Payday Loans in Arizona

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xArizona, situated in the southwestern United States, is celebrated for its diverse landscapes, ranging from the expansive Sonoran Desert to the awe-inspiring Grand Canyon. The bustling city of Phoenix, its capital, thrives with a dynamic cultural scene. The state showcases red-rock buttes, saguaro cacti, and distinctive geological formations.

Payday Loans in Arizona: Quick Look

Payday loans in Arizona, chosen for their convenience during unexpected expenses, demand careful consideration of terms and costs. Borrowers must explore alternatives and prioritize responsible use and prompt repayment to minimize associated financial risks.

Top 5 Payday Loans in Arizona Providers

5 Best Payday Loans in Arizona Providers

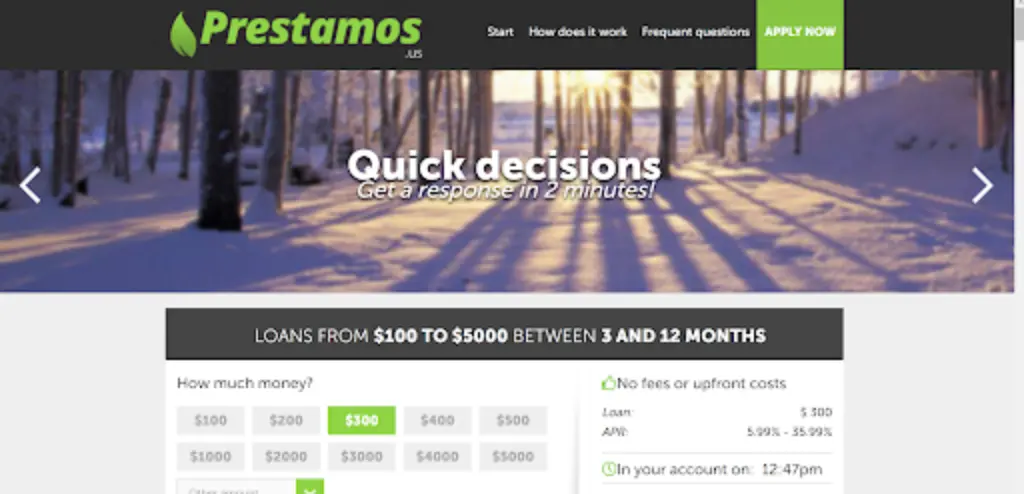

1. Prestamos USA

Prestamos USA offers a hassle-free and efficient loan application process, distinguishing itself from traditional loans that involve lengthy waiting periods and extensive paperwork. The platform instantly connects borrowers with approved lenders, eliminating the need to navigate multiple websites. Every inquiry is promptly addressed, ensuring a swift response and facilitating the disbursement of Payday Loans in Arizona funds in less than a day.

Highlights:

- A secure platform for installment loans with a 100% security guarantee.

- Flexible repayment terms tailored to your needs.

- Credit score not considered for loan approval.

Eligibility Criteria:

- Be qualified to earn $1000 as monthly income.

- Be a US national or legal resident to avail loan.

- Verify if you are over 18 years of age.

Loan Details:

- Prestamos USA is open to provide loans from $100 to a maximum of $5,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to prestamos.us and complete the application form.

- You will have to complete an online application, and await approval.

- You can expect a transfer of money within 2 days.

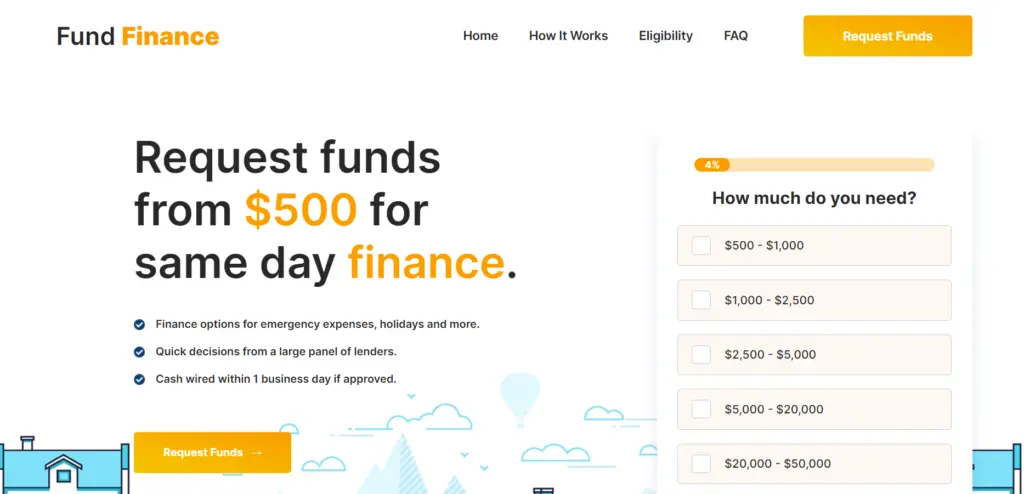

2. Fund Finance

Securing a loan becomes a seamless process with Fund Finance. Upon receiving your application, Fund Finance promptly links you with a lender or lending partner by the following business day. It’s important to note that Fund Finance doesn’t directly offer lending services to customers. Instead, it leverages its database to identify the most fitting lender for your needs, ensuring a stress-free and secure experience.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $50,000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility Criteria:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Fund Finance is open to provide loans from as much as $500 to $50,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Fees rack up on late/missed payments.

Application Procedure:

- Reach out to fundfinance.net and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 business days.

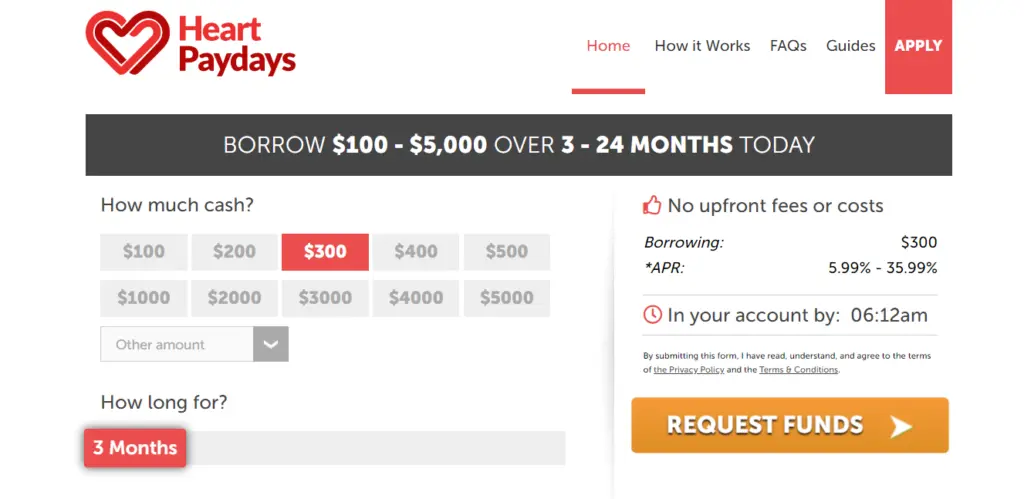

3. Heart Paydays

Heart Paydays streamlines the loan process by swiftly connecting borrowers with lenders through a simple application. Conducting a rapid search for lenders offering amounts from $100 to $5000, Heart Paydays facilitates a quick and efficient connection. Notably, the platform solely suggests suitable lenders and does not engage in credit decisions, ensuring a straightforward experience for borrowers. For a dependable and secure lending solution, turn to Heart Paydays, your trusted destination!

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $5,000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility Criteria:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Heart Paydays is open to provide Payday Loans in Arizona from as much as $100 to $5,000.

- Be vigilant about the interest rates which are determined by the lender during the application process.

- Fees rack up on late/missed payments.

Application Procedure:

- Reach out to heartpaydays.com and complete the application form.

- Complete an online application and await approval.

- Post approval, disbursement happens within 2 days.

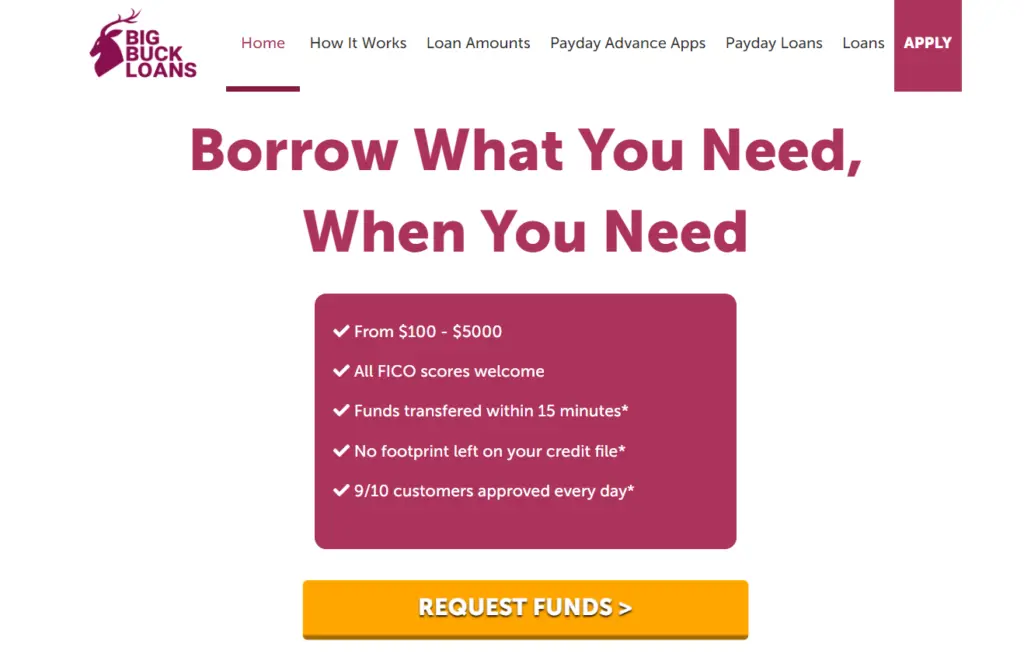

4. Big Buck Loans

Big Buck Loans acknowledges the urgency of financial emergencies and provides a simplified online process to swiftly access the needed funds, eliminating the need for lengthy queues. Leveraging secure technology, Big Buck Loans identifies a suitable lender within its network based on the submitted information. Once a compatible lender is found, you will be required to prepare necessary documents such as employment verification and salary slips for further processing.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get readily up to $5k.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility Criteria:

- 18+ to apply

- Income of $1k+ and be able to prove the same.

- Submit corroborating documents, including proof of address, proof of income, and a valid ID.

Loan Details:

- Loan Amount: $200 to $5,000.

- Loan Rate: It is negotiable and depends on lenders.

- Approval Time: 24 to 48 hours.

Application Procedure:

- Visit the website: bigbuckloans.net

- Fill out the form which later undergoes a verification process.

- Funds are credited to the bank account rapidly in 2 working days.

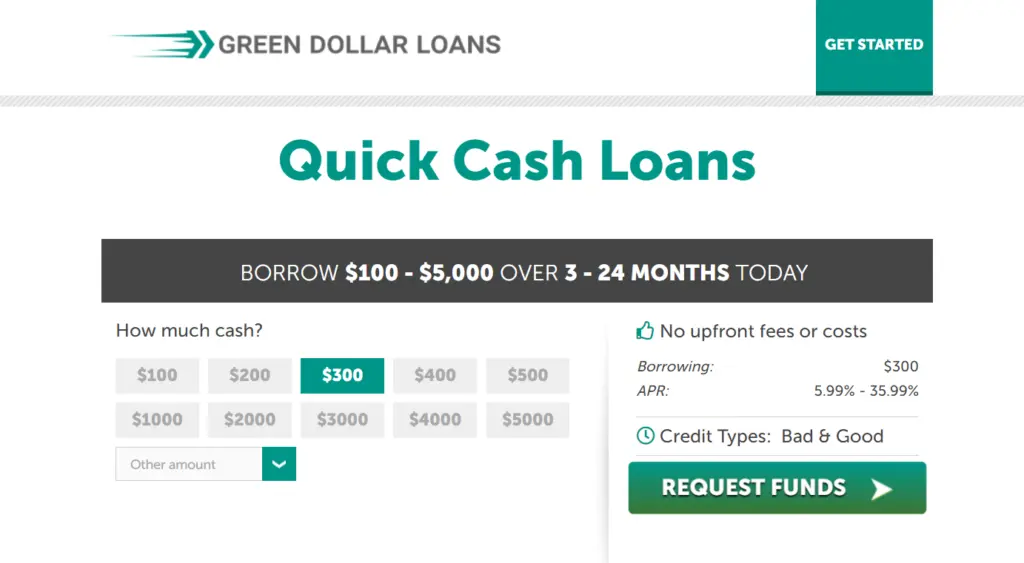

5. Green Dollar Loans

As a reputable and trusted lender, Green Dollar Loans has successfully assisted numerous customers with diverse loan needs. The platform prioritizes transparency by informing borrowers about rates and fees before accepting the loan. In case of repayment challenges, there may be additional fees or charges. Green Dollar Loans is committed to collaborating with reputable lenders and lending partners who adopt fair and reasonable practices in pursuing collections for past due accounts.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $5000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility Criteria:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Open to provide loans from as much as $100 to $5,000.

- Be careful of the interest rates which are determined by the lender during the application process.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to greendollarloans.net and complete the application form.

- You will have to complete an online application, and await approval.

- You can expect a transfer of money within 2 days.

How To Request For Payday Loans in Arizona

You can adhere to these four straightforward application steps on any of the above-stated leading money lenders’ websites in the United States of America.

Step 1: Choose the desired amount for payday loans.

Step 2: Specify the loan amount and preferred terms, ranging from $100 to $50, 000.

Step 3: Fill in all details as stated in the online application form for payday loans.

Step 4: Click the ‘Request Funds’ button and proceed with the instructions to finalize the application.

Conclusion:

As you navigate through the loan approval process with these lenders, exercising discretion and using the funds based on your immediate needs is crucial for responsible repayment and effective loan management. Instant payday loans in Arizona serve as a lifeline during emergencies and provide a spectrum of flexible and viable payment options to borrowers.

FAQs:

Q1. Why consider online payday loans in Arizona?

Online payday loans in Arizona offer a convenient solution for individuals facing unexpected expenses or financial emergencies. With quick access to funds, streamlined application processes, and flexibility, these loans cater to urgent financial needs. However, borrowers should exercise caution, carefully review terms, and explore alternatives to ensure responsible and informed borrowing practices.

Q2. What factors should borrowers in Arizona consider when choosing online payday loans?

Borrowers in Arizona should consider interest rates, repayment terms, and the lender’s reputation when choosing online payday loans. Additionally, evaluating the loan amount, fees, and the transparency of the application process is crucial. Responsible borrowing involves understanding all terms and ensuring the loan aligns with the borrower’s financial situation for a secure and manageable experience.

Q3. Can I avail a payday loan if I have a bad credit?

Having good credit is a symbol of trust and commitment. Most of the payday loans Huntsville lenders prefer customers having good credit. The five leading lenders suggested in this article also consider customers with bad and poor credits. Hence, do not worry about your credit, but make efforts to clear your debts at the earliest and improve your credits.

Disclaimer: The loan websites reviewed are loan matching services, not direct lenders; therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from my financial advisor if you need financial assistance. Loans are available for the US residents only.