Payday Loans in Chicago

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xJust like the unexpected windy weather in the vibrant streets of Chicago, the situations demanding immediate fund assistance are also unexpected. Well, we can’t help the weather in Chicago, but we can surely help with the financial requirements of the people of Chicago.

In this article, we have presented Payday Loans in Chicago. All the details about these payday loan options, ranging from their eligibility criteria to application, are provided here for the people of Chicago.

5 Best Payday Loans Providers in Chicago

1. 24M Loans – a getaway to accessible payday loans in Chicago.

2. Super Personal Finder – a platform that cares more about you than just money.

3. Big Bucks Loans – serving hope in the streets of Chicago.

4. Fund Finance – a place that funds dreams.

5. Credit Clock – the time clock at your home may have just three keys, but the Credit Clock provides you with many more service keys to your financial future.

Top 5 Lenders For Payday Loans In Chicago

1. 24M Loans

Just like the diverse cultures and lifestyles of Chicago, the needs of its people are also diverse. 24M Loans understands this requirement of the people of Chicago and that’s why they provide a wide network of lenders. You can go through the terms and services offered by multiple lenders, all on just this one platform.

Highlights:

- Multiple lenders

- Easy accessibility

- Inclusive approach

Eligibility Criteria:

- Applicants must provide proof of stable income to avail of these services.

- Applicants only above the age of eighteen are eligible for the services of 24M Loans.

- You are required to be a citizen of the United States.

Application Process:

- Register on the official website of 24M Loans.

- Upload the required documents on the site.

- Wait for the lenders to approve your loan request.

2. Super Personal Finder

If you are looking for a partner in Payday Loans in Chicago with the big busy state of Chicago then Super Personal Finder is just the perfect ally for you. The vibrant lifestyle of Chicago comes with a lot of expenses and simply relying on your jobs or business at times fails to serve your needs. These situations call for support and the Super Personal Finder provides that support to you with its personalized payday loans.

Highlights:

- Personalized services

- Wide variety of offers

- No extra fees

Eligibility Criteria:

- You need to be older than eighteen years to be eligible.

- Only legal residents of America can avail of these services.

- You are required to provide details of your bank account.

Application Process:

- Create your profile on the Super Personal Finder’s page.

- Choose a loan amount you need.

- Wait for the lender to send you an offer.

3. Big Bucks Loans

In the rhythm of Chicago’s bustling urban centers where financial problems demanding immediate assistance can strike anytime, the Big Bucks Loans stands as the beacon of hope. This platform offers accessibility and efficiency to the people who are navigating the financial challenges in the state of Chicago.

Highlights:

- Quick fund disbursements

- Transparent terms

- Encrypted security

Eligibility Criteria:

- You must be a permanent resident of the state of America.

- You need to be a minimum of eighteen years old.

- You need to provide a verified address for communication.

Application Process:

- Fill out the online application form available on the website of Big Bucks Loans.

- Submit your details as requested by the lenders.

- You can disburse the amount into your account after you are approved.

4. Fund Finance

In a big state like Chicago, people are filled with dreams, but financial constraints block their way to the future they aspire to. But Fund Finance is committed to saving the dreams of the people of Chicago with its customized Payday Loans in Chicago catering to all your needs.

Highlights:

- Minimal documentation

- Quick approvals

- Streamlined application

Eligibility Criteria:

- The services of Fund Finance are exclusive to Americans.

- The minimum required age is restricted to applicants above the age of eighteen years.

- You have to submit your income details.

Application Process:

- Complete the application form on the website of Fund Finance.

- Specify the loan amount and repayment tenure as you need.

- Wait to hear from the lender after you submit your request.

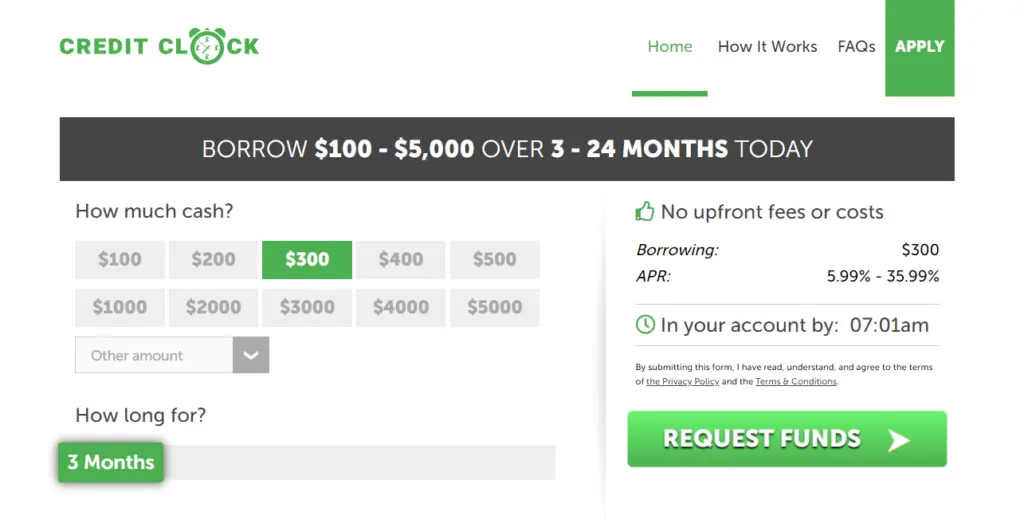

5. Credit Clock

The credit clock is a place that takes care of all your financial needs. From Payday Loans in Chicago to credit tools help you manage your financial life. Their website provides various services you can seek just with a click at the convenience of your home, or anywhere you like.

Highlights:

- Seamless process

- Quick application form

- Variety of services

Eligibility Criteria:

- You must be either eighteen or above in age to avail of the services of Credit Clock.

- A valid proof of identity is required.

- You are required to be a legal citizen of the United States of America.

Application Process:

- Apply on the online webpage of Credit Clock.

- Submit the required details and documents.

- You will be notified after you are approved.

Tips for responsible borrowing

Borrowing loans is a big responsibility that requires careful decisions. Here are some tips for responsible borrowing.

1. Access your needs

Budget your needs and incomes. Do not borrow more than you need, and always be ready with an income source you can rely on to repay your loans.

2. Read the agreement

Thoroughly read the loan agreement before signing. Carefully examine all the costs and terms of the loan, as at times the lenders hide extra costs.

3. Research and compare

Do thorough research about the available lenders. Make sure you borrow only from a verified lender. Compare the offered rates and terms to choose the one that suits your situation.

4. Avoid multiple loans

Taking multiple loans often pushes you into the never-ending credit trap. Look for alternative options like borrowing from family or friends instead of lenders.

5. Seek financial advice

Taking advice from a finance expert can give you more helpful insights to manage your finances and make more informed decisions about your future.

Conclusion

The vibrant lifestyle of Chicago may bring unforeseen financial challenges, and delving into the realm of payday loans Chicago emerges as a practical consideration. Throughout this guide on the “Payday Loans in Chicago,” we’ve navigated the landscape of swift financial solutions, highlighting crucial aspects to empower your borrowing decisions.

Recognizing that payday loans offer a rapid financial bridge in times of necessity, it’s imperative to approach this option with care and responsibility. Opting for reputable lenders with transparent terms and reasonable fees allows borrowers to navigate the financial currents more securely.

As you traverse the pathways of Payday Loans in Chicago, keep in mind the significance of borrowing within your means, explore alternatives, and thoroughly review the terms of each loan. A measured and knowledgeable approach ensures that payday loans function as a useful tool rather than a financial burden.

In the end, the most appropriate Payday Loans in Chicago is one that suits your needs, offers fair terms, and aligns with your financial goals. Equipped with insights from this guide, you are better positioned to make well-informed decisions and navigate the bustling financial landscape of Chicago with confidence.

FAQs:

Q1. How do I choose the best lender in Chicago?

A1. Look at various options and compare their offered terms to choose the one that suits your needs the most. Also, make sure you always borrow from verified lenders.

Q2. How can payday loans affect my credit score in Chicago?

A2. Although timely repayments can help you boost your credit score. Credit checks by multiple lenders can also have a bad effect on your credit.

Q3. Can I extend my payday loans in Chicago?

A3. Some lenders do provide the facility of extending payday loans with an additional charge. Connect with your lender for more accurate details.

Disclaimer: The content presented in this article on “Payday Loans In Chicago” serves for general informational purposes and should not be construed as financial advice or an endorsement of specific lenders. Readers should conduct independent research and carefully evaluate their individual financial circumstances before making any borrowing decisions.

While endeavors have been made to verify the accuracy and pertinence of the information, it should be acknowledged that the financial environment and lending regulations are subject to potential changes.

This article does not guarantee the availability, terms, or conditions of loans from any mentioned lenders. Readers are urged to thoroughly review the terms and conditions of any payday loan agreement, including interest rates, fees, and repayment terms, before committing to any financial obligations.

Furthermore, considering alternative financial options and seeking guidance from financial professionals is recommended to guarantee informed borrowing decisions. The author and publisher of this article disclaim any responsibility for actions taken by readers based on the information presented. Given the variability of financial situations, it is advised to directly consult with financial advisors or lenders for personalized guidance.