Payday Loans In Washington State

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xFeeling perplexed and anxious due to a financial shortfall? Faced with an inevitable financial commitment, consider turning to online payday loans for a swift resolution. Bid farewell to the stress of extensive and complicated requirements or disruptions to your daily routine—everything is streamlined with just a few clicks.

Payday Loans In Washington State: Quick Look

A payday loan is a short-term, high-interest loan intended to be repaid on the borrower’s next payday. These loans offer quick access to funds, typically requiring minimal documentation and accommodating individuals with less-than-perfect credit scores. Despite their ease of accessibility, payday loans come with substantial costs, often resulting in an annual percentage rate (APR) higher than traditional loans.

In this article, Payday Loans In Washington State, an analysis is made on the top five leading online money lenders in Washington enabling your loan process an easy cake walk.

Top 5 Leading Lenders For Payday Loans In Washington State

Best 5 Leading Lenders For Payday Loans In Washington State

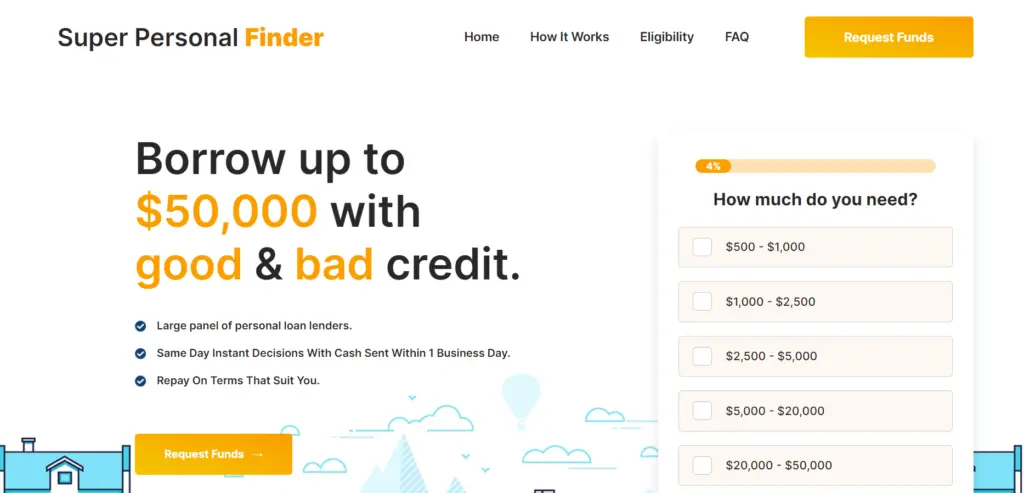

1. Super Personal Finder

Super Personal Finder has the opportunity to carve a unique identity in the financial sector. Streamlining the Payday Loans In Washington State application process, the platform acts as a gateway to officially approved lenders. It eradicates the need to scour through numerous websites and extensive data, saving users precious time and effort. Moreover, it facilitates open communication between borrowers and lenders, encouraging transparent discussions on loan-related matters.

Highlights:

- Efficient loan processing with funds available in as little as 24 hours.

- Emphasis on user privacy with robust data protection.

- Utilizes advanced 2048-bit encryption for heightened security.

- Secure SSL technology ensures safe and protected transactions.

Eligibility:

- Earn $1000 every month in income.

- Can be obtained only by the US nationals and legal residents only.

- 18+ years.

- Must own an active US bank account with direct deposit capabilities.

Loan Details:

- Super Personal Finder is open to provide loans from as much as $500 to $50, 000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to superpersonalfinder.com and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 days.

2. Money Lender Squad

Money Lender Squad, dedicated to user privacy, discreetly assists with a range of financial needs. Whether facing urgent car repairs or unexpected medical expenses, the platform’s network of lenders offers personalized solutions while ensuring the utmost privacy. Users can trust Money Lender Squad, to swiftly deliver funds directly to their bank accounts, emphasizing financial security and peace of mind.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $5000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Money Lender Squad is open to provide loans from as much as $500 to $50,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to moneylendersquad.com and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 days.

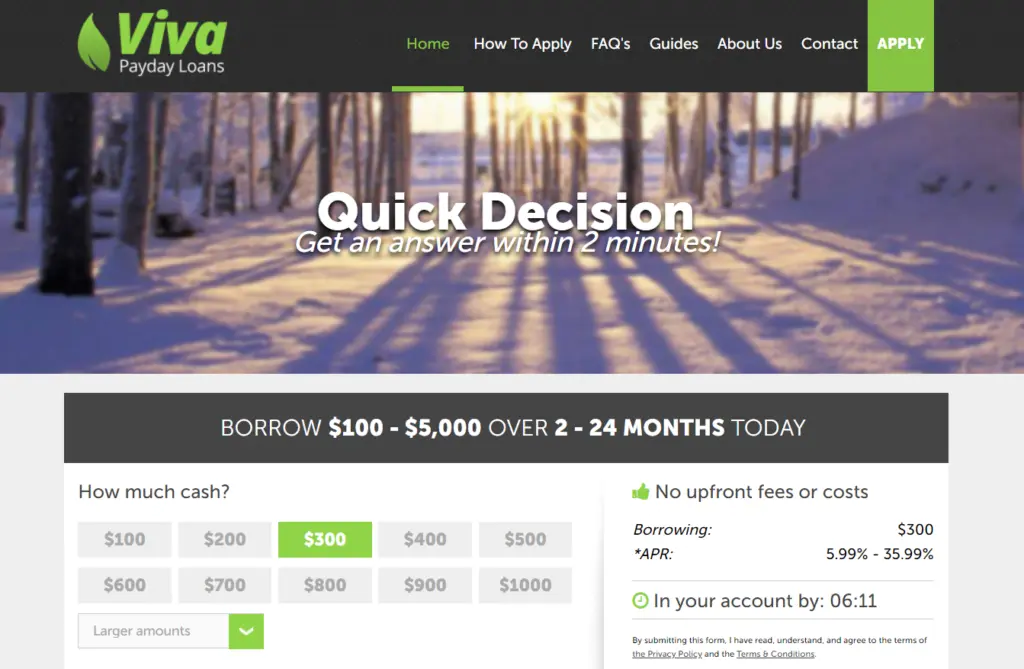

3. Viva Payday Loans

Viva Payday Loans distinguishes itself by prioritizing financial well-being and offering a variety of affordable loans ranging from $100 to $5,000. The platform stands out through its commitment to excellent customer support, streamlining the loan approval process, and maintaining transparency by clearly displaying interest rates and associated expenses.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $5000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Viva Payday Loans is open to provide loans from as much as $100 to $5000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Fees rack up on late/missed payments.

Application Procedure:

- Reach out to vivapaydayloans.com and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 days.

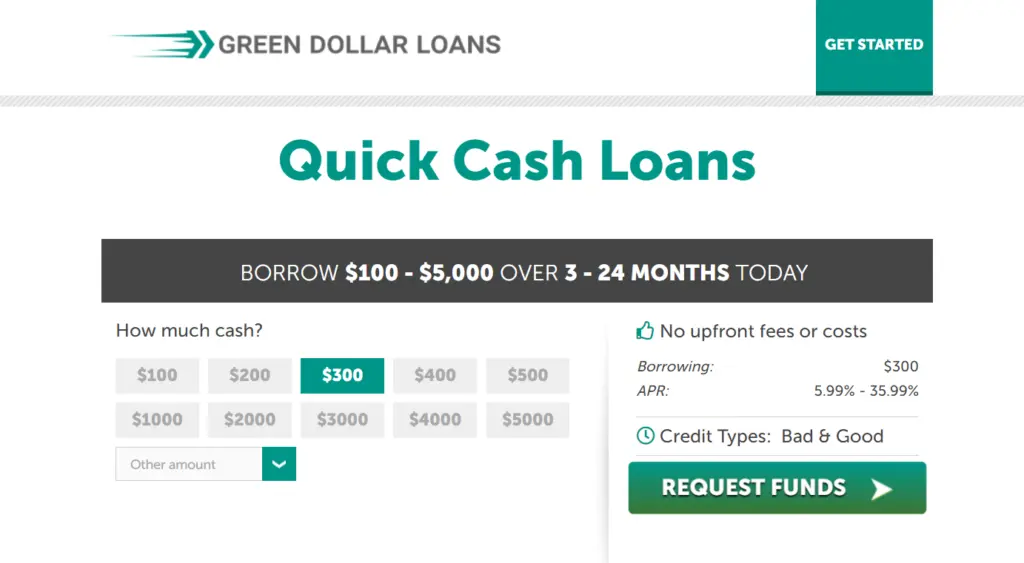

4. Green Dollar Loans

If you’ve been exploring ways to borrow money online, searching for apps that facilitate borrowing, or looking for a practical alternative to the borrow money feature, your search ends here. Green Dollar Loans offers nearly instant online lending decisions, connecting you with a vast network of lenders and alternative options for your financial needs.

Highlights:

- 3-24 months to pay.

- Max 35.99% APR.

- Get up to $5000.

- Simple repayment structure.

- Deal with direct lenders.

Eligibility:

- 18+ to apply.

- Income of $1000+.

- Supporting documentation (Address and Income Proof & a valid ID).

Loan Details:

- Open to provide loans from as much as $100 to $5,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to greendollarloans.net and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 days.

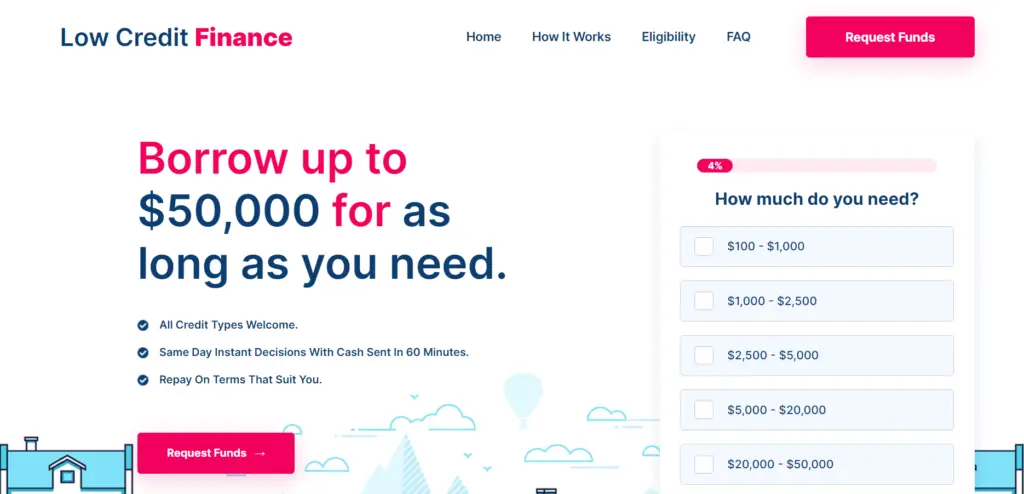

5. Low Credit Finance

Utilizing innovative loan-matching software, Low Credit Finance seamlessly connects users with appropriate personal or alternative loan options. The streamlined process starts with a single form, saving valuable time. Employing a secure and efficient system, the platform establishes a direct link between borrowers and reputable lenders, enhancing the overall borrowing experience with unparalleled convenience and speed.

Highlights:

- A secure platform for installment loans with a 100% security guarantee.

- Flexible repayment terms tailored to your needs.

- No credit score requirement for loan approval.

- Get your access to a huge network of lenders.

Eligibility:

- Be qualified to earn $1000 as monthly income.

- Be a US national or legal resident to avail loan.

- Verify if you are over 18 years of age.

Loan Details:

- Low Credit Finance is open to provide loans from $100 to a maximum of $50,000.

- Beware of the interest rates which are determined by the lender during the application process.

- Consult with the lender as to when the loan amount will be approved.

- Penalties accrue for delayed or missed payments.

Application Procedure:

- Reach out to lowcreditfinance.com and complete the application form.

- You will have to complete an online application, and await approval.

- You can await transfer of money within 2 days.

Why Is Online Payday Loans in Washington State Preferred?

1. Less Time

Online payday loans offer quick approval and disbursement of funds, surpassing the time taken by traditional banking systems. In emergencies where prompt access to funds is crucial, online lenders provide a notable advantage over traditional banks with their faster processing and transaction times.

2. No Paperwork

Unlike traditional banks, online payday loans require minimal paperwork. The process is transparent, with fewer details to fill in. While essential documents such as valid contact details, work experience, nationality proof, and age proof are necessary, the overall documentation is significantly reduced.

3. Home Convenience

Applying for online payday loans provides unparalleled convenience, allowing individuals to complete the entire process from the comfort of their home, office, or any preferred location. The elimination of the need for physical appearances streamlines and enhances the overall experience for borrowers.

Conclusion:

The references made in this article have been meticulously crafted for people who look forward towards availing Payday loans in Washington state. Consider applying to the above-mentioned leading 5 lenders to avail your Payday Loans in Washington State today, and release yourself from financial burden. Discover the swift application process, quick fund disbursement, and transparent fee structures provided by these lenders.

FAQs:

Q1. What are the eligibility criteria for payday loans in Washington State?

A1. To qualify for a Payday Loan in Washington State, you must have fulfilled the below standards.

1. Be a citizen of the US/ permanent resident.

2. Over 18 years of age.

3. Employed and served a minimum of at least 3 months.

4. Be a salary holder earning a minimum of $1,000 excluding tax deductions.

Also, you would be required to submit the below documents during the verification process. You will be intimidated if the lender looks for any specific documents other than the ones mentioned below.

1. Address proof.

2. Valid contact number (personal & official)

3. Salary statement/ work experience certificate for the last 3 months.

4. Driving License/ Passport.

5. Nationality proof.

Q2. What is the waiting period for the processing of the loan?

A2. The process of approving a loan from the lenders mentioned in this article typically requires a minimum of one day, ensuring a swift response to borrowers’ financial needs.

Q3. I have a bad credit, can I still avail? What are my chances?

A3. Your bad credit score is not a concern! Regardless of your credit history, Payday Loans in Washington State can provide you with loans. Understand the specific documentation and other requirements, as they vary among lenders.

Disclaimer: The loan websites reviewed are loan matching services, not direct lenders; therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. Payday loans in Washington State are short-term loans designed to provide quick cash to borrowers facing immediate financial needs. Here’s an overview of how payday loans typically work in Washington. This article does not provide financial advice. Please seek help from my financial advisor if you need financial assistance. Loans are available for the US residents only.