and conditions.

- Sign the loan agreement to receive the funds.

- Repay the debt on the agreed-upon terms.

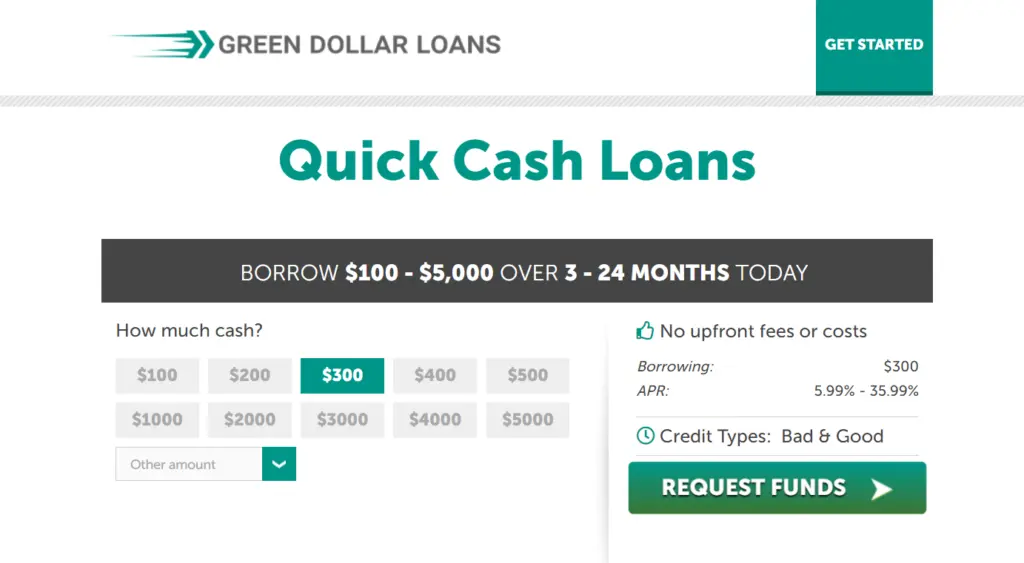

4. Green Dollar Loans

As an intermediary that allows customers to access multiple lenders on the same online platform, Green Dollar Loans becomes the quickest and easiest way to get online payday loans in Oregon at the just click of a button. A simple 2-minute application process where you can fill up the form and have a chance of lending from lenders who are prepared to give you what you need for your urgent needs. Green Dollar Loans extends its welcome hand to all FICO score holders which gives them the equal access to funds they deserve regardless of their credit history.

When it is lending Green Dollar its loans, the lenders have to be very transparent. They offer straightforward APRs and rate descriptions, thus equipping borrowers with the material they require to make wise budgetary choices. By being able to choose a term that will fit your budget, you can select one of the 60-90-day repayment programs.

Key Highlights:

- Quick and convenient 2-minute application process

- All FICO scores welcome

- Transparent APRs and rates

- Flexible repayment periods ranging from 61 to 90 days

- Wide state availability, including Oregon

Eligibility Criteria:

- Must be a resident of Oregon

- Must be at least 18 years old

- Must have a regular source of income

- Must have an active bank account

Application Process:

- Fill in the 2-minute application form on the Green Dollar Loans website.

- Confirm loan terms with your lender.

- Collect your loan funds upon approval.

- Repay the loan according to the agreed-upon terms.

- Enjoy peace of mind knowing that you have access to quick and convenient online payday loans Oregon.

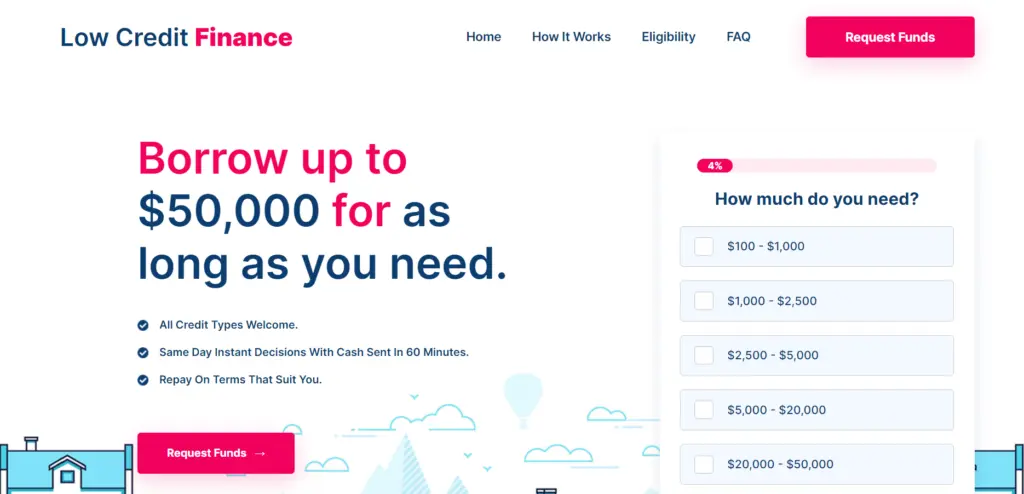

5. Low Credit Finance

With the ability to borrow up to $50,000 for as long as you need, Low Credit Finance offers loans to individuals with all types of credit. Whether you have good credit, bad credit, or no credit at all, Low Credit Finance welcomes all credit types. Plus, with same-day instant decisions and cash sent in as little as 60 minutes, you can get the online payday loans in Oregon you need when you need them. With repayment terms that suit your needs, Low Credit Finance ensures that you can repay your loan on your terms, making it easier to manage your finances.

Low Credit Finance prides itself on offering transparent and competitive APR rates, ranging from 5.99% to 35.99% maximum APR for qualified consumers. Their easy three-step process makes it simple to apply for a loan – just select your loan amount, apply, and receive your loan the same working day if approved by a lender. With no paperwork and no hidden fees, Low Credit Finance offers a hassle-free borrowing experience. Whether you need a small loan or a larger sum, Low Credit Finance can help you find the financial solution that fits your needs.

Key Highlights:

- Borrow up to $50,000 for as long as you need

- All credit types welcome

- Same-day instant decisions with cash sent in 60 minutes

- Repay on terms that suit you

- Competitive APR rates range from 5.99% to 35.99%

Eligibility Criteria:

- Must be a resident of Oregon

- Must be at least 18 years old

- Must have a regular source of income

- Must have an active bank account

Application Process:

- Select your loan amount, ranging from $100 to $50,000.

- Complete your request using the quick form on the Low Credit Finance website, which only takes 2 minutes.

- If approved by a lender, you’ll receive your online payday loans in Oregon on the same day.

- Repay your loan on terms that suit you.

- Experience a hassle-free borrowing experience with Low Credit Finance. Apply today and take control of your finances!

Debunking Myths About Online Payday Loans in Oregon

Online payday loans in Oregon have turned out to be a topic of debate, with many myths surrounding their utilization and impact. These quick-time period loans are designed to provide brief economic assistance to individuals facing unexpected prices or emergencies. However, misconceptions regularly overshadow the advantages they offer.

In this blog, we will debunk some commonplace myths approximately online payday loans in Oregon, dropping light on the truth at the back of those convenient economic solutions.

Myth 1: Online Payday Loans Don’t Always Lead to More Debt

Many think online payday loans in Oregon always cause people to owe more and more money over time. But this isn’t always true if used correctly. These loans have high interest rates but are meant to only be used for a short time. If someone borrows wisely to pay for something urgent and pays it back on schedule, they won’t have to pay a lot in extra fees.

Oregon laws also limit how many payday loans in a row a person can get. This stops folks from owing money forever. Payday loans may work out okay if borrowed carefully for a short emergency and repaid as agreed.

Myth 2: Online payday loans are Malicious and use Unsecured Lenders

Another misconception is that online payday lenders prey on vulnerable borrowers, exploiting their financial difficulties for profit. While it is important to be on the lookout for unscrupulous lenders, popular online payday lenders in Oregon adhere to strict regulations and fair lending practices Thus these lenders transparently disclose their terms and fees, giving borrowers clear information before committing to a loan.

Additionally, online payday loans in Oregon can be a lifeline for individuals without access to traditional banking services or a lifeline for individuals with poor credit scores, providing a viable option on in times of emergency.

Myth 3: Online Payday Loans Unnecessarily Require a Good Credit Score Before Credit Is Granted.

On the contrary, an idea that is heard from people the most often that mortgage lenders in Oregon demand a spotless credit report, while the reality shows the truth to be the opposite. In contrast with conventional lending institutions, payday loan providers concentrate more on an individual’s income and the borrower’s capacity to pay back in an inevitable way that is more related to their credit history.

So far as the eligibility criteria considered essential (for example, having a steady income and a valid checking account) play their role, online payday loans in Oregon are available to all borrowers.

This accessibility is what makes payday loans a logical justification for individuals with imperfect credit scores to fall back on when getting any financial aid from other places is barely possible.

Myth 4: Online cash borrowing is unlicensed and dangerous.

Others state that the online payday loan industry in Oregon stays in a kind of nonexistent zone relative to their regulation and so is dangerous for borrowers. Nevertheless, the fact remains that payday lending operations are backed both by the federal government and state authorities to ensure that borrowers are not exploited by unethical practices.

In the American state of Oregon, payday lenders are obliged to follow a license and keep the laws about the duration of the loan term, the interest rate, and the fees in mind. Besides, responsible payday lenders on the internet utilize state-of-the-art encryption technologies to protect their customers’ private and financial details and to provide loan applicants with a safe and uncorrupted lending experience.

Myth 5: Online payday lenders should only be used in serious financial emergencies.

Unlike commonly perceived, online payday loans in Oregon are not always floated out to get the emergency covered but are now engaged in a variety of situations. A borrower from Oregon can resort to using short-term loans for various purposes, like paying bills, dealing with emergency costs, or buying some desired things.

The turn-around time of the approval of these loans is often very quick and flexible repayment options assuage the stress of the clients, this is because short-term inadequacies are being focused on. Yet the vital thing is to utilize payday

Conclusion:

Online payday loans in Oregon provide an invaluable resource for individuals in need of emergency financial assistance. By debunking common myths surrounding these types of loans, we can better understand their role in helping borrowers navigate debt or unexpected emergencies.

While payday loans may not be right for everyone, they provide a viable solution for individuals without traditional banking services or poor credit scores. By choosing reputable lenders and borrowing responsibly, individuals can use payday loans to meet immediate financial needs without falling prey to debt in.

FAQs:

Q1. What are the online payday loan eligibility criteria for Oregon residents?

A1. The requirements to be eligible for an online payday loan in Oregon vary, you should be at least 18 years old, have recurring income, provide a valid ID, and have an active bank account.

Q2. What is the maximum amount you can get borrowing an online payday loan in Oregon?

A2. The number of dollars you may get out from an online payday loan in Oregon is different for every lender and customer. Generally, the size of the loan varies from $100 to $5000, but a lender may be able to offer a higher amount.

Q3. How long does it take to receive funds from an online payday loan in Oregon?

A3. The time it takes to receive funds from an online payday loan in Oregon varies depending on the lender and the loan approval process. You can often expect to receive funds within 24 hours of loan approval.

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial advice. Borrowers should carefully review the terms and conditions of any loan agreement before committing to a loan. Additionally, borrowers should exercise caution and ensure they can afford to repay the loan on time to avoid additional fees and charges.