Payday Loans In Texarkana

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xTexarkana, positioned on the Texas-Arkansas border, presents a unique city experience divided between two states. Residents enjoy the novelty of living in both Texas and Arkansas simultaneously. Notable for its historical landmarks like the Perot Theatre and the Ace of Clubs House, Texarkana offers a rich cultural tapestry. The city’s scenic parks, including the popular Spring Lake Park, cater to outdoor enthusiasts.

Payday Loans In Texarkana: Quick Look

With the Texarkana Regional Airport enhancing accessibility, the city serves as a regional travel hub. From its historic downtown to community events, Texarkana provides a distinctive blend of Southern hospitality and cross-border charm. Continue reading this article on Payday Loans In Texarkana for more details on payday loans for the citizens of the US.

Despite the city’s charm and cultural offerings, unforeseen financial needs can arise for residents. Whether it’s covering medical expenses, urgent home repairs, or pursuing educational goals, the need for additional funds can be crucial.

5 Best Payday Loans In Texarkana Providers

Top 5 Lenders For Payday Loans In Texarkana

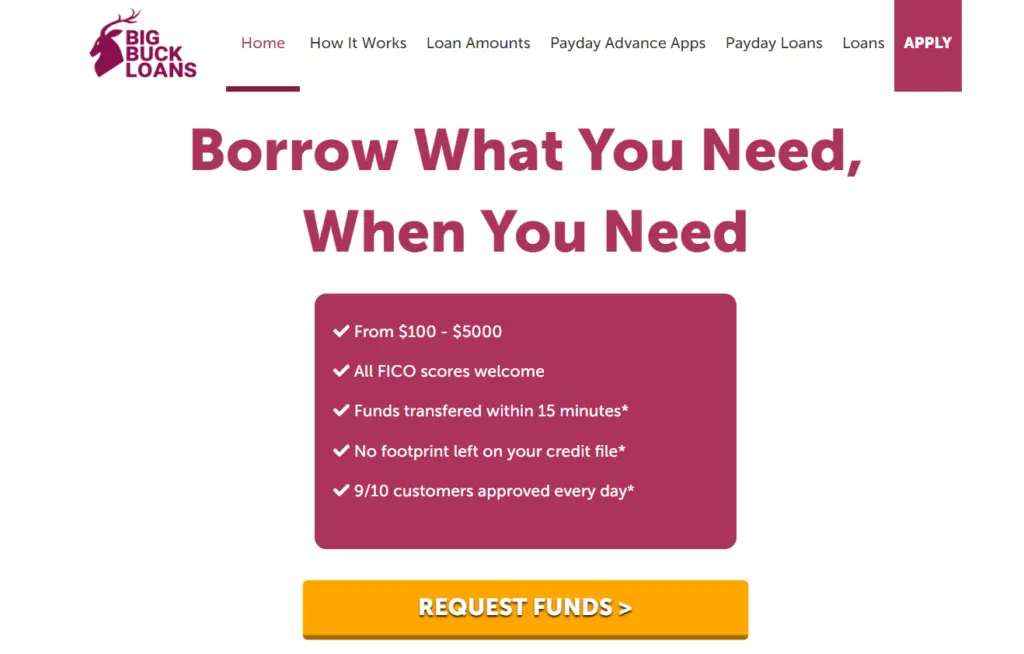

1. Big Buck Loans

In a financial bind and urgently in need of funds? Look no further than Big Buck Loans! Whether you’re facing unforeseen expenses or gearing up for upcoming financial needs, Big Buck Loans is your reliable partner for quick and hassle-free borrowing. If the unexpected has thrown a wrench in your plans or you’re proactively preparing for financial demands, Big Buck Loans is committed to assisting you with instant solutions.

Highlights:

- Loan amounts: $100 – $5,000.

- All FICO scores accepted.

- Funds transferred within 15 minutes.

- No impact on credit file.

- 9/10 customers approved daily.

Eligibility:

- Minimum monthly income of $1000 required.

- At least 90 days of employment or proof of stable alternative income.

- Applicants must be 18 years or older, US citizens, or permanent residents.

- Valid email, work, and home phone details needed.

Loan Details:

- Anywhere between $100 and $5,000.

- Loan rate is generally lender-determined based on the loan sum.

- As per loan value, approval time varies.

Application Procedure:

- Go to bigbuckloans.net

- Complete the process.

- Get immediate response.

- The approved funds will be disbursed into your account within 24 hours.

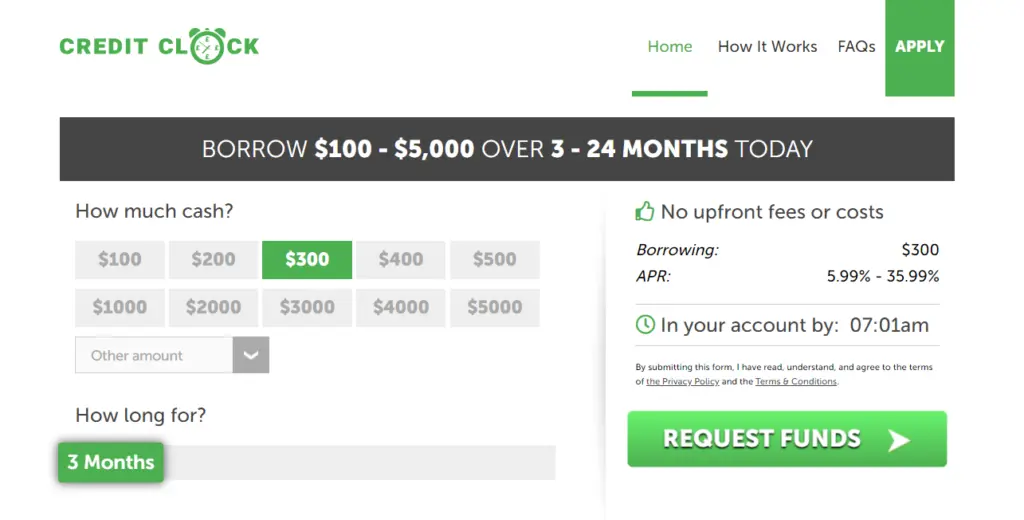

2. Credit Clock

Credit Clock excels in promoting financial health, offering budget-friendly Payday Loans In Texarkana ranging from $100 to $5,000. Prioritizing customer support, the platform simplifies the Payday Loans In Texarkana approval process with transparency in interest rates and costs. Notably, Credit Clock enhances convenience by removing in-person application requirements, making borrowing hassle-free for individuals.

Highlights:

- Swift online application process.

- Ensures data security with 2048-bit encryption.

- Simple document submission without the need for paperwork.

Eligibility:

- 18+ to apply

- Income of $1k+ and be able to prove the same.

- Submit corroborating documents, including proof of address, proof of income, and a valid ID.

Loan Details:

- Borrow amounts ranging from $100 to $5,000, with negotiable loan rates determined by individual lenders.

- Experience swift approval within 24 to 48 hours, ensuring a timely and efficient process for your financial needs.

Application Procedure:

- Visit the website: creditclock.net

- Fill out the form which later undergoes a verification process.

- Rapid fund crediting within 2 business days.

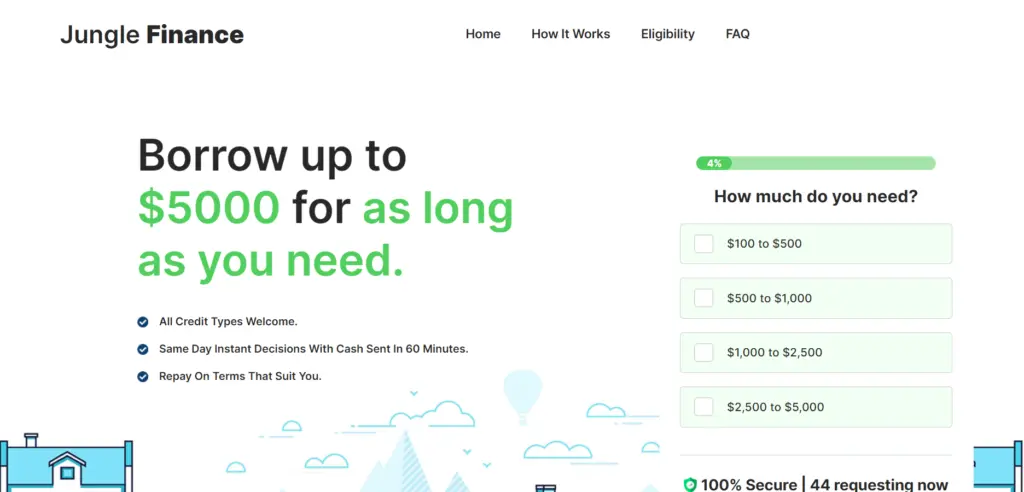

3. Jungle Finance

Jungle Finance is a dynamic financial company that champions agility and versatility in navigating diverse financial landscapes. Infused with a spirit of exploration and innovation, Jungle Finance aligns with the attributes of a modern and forward-thinking financial institution. For those seeking prompt responses, unwavering commitment, and dedicated service, Jungle Finance stands out as the ideal destination.

Highlights:

- Comfortable 3-24 months to pay.

- Max 35.99% APR.

- Disburses up to $5,000 instantly.

- Simple repayment structure with flexible payment options.

- Deals with direct lenders avoiding middlemen in the process.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- Provide supporting documents such as proof of address, proof of income, and a valid ID during the application process.

Loan Details:

- Open to provide loans from as much as $100 to $5,000.

- Pay close attention to the interest rates set by the lender during the application process.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to junglefinance.com and complete the application form.

- You’ll need to fill out an online application and then wait for approval.

- You can expect a transfer of money within 2 days.

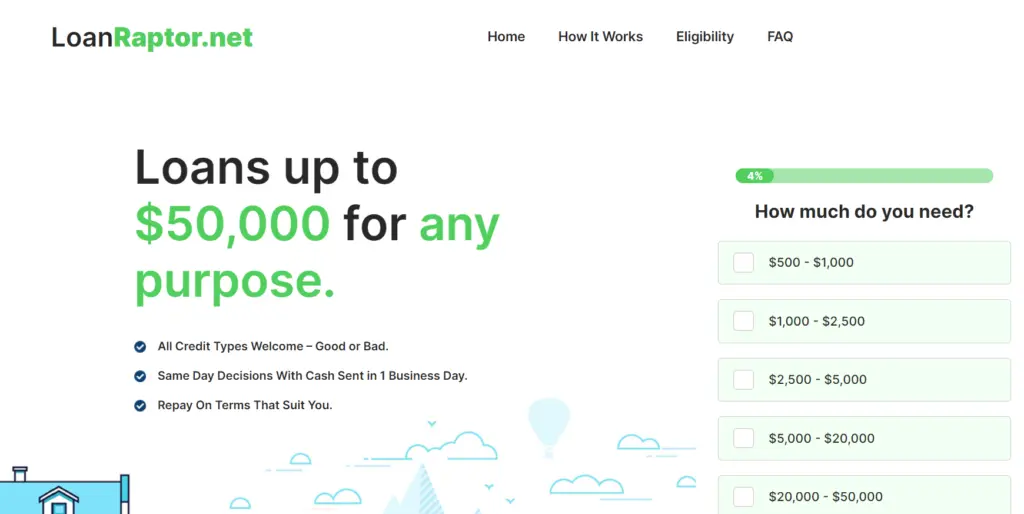

4. Loan Raptor

Loan Raptor distinguishes itself as a prominent and successful Payday Loans In Texarkana lender in the country, recognized for its prompt and efficient service. Specializing in Payday Loans In Texarkana plans ranging from $500 to $50,000, the platform underscores the importance of selecting loan amounts judiciously based on repayment capacity. Enjoy transparent terms and a straightforward application process for a convenient and secure experience.

Highlights:

- Easy installment 3-24 months to pay.

- Max 35.99% APR.

- Get readily up to $50,000.

- Flexible repayment structure.

- Deal with direct lenders and avoid middlemen.

Eligibility:

- 18+ to apply

- Income of $1k+ and be able to prove the same.

- Provide supporting documents such as proof of address, proof of income, and a valid ID during the application process.

Loan Details:

- The loan amount ranges from $500 to $50,000.

- Negotiable interest rate determined by the lenders.

- Approval typically occurs within 24 to 48 hours.

Application Procedure:

- Visit the website: loanraptor.net

- Fill out the form which later undergoes a verification process.

- Rapid fund crediting within 2 business days.

5. 24M Loans

Effortlessly explore loan options and seamlessly request financial assistance via the website on any device. 24M Loans’ streamlined process eliminates unnecessary stress, providing a prompt solution for your financial needs. Enjoy a user-friendly interface and transparent terms for a hassle-free experience.

Highlights:

- Secure platform where privacy is assured.

- Get up to $50,000, with max 35.99% APR.

- Repay over 3-24 months.

- Enjoy a straightforward repayment plan.

- Directly engage with lenders.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Open to provide loans from as much as $500 to $50,000.

- Pay attention to the interest rates set by the lender during application.

- Late or missed payments may result in accruing fees.

Application Procedure:

- Click 24mloans.com to submit the application form.

- Complete an online application and await approval.

- Post approval, disbursement happens within 2 days.

Considerations When Choosing a Lender

1. Comprehend Legal Terms and Interest Rates

- Thoroughly examine all the terms outlined in the documents and reach out to the lender for clarification if any questions arise.

- Reject lenders who are not transparent in their terms.

- Assess your monthly income against expenses to ensure you can manage the interest on installment loans.

2. Make An Informed Decision

- Clarity of thought is crucial. Avoid signing agreements if you are uncertain.

3. Reputation

- Research and assess the lender’s reputation through ratings, feedback, and customer reviews.

- Eliminate lenders with a poor track record.

4. Transparency

Choose a lender who maintains transparency and provides assistance throughout the process.

Conclusion

Payday Loans In Texarkana have transformed borrowing with accessibility, speed, transparency, and flexibility, surpassing traditional banking. This financial shift reflects technology’s transformative impact on immediate financial needs. As fintech innovation advances, payday loans remain vital for efficient, customer-focused solutions, making this article a valuable resource for those seeking these financial tools.

FAQs:

Q1. What is the guaranteed interest rate?

A1. Interest rates are a critical consideration for individuals seeking loans. The rate of interest varies among lenders, each having its own flexible repayment policies. After submitting your loan application, the lender will provide details on payment terms, interest rates, and other relevant policies for your appraisal.

Q2. Where can I borrow money safely and immediately?

A2. In times of urgency or unforeseen expenses, traditional banks may not provide prompt assistance. Choosing for same-day loans, payday loans, or instant loans online offers a faster alternative. The streamlined application process ensures quick approval, and if accepted, funds are usually dispersed within 60 minutes, 24 hours, or the next business day.

Q3. I have a bad credit, can I still avail? What are my chances?

A3. Do not worry about your bad credit score! Irrespective of your credit scores, Online Payday Loans Nevada can still offer you loans. Be informed of the documents that are required to be submitted and other formalities as it varies from each lender.

Disclaimer: The loan websites reviewed are loan matching services, not direct lenders; therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from my financial advisor if you need financial assistance. Loans are available for the US residents only.