Tennessee Payday Loans

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xPayday loans are easy to borrow but come with their specific regulatory norms. Each state has different norms for payday loan lending. In Tennessee payday loans are legal, but individuals often look for alternatives for reasons like bad credit scores. A credit score is one of the primary checks for approval of payday loans.

Any traditional payday loan provider will have a long application approval process. However, there are online financial service providers that provide payday loans with limited paperwork. In this article, we will break the cycle of following one kind of Tennessee payday loans provider . You can look out for alternatives to take payday loans through online platforms.

5 Best Tennessee Payday Loans Alternatives

Top 5 Lenders Of Tennessee Payday Loan

1. Jungle Finance

Jungle Finance is an online financial platform that offers payday loans for customers during emergency needs. This Tennessee payday loan amount can be used for any personal purposes. It does not come with any term policies unlike traditional loans. For instance, if you take a loan from traditional banks, you will come across term policies like that loan amount could only be used for medical purposes. However, payday loans through online platforms offer transparency in usage.

This platform also has content which is informative for individuals seeking financial advice. You can understand loan applications, term plans, interest rates, and more through such online platforms. You also get the chance to meet multiple lenders for financial assistance.

Eligibility Criteria:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount ranges from $100–$5,000.

- Lender fix the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link junglefinance.com

- Application form needs to be filled up.

- Funds transfer takes place on the same business day.

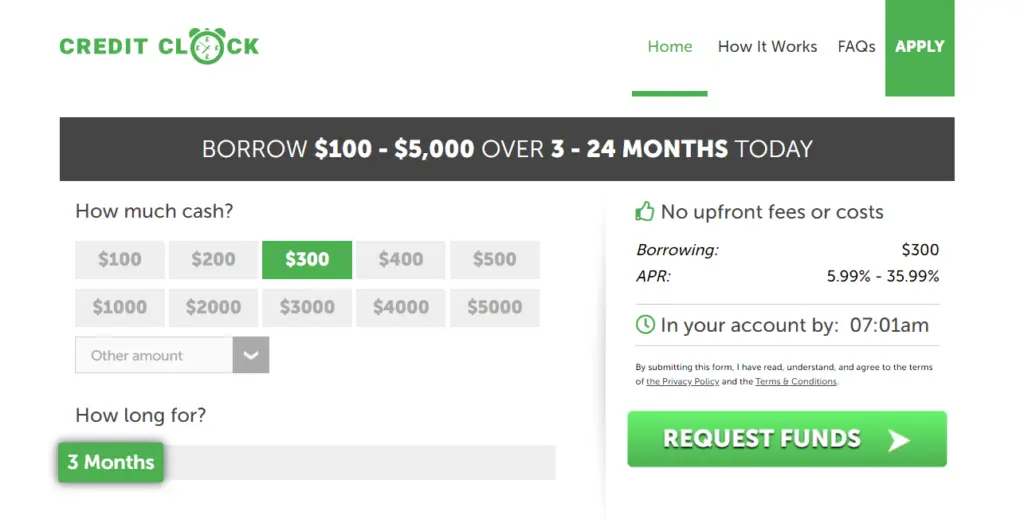

2. Credit Clock

Credit Clock is one such platform which is specially designed for financial support. The educational content available on this online platform provides guidance for making good financial decisions. The options available for financiers selection also allow customers to get the best payday loans. Tennessee Payday loans have short term plans for Repayment.

Eligibility Criteria:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount starts from $100 and $5,000.

- Lender fix the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link creditclock.net

- Application form needs to be filled up.

- Funds transfer takes place on the same business day.

3. Heart Paydays

This online platform could guide you through your financial matters. It has a range of financiers which can offer you best loan deals as well as guidance for taking financial decisions. The credit checker tool helps customers to check their score on a daily basis. Every month, you can get access to a credit score report. This report will have details related to the improvement or degradation of your credit scores.

Heart Paydays has informative content as well for those who are seeking knowledge and understanding on payday loans. This application provides an easy-to-use interface and smooth application process. Except for payday loans, this platform also offers other kinds of loans up to $5,000.

Eligibility Criteria:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount covers around $100 to $5,000.

- Lenders fix the interest rate.

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link heartpaydays.com

- Application form needs to be filled up.

- Funds transfer takes place on the same business day.

4. Big Buck Loans

Big Buck Loans offer extensive payday loan offers for your financial needs. This online platform allows you to check your accounts on time. You do not have to visit your bank for any updates and new activity on account. Try hands on this platform and get payday loan approvals within the same day of putting the request. There are so many lenders available on this platform that it becomes easy for anyone to get an approval on a loan request. Also, read the content available on the website for additional knowledge on the Tennessee Payday loan process.

Eligibility Criteria:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount starts from $100 to $5,000.

- Lender fix the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link bigbuckloans.net

- Application form needs to be filled up.

- Funds transfer takes place on the same business day.

5. Fund Finance

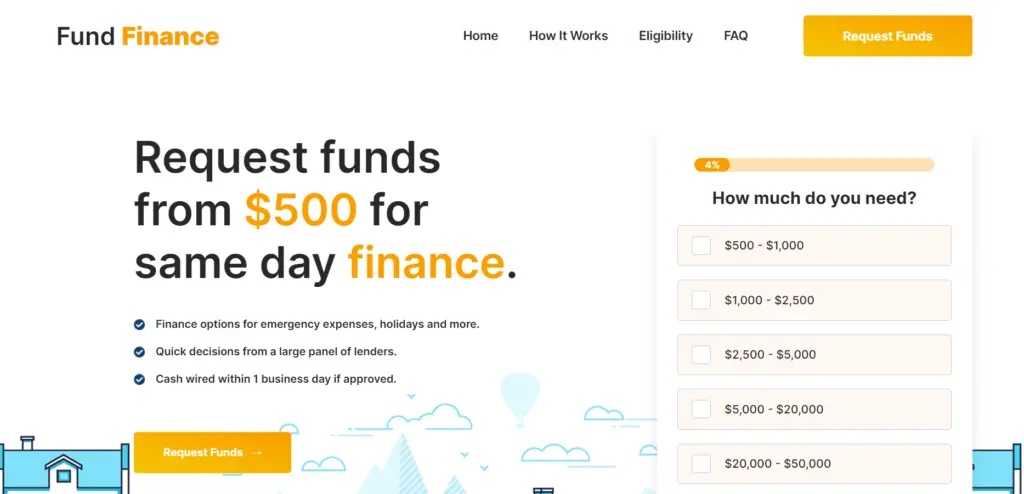

Fund Finance is another substitute to choose if you are looking out for alternates for Tennessee Payday loans. The regulatory norms of this website could be checked by customers for verification. You can easily share your personal details and bank account details with this platform. It is because this platform uses end-to-end encryption for securing all its data from unwanted access.

This online platform connects you with a range of financiers from around the world. You can either request for a short-term payday loan here or take guidance from the lenders on making good financial decisions. This online platform has multiple choices for customers on payday loan amount selection. The application process also takes minutes to complete, and the approval takes around 48 hours.

Eligibility Criteria:

- Phone number for verification.

- An active bank account.

- Identification proof is mandatory.

Loan Details:

- Loan amount covers amounts from $500–$50,000.

- Lender fix the interest rate

- Approval for the loan amount takes around 24–48 hours.

Application Procedure:

- Connect to the website with the link fundfinance.net

- Application form needs to be filled up.

- Funds transfer takes place on the same business day.

Limitations of Taking Tennessee Payday Loans from Online Platforms

When you take up a Tennessee payday loan, you take it because of its benefits. For instance, the flexibility, accessibility, and quick approval invites interest of people to take up these loans from online platforms. However, every good offer comes with certain kinds of limitations. It is important to understand the limitations for making better choices.

High interest rate is one of the reasons why people suffer taking payday loans from online platforms. Even though the approval process is quick, and the application procedure has limited checks, high interest rates often make individuals struggle after taking the loan. However, if you are confident about taking the loan and repaying it on time, high interest will not let you suffer on taking up this loan. Rather, your credit score can increase if you take this loan and repay on time.

Secondly, individuals struggle with taking up payday loans from online platforms because some platforms turn out to be fraud. It is important to check regulatory norms and license of the platform for being sure of taking the loan. Otherwise, the money you borrow will cause you high penalties and will degrade your credit score.

Thirdly, payday loans have smaller amounts requested as loans, so lenders often provide short-term repayment plans. Due to the short duration, individuals end up missing payment on time. As a result, your credit score goes down, and you are also imposed with penalties. Due to its smaller amount requested, payday loans are neglected by customers. It is because individuals look out for other alternatives such as borrowing from a friend, informal establishments, and more.

Conclusion

Tennessee Payday loans are easy to borrow and lenders end up approving the loan within a shorter time period. However, it is important to check all regulations and policies associated with the lending of payday loans. Every region has got their own policies for loan lending, especially that of payday loans.

If you are not eligible to take a Tennessee payday loans, you can always check out the above-mentioned finance service providers for help. These platforms offer free of cost services for connecting you with lenders for borrowing loan amounts.

FAQs:

Q1. How much does the lender charge interest for payday loans in Tennessee?

A1. In Tennessee payday loans, lenders often charge around 459% APR for a term plan of 14-days when you borrow around $200.

Q2. Does missing repayment on time affect your credit score?

A2. Credit score is always associated with repayment of loan on time. In case, you will not be able to repay the loan taken from online platforms, you can always connect with your lender for finding out other alternatives.

Q3. How long does it take for payday loans to get approved when taken through online applications

A3. Usually, online payday loans get approval within 48 hours due to short-term loan applications with smaller amount requests.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any financial decisions. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any financial institution. Any action taken by the reader based on the information provided is at their own risk.