Payday Loans In Utah

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xIn the sprawling deserts and majestic mountains of Utah, financial challenges can sometimes loom as large as the landscape itself. But fear not, for amidst the red rock canyons and snow-capped peaks, a myriad of payday loan options await, ready to provide a lifeline when financial storms brew.

From Salt Lake City to St. George, payday loan seekers can find solace in the diverse array of lenders ready to offer swift financial assistance. Let’s embark on a journey through Utah’s 5 most prominent payday loan providers, each offering a unique blend of convenience, flexibility, and reliability.

Top 5 Lenders Of Payday Loans In Utah

Best 5 Lenders Of Payday Loans In Utah

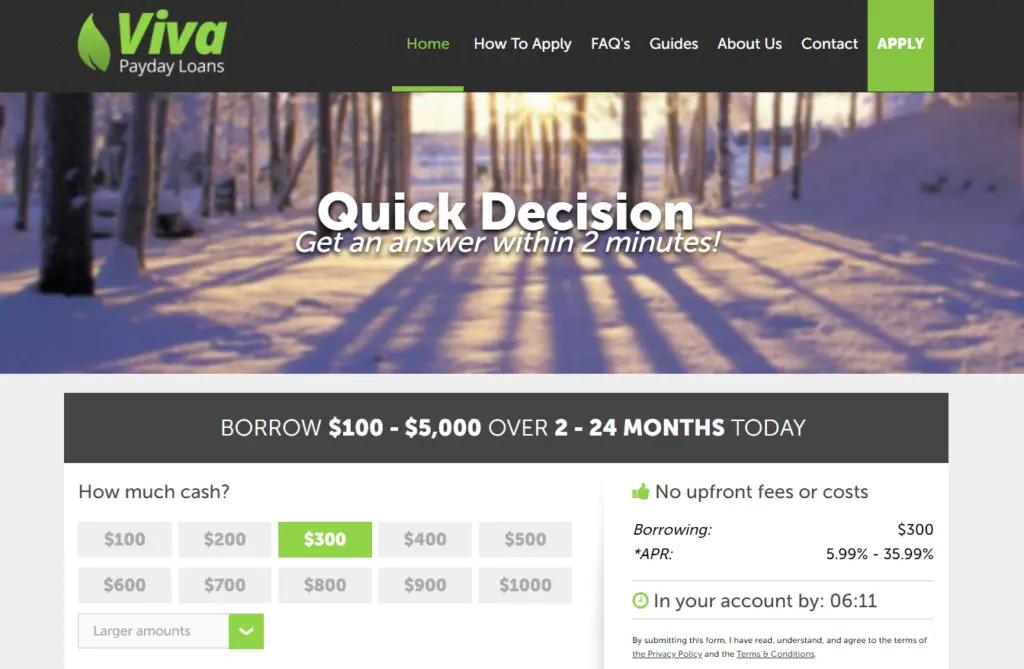

1. Viva Payday Loans

Looking for a lifeline to bridge the gap until your next pay check in the stunning landscapes of Utah? Look no further than Viva Payday Loans, your trusted ally in financial flexibility! Nestled amidst the rugged beauty of the Beehive State, Viva Payday Loans offers a beacon of hope for those navigating unexpected financial hurdles.

When it comes to payday loans in Utah, Viva stands tall with an array of loan options tailored to suit your needs. Whether it’s a modest sum to cover a car repair, a medical bill, or an unforeseen expense, Viva Payday has your back. Payday Loans In Utah options are as diverse as the colors of Utah’s majestic landscapes, providing you with the flexibility you crave during challenging times.

Loan Options:

- Payday Loans: Access quick cash to bridge the gap until your next pay check.

- Installment Loans: Enjoy a more extended repayment period with manageable installment.

- Title Loans: Leverage the value of your vehicle to secure a loan, unlocking larger sums.

Pros:

- Speedy Access: Get funds deposited into your account swiftly, often within a day.

- Convenient Repayment: Choose from various repayment options tailored to your financial situation.

- Accessible to All: Viva Payday Loans considers applicants with varying credit histories.

Cons:

- Higher Interest Rates: Be mindful of the associated costs, as payday loans often come with elevated interest rates.

- Risk of Debt Cycle: While convenient, misuse of payday loans can lead to a cycle of debt if not managed responsibly.

Eligibility:

- Age Requirement: Must be at least 18 years old.

- Income Stability: Provide proof of a regular income source.

- Residency: Reside in the state of Utah.

Application Process:

- Online Application: Navigate the user-friendly online portal to initiate the application process.

- Document Submission: Upload necessary documents, including proof of income and identification.

- Approval: Receive a prompt response regarding your loan approval status.

- Funds Disbursement: Once approved, watch your funds appear in your bank account, ready to address your financial needs.

2. Money Lender Squad

Nestled amidst the majestic red rock canyons of Utah, unforeseen financial challenges can disrupt even the most meticulously planned adventures. Money Lender Squad is here to offer a reliable and transparent solution. They understand that every financial situation is unique, and our diverse loan options are tailored to address individual needs. Whether you require a payday loan to cover unexpected medical expenses or a strategic investment for your growing business, we offer a range of personalized options to empower your financial journey.

Their streamlined application process reflects our commitment to efficiency and transparency. You can expect a smooth and prompt experience, free from the complexities of traditional loan applications. By minimizing the time spent navigating paperwork, Money Lender Squad allows you to focus on your goals and get back to enjoying the breath taking beauty of Utah, both literally and figuratively.

Loan Options:

- Payday Loans: Secure quick access to funds to tide you over until your next pay check arrives.

- Installment Loans: Enjoy the flexibility of repaying your loan over a longer period with manageable installments.

- Title Loans: Utilize the equity in your vehicle to unlock larger loan amounts, ideal for addressing substantial financial needs.

Pros:

- Swift Application: Complete our user-friendly 2-minute application form to kickstart your journey toward financial stability.

- Transparent Terms: Confirm loan terms directly with your lender, ensuring clarity and confidence throughout the borrowing process.

- Accessible Funding: With eligibility subject to credit and affordability checks, Money Lender Squad strives to extend financial assistance to as many individuals as possible.

Cons:

- Variable APR Rates: Be aware that APR rates range from 5.99% to 35.99%, ensuring transparency but necessitating careful consideration of associated costs.

- State Limitations: Availability may vary based on state legislation, with some services not accessible to residents of certain states, including Arkansas, Connecticut, and New York among others.

Eligibility:

- Age Requirement: Applicants must be over 18 years old.

- Residency: Reside in a state where Money Lender Squad services are available.

- Creditworthiness: While credit checks may be conducted, individuals with varying credit profiles are encouraged to apply.

Application Process:

- Online Application: Complete our intuitive 2-minute application form, providing essential details.

- Confirmation: Confirm loan terms directly with your lender, ensuring alignment with your financial goals and capabilities.

- Funds Disbursement: Upon approval, collect your loan swiftly, empowering you to address your financial needs with confidence.

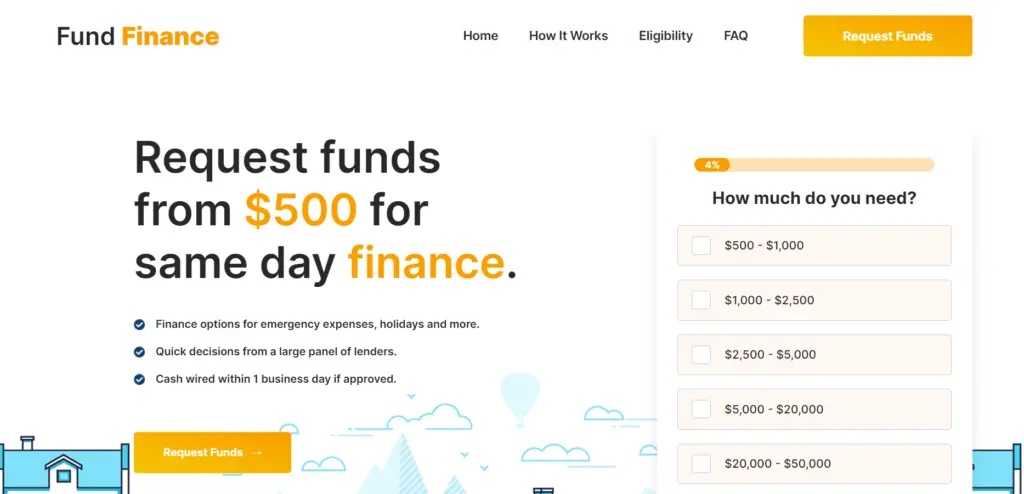

3. Fund Finance

Car troubles? Unexpected medical bills putting a damper on your Salt Lake City stay? Utah’s vibrant landscapes can be just as unpredictable as life itself, and financial roadblocks can quickly derail your well-laid plans. That’s where Fund Finance steps in, acting as your trusted financial compass on life’s unexpected detours.

Fund Finance understands the immediate impact of unforeseen expenses. We offer quick and transparent same-day financing, starting at $500, to help you bridge the gap between unexpected costs and your financial security. Whether it’s a car repair derailing your scenic road trip or a medical bill putting a strain on your budget, Fund Finance empowers you to navigate these challenges confidently. We prioritize clarity and speed, ensuring a swift decision-making process with funds wired directly to your account within one business day of approval.

Loan Options:

- Personal Loans: Access funds ranging up to $50,000, providing ample support for various financial needs.

- Quick Decision Making: Benefit from almost instant online lending decisions, ensuring you receive timely assistance.

- No Hidden Fees: Enjoy transparency in your borrowing experience, with no paperwork or hidden charges to worry about.

Pros:

- Wide Range of Options: With access to a large network of lenders and alternative options, Fund Finance ensures you find the best-suited solution for your unique circumstances.

- Speedy Approval: Experience quick decisions from a panel of lenders, with funds wired within one business day if approved, providing prompt financial relief.

- Accessibility: Regardless of your credit history, Fund Finance strives to assist consumers with both good and bad credit, ensuring financial inclusivity.

Cons:

- Variable APR Rates: APR rates range from 5.99% to 35.99%, offering flexibility but necessitating careful consideration of associated costs.

- State Limitations: Availability may vary based on state legislation, with some services not accessible to residents of certain states, including Arkansas, Connecticut, and New York among others.

Eligibility:

- Residency: Reside in a state where Fund Finance services are available.

- Age Requirement: Applicants must be over 18 years old.

- Creditworthiness: While credit checks may be conducted, Fund Finance welcomes individuals with varying credit profiles to apply.

Application Process:

- Request Funds: Complete a simple request form, providing essential details.

- Decision Making: Await almost instant online lending decisions, ensuring a swift process.

- Funds Disbursement: If approved, funds are wired within one business day, allowing you to address your financial needs without delay.

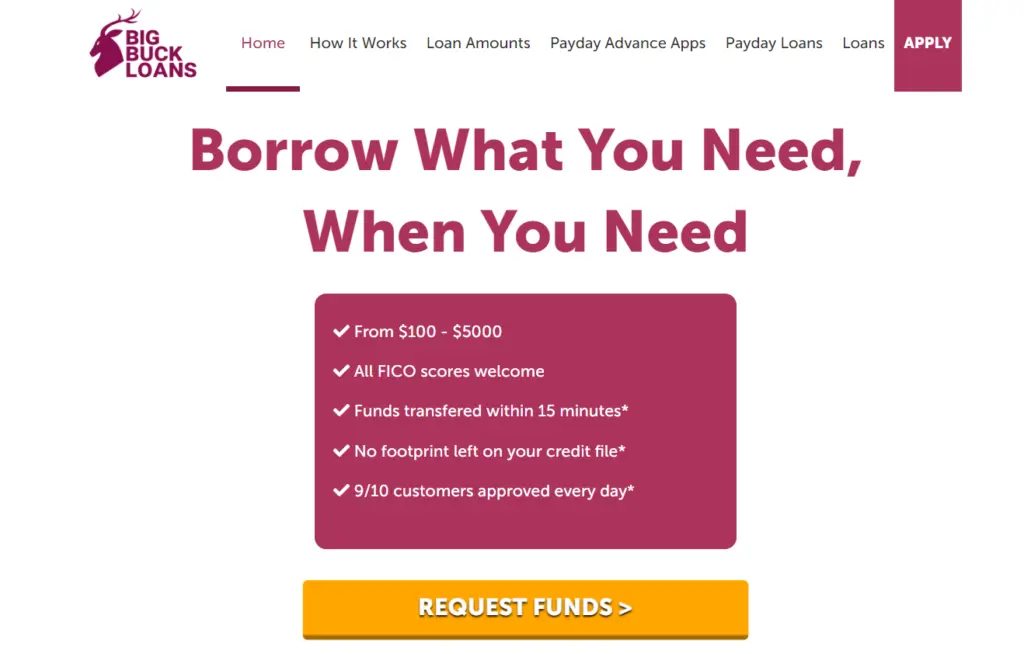

4. Big Buck Loans

Big Buck Loans understands the urgency of unforeseen expenses. Whether you require a quick $100 to cover an emergency car repair or need up to $5,000 for that unexpected home improvement, we offer a spectrum of Payday Loans In Utah options to bridge the gap. Our commitment to speed and efficiency is unparalleled – receive your approved funds within 15 minutes, allowing you to get back on track with minimal disruption.

Additionally, Big Buck Loans prioritizes responsible borrowing practices, ensuring these solutions come without impacting your credit score. With an outstanding 90% approval rate, we strive to be a beacon of financial accessibility and support for Utah residents, empowering you to navigate life’s challenges with confidence.

Loan Options:

- Personalized Loan Amounts: Access funds ranging from $100 to $5000, ensuring flexibility to meet your unique financial requirements.

- All FICO Scores Welcome: Regardless of your credit history, Big Buck Loans welcomes all FICO scores, providing an inclusive financial solution.

- Quick Funding: Experience the convenience of funds transferred within 15 minutes, offering rapid relief for urgent financial needs.

Eligibility:

- Age Requirement: Applicants must be at least 18 years old.

- Residency: Borrowers must be legal US citizens or residents with a valid US bank account.

- Income Threshold: Demonstrate a minimum monthly income of $1000 and the ability to afford the loan.

Application Process:

- Online Application: The 100% online application process eliminates the need for calls, faxes, or paperwork.

- Loan Amount and Term Selection: Choose the desired loan amount (ranging from $100 to $5000) and the repayment term (3 to 24 months).

- Document Submission: Gather supporting documents, including proof of address, valid ID, last three pay slips, and bank statements.

- Two-Minute Decision: Receive a Payday Loans In Utah decision within two minutes, with the option to proceed and finalize the deal directly with the lender.

- Finalize and Get Cash: Sign the Payday Loans In Utah agreement, ask for clarifications if needed, and receive the loan amount within 15 minutes to 1 hour.

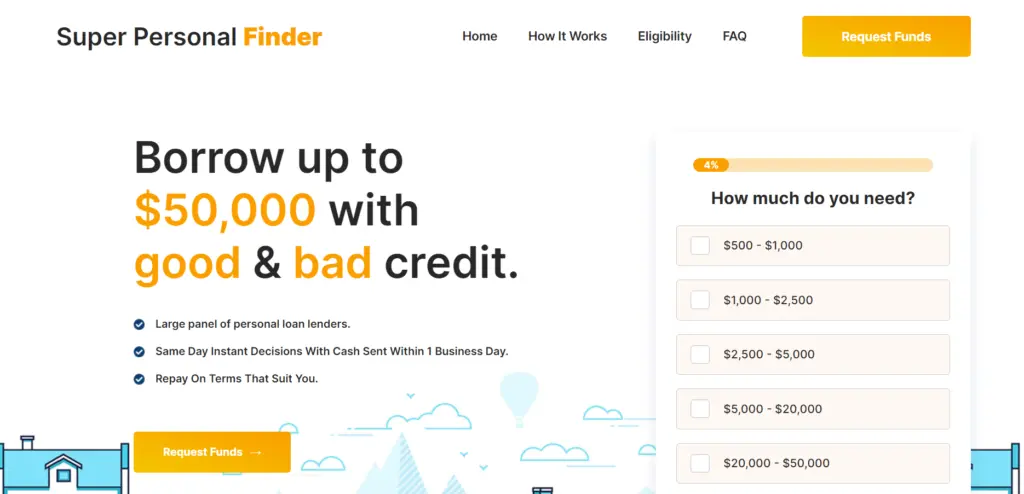

5. Super Personal Finder

Nestled amidst the majestic beauty of Utah’s landscapes, Super Personal Finder emerges as a guiding light in the realm of financial assistance. Here, borrowers are met with a diverse array of personal loan options, meticulously crafted to cater to their unique needs and circumstances. Whether basking in the glow of a pristine credit history or weathering the storms of financial adversity, Super Personal Finder extends its hand to all, granting access to loan amounts of up to $50,000.

What truly distinguishes Super Personal Finder is its unwavering commitment to flexibility. As borrowers navigate the intricate pathways of their financial journeys, they are empowered to tailor repayment terms that harmonize with their individual situations. With same-day instant decisions and cash disbursed within a single business day, Super Personal Finder orchestrates a symphony of efficiency, ensuring that financial relief arrives precisely when needed.

Loan Options:

- Wide Borrowing Range: Super Personal Finder caters to diverse financial needs, offering personal loans ranging from smaller amounts to a substantial $50,000.

- Inclusive Credit Approval: Whether you have a good credit score or have faced challenges, Super Personal Finder welcomes all credit profiles, fostering financial inclusivity.

- Swift Decision and Disbursement: Experience the convenience of almost instant online lending decisions, with approved funds sent directly to your account within 1 business day.

Pros:

- Flexible Repayment Terms: Super Personal Finder empowers borrowers with the flexibility to repay their loans on terms that align with their financial capabilities, enhancing financial control.

- Large Network: Benefit from a vast network of personal loan lenders and alternative options, ensuring a comprehensive search for the best financial solution.

- No Hidden Fees: Enjoy transparency in the borrowing process, with Super Personal Finder priding itself on a streamlined experience free from hidden fees and unnecessary paperwork.

Cons:

- Variable APR Rates: While offering flexibility, borrowers should be aware that APR rates range from 5.99% to 35.99%, necessitating careful consideration of associated costs.

- Eligibility Criteria: Meeting certain eligibility criteria, such as income thresholds and creditworthiness, is crucial for accessing the diverse loan options.

Eligibility:

- No Discrimination Based on Credit: Super Personal Finder welcomes borrowers with both good and bad credit histories, promoting financial inclusivity.

- Income Stability: Demonstrating a stable income is essential to qualify for personal loans with Super Personal Finder.

- No Paperwork: Enjoy a hassle-free application process with no hidden fees or paperwork, simplifying the borrowing experience.

Application Process:

- User-Friendly Request: The application process with Super Personal Finder is user-friendly; simply complete the online request form to initiate the hassle-free journey.

- Proprietary Loan-Matching Software: Leverage the efficiency of Super Personal Finder’s proprietary loan-matching software, which streamlines the process, saving time with a single, easy-to-complete form.

- Swift Decision: Expect almost instant online lending decisions, allowing borrowers to proceed with confidence based on the lender’s offer.

- Funds Disbursement: Upon approval, experience the speed of cash sent within 1 business day, providing prompt access to the requested funds.

Understanding Payday Loans

Payday loans are short-term, small-dollar loans designed to provide quick financial relief until the borrower’s next pay check. Payday Loans In Utah, these loans are a legal and regulated financial tool, subject to specific rules and restrictions to ensure consumer protection. Individuals facing urgent financial needs, such as medical bills, car repairs, or other unforeseen expenses, often turn to payday loans for a swift solution.

The Landscape of Payday Lenders in Utah:

Utah residents have access to a diverse array of payday loan providers, each with its unique offerings. Viva Payday Loans, for instance, stands out for its swift and hassle-free loan approval process. Money Lender Squad provides access to a large panel of lenders and alternative loan options, catering to various credit profiles.

Fund Finance boasts same-day decisions and quick cash disbursal, addressing emergencies promptly. Big Buck Loans offers a wide range of loan amounts with a high approval rate, while Super Personal Finder shines as a beacon of financial assistance accommodating all credit profiles.

Navigating the Application Process:

Typically, applying for a payday loans in Utah involves a straightforward online process. Borrowers fill out a simple application form, provide essential documents such as proof of identification and income, and await a prompt decision from the lender. Once approved, funds are usually disbursed within one business day, offering quick relief for urgent financial needs.

Conclusion:

As we conclude our exploration of payday loans in Utah, it’s evident that these financial lifelines offer a vital support system for individuals facing unexpected expenses or temporary cash shortages. Whether you find yourself in the bustling streets of Salt Lake City or the serene landscapes of St. George, the diverse array of lenders showcased here stand ready to provide swift and reliable assistance tailored to your unique needs.

From the convenience of Viva Payday Loans to the flexibility of Super Personal Finder, Utah residents can navigate their financial challenges with confidence, knowing that help is readily available when needed.

FAQs:

Q1. Are payday loans legal in Utah?

A1. Yes, payday loans are legal in Utah. However, they are subject to regulations and limitations to ensure consumer protection.

Q2. What documents do I need to apply for a payday loans in Utah?

A2. While requirements may vary among lenders, typical documents include proof of identification, proof of income, and bank account information.

Q3. Can I repay my payday loan early?

A3. Yes, many lenders allow early repayment of Payday Loans In Utah without penalties. However, it’s essential to check with your specific lender for their terms and conditions regarding early repayment.

Disclaimer: The information provided in this blog is for informational purposes only and should not be construed as financial advice. While we strive to provide accurate and up-to-date information, the topic of payday loans in Utah is complex and may vary based on individual circumstances and state regulations. Before making any financial decisions, readers are encouraged to conduct their own research and consult with a qualified financial advisor. Additionally, please be aware that payday loans may not be suitable for everyone and should be used responsibly.