Personal Loans In Wilmington

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xPersonal loans provide people with the financial flexibility they need to take care of a variety of demands, such as paying for home upgrades, consolidating debt, or covering medical costs. When someone is in dire need of money, personal loans provide a lifeline by enabling them to pay for a range of costs, including planned purchases and unforeseen crises.

In Wilmington, like in other places, personal loans offer a practical way for people in need of financial support. Let’s examine personal loans in more detail, including what they include, how they work, what the hazards are, and how to get around Wilmington.

Best 5 Lenders For Personal Loans In Wilmington

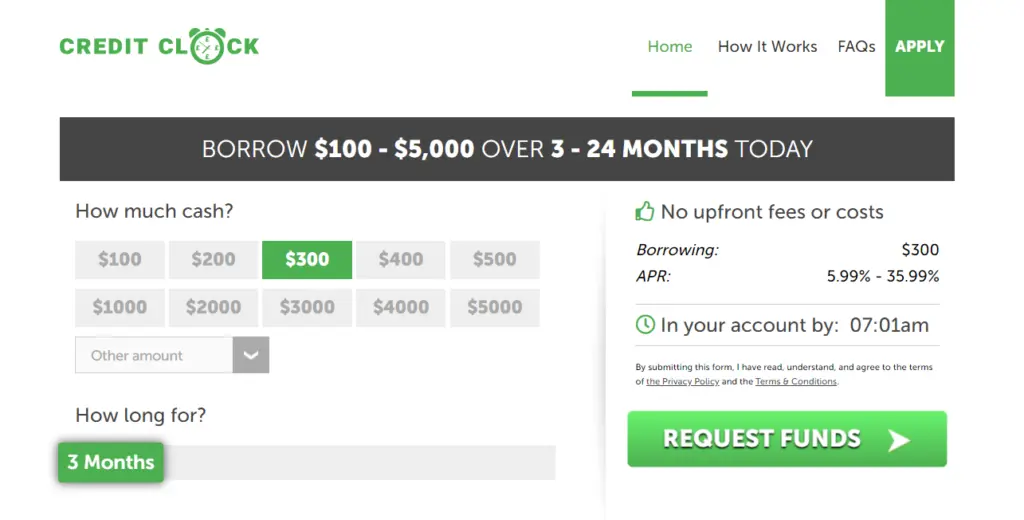

1. Credit Clock

One of the primary advantages of using Credit Clock is the speed at which borrowers receive feedback on their loan applications. Unlike traditional loan application processes that can take days or even weeks, Credit Clock provides assurance of loan approval or rejection within a matter of minutes. This rapid response time is invaluable for individuals in urgent need of funds, allowing them to make informed decisions quickly.

Highlights:

- It welcomes credit types.

- Borrow $100 to $5000.

- There aren’t any upfront or hidden costs.

- For these loans, the annualised percentage rate of those expenses still varies from 5.99% to as high as 35.99%.

- Quick decisions with cash sent the same day.

How Does It Work?

- You can visit the official website- creditclock.net

- Pick a loan amount: Credit Clock collaborates with lenders who offer up to 24 months of loans in quantities ranging from $100 to $5000.

- Complete the Short Loan Form: You will choose the loan amount and the payback schedule when completing the form. To prevent loan default, make sure the loan amount and payback schedule you select are reasonable.

- It’ll investigate the Loan Market: It has a list of lenders that work with Credit Clock. Following your completion of the application, we will go across the market to find lenders that provide the kind of loan you’re looking for.

- Obtain a Decision in Just a Few Minutes: You will receive notification of the outcome of your loan application processing in a matter of minutes. You will be put in contact with an impartial third-party lender to complete the procedure if you are approved for the loan.

- Receive Your Cash: You will receive your loan the same working day if the lender approves your application.

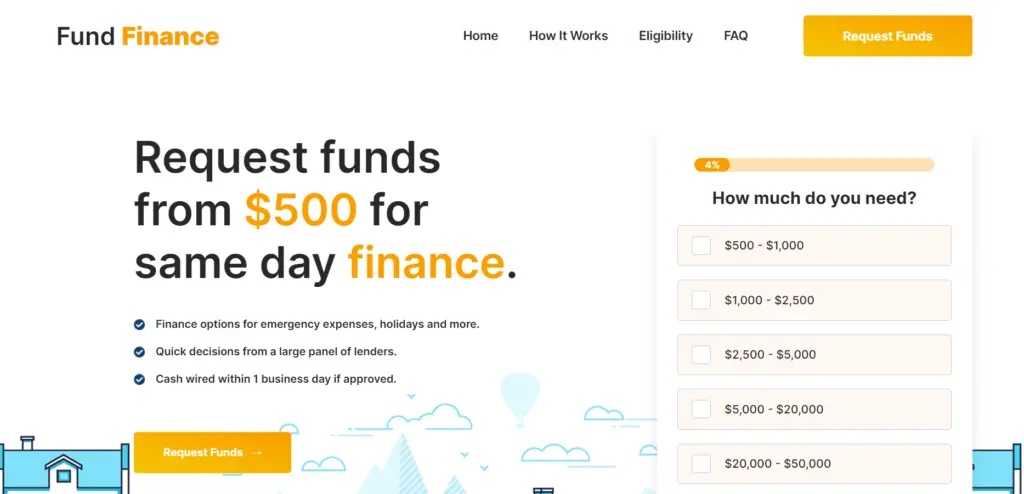

2. Fund Finance

By opening its website, you can seamlessly apply for a Personal Loans In Wilmington through Fund Finance. Once you’ve completed the application process and your request is approved by a lender, Fund Finance will connect you directly with the lender. This streamlined approach ensures that you have a direct line of communication with the lender who has approved your loan.

Highlights:

- It provides financial possibilities for holidays, unexpected costs, and other things.

- If authorised, funds are transferred within one business day.

- There are no hidden fees and no paperwork in the application process.

- Use a $500–$50000 loan, based on what you require.

- For these loans, the annualised percentage rate of those expenses still varies from 5.99% to 35.99%.

How Does It Work?

- You can visit the official website- fundfinance.net

- Pick a loan amount: Decide how much you require; the range is $500 to $50,000.

- Apply with an application: Use the website’s fast form to complete your request; it will just take two minutes.

- Obtain a loan: You will receive your loan the same working day if the lender approves your application.

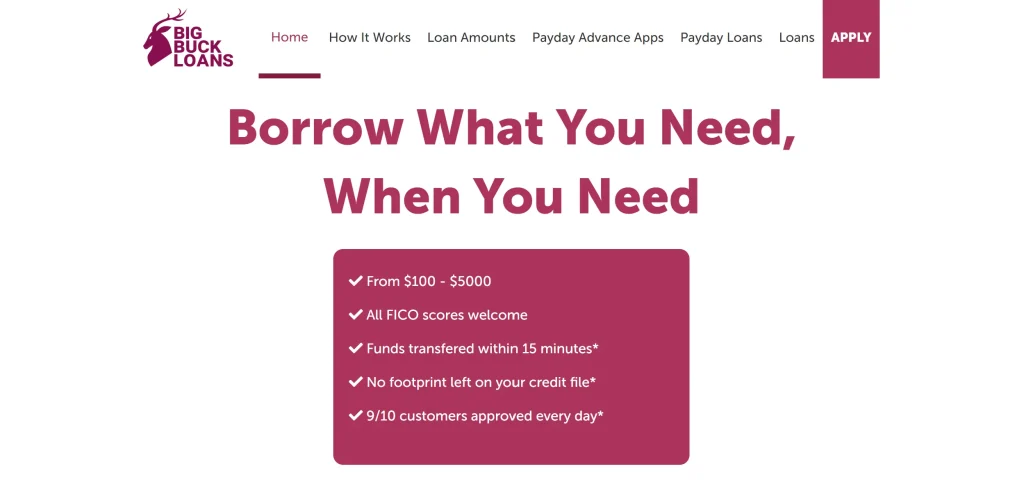

3. Big Buck Loans

The main objective at Big Buck Loans is to help people achieve the financial freedom they need while staying within their means. It accomplishes this by providing in-depth details on a range of service providers and lending applications. The platform serves as a resource hub where individuals can explore a wide range of options tailored to their specific needs, whether they’re seeking short-term loans, installment plans, or other financial solutions.

Highlights:

- It welcomes all FICO score credit types.

- Borrow $100 to $5000 over 3 to 24 months to pay.

- Nothing remains on your credit record.

- For these loans, the annualised percentage rate of those expenses still varies from 5.99% to as high as 35.99%.

- Quick decisions with cash sent the same day in under 15 minutes.

How Does It Work?

- You can visit the official website- bigbuckloans.net

- Pick a loan amount: Big Buck Loans collaborates with lenders who offer up to 24 months of loans in quantities ranging from $100 to $5000.

- Complete the Short Loan Form: You will choose the loan amount and the payback schedule when completing the form. To prevent loan default, make sure the loan amount and payback schedule you select are reasonable.

- Obtain a Decision in Just a Few Minutes: You will receive notification of the outcome of your loan application processing in a matter of minutes. You will be put in contact with an impartial third-party lender to complete the procedure if you are approved for the loan.

- Receive Your Cash: You will receive your loan the same working day if the lender approves your application.

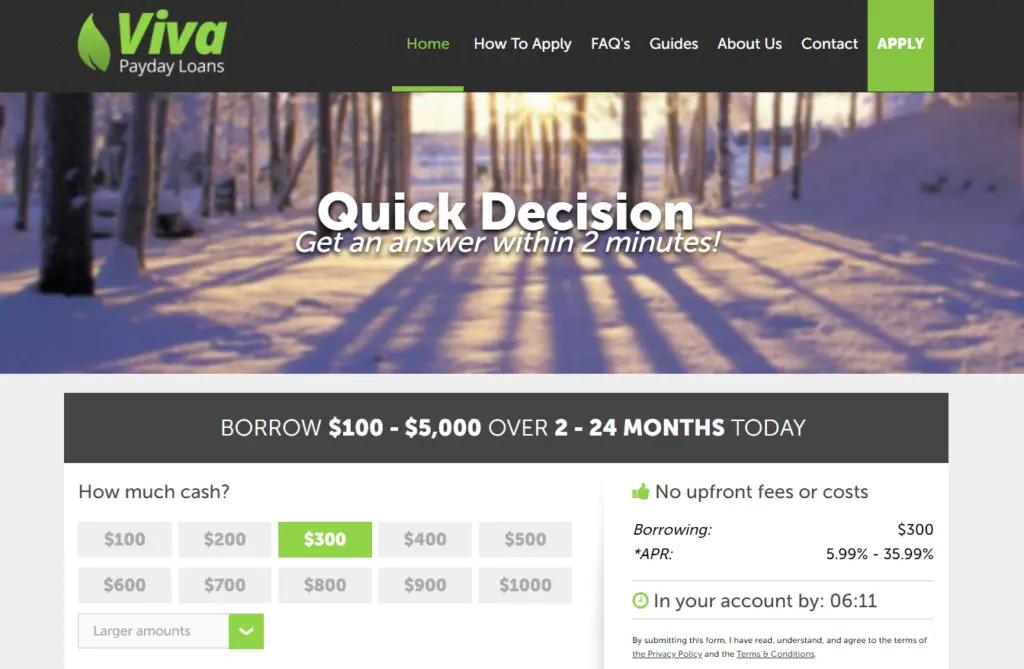

4. Viva Payday Loans

The purpose of Viva Payday Loans is to assist Americans in times of need by providing them with short-term payday loans. Consumers no longer need to visit physical locations or complete voluminous documentation in order to make their loan requests; they may do so online. This convenience is especially helpful for people who need quick access to money without having to wait around for it. Additionally, Viva Payday Loans prioritises transparency and consumer protection.

Highlights:

- It welcomes all credit types.

- Borrow $100 to $1000 over 2 to 24 months.

- There aren’t any upfront or hidden costs.

- For these loans, the annualised percentage rate of those expenses still varies from 5.99% to as high as 35.99%.

- Quick decisions with cash sent the same day in minutes.

How Does It Work?

- You can visit the official website- vivapaydayloans.com

- Pick a loan amount: Viva Payday Loans collaborates with lenders who offer up to 24 months of loans in quantities ranging from $100 to $1000.

- Complete the Short Loan Form: You will choose the loan amount and the payback schedule when completing the form. To prevent loan default, make sure the loan amount and payback schedule you select are reasonable.

- Receive Your Cash: You will receive your loan the same working day if the lender approves your application.

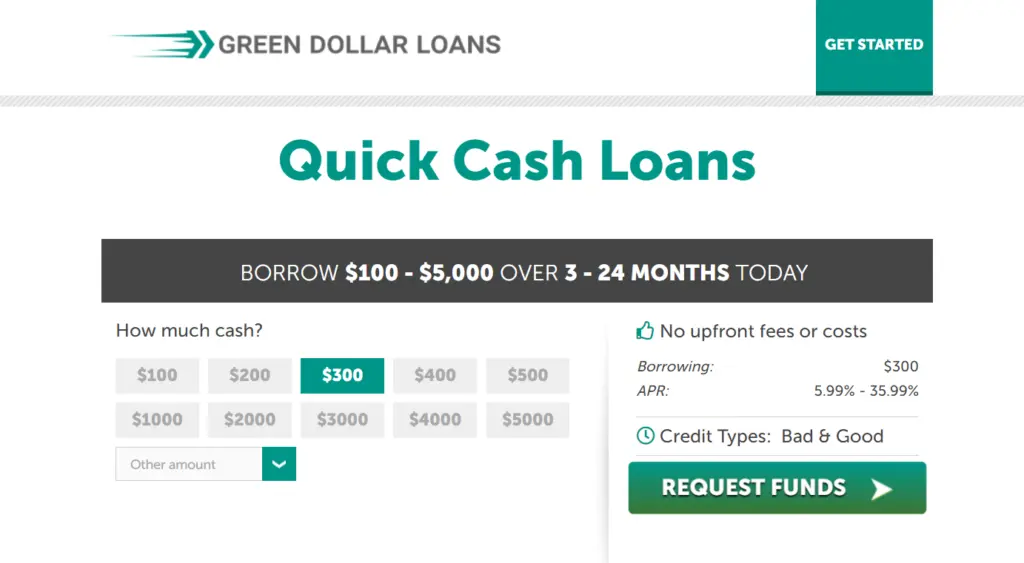

5. Green Dollar Loans

Green Dollar Loans is a lender that offers borrowers the flexibility to obtain various types of loans, catering to their specific financial needs. Green Dollar Loans seeks to offer an answer whether you need money for debt consolidation, home improvements, unforeseen costs, or any other reason. A noteworthy feature of Green Dollar Loans is its dedication to providing consumers with competitive interest rates, hence lowering the cost of borrowing.

Highlights:

- It welcomes all credit types whether it is bad or good.

- Borrow $100 to $5000 over 3 to 24 months.

- There are no hidden fees or charges upfront.

- For these loans, the annualised percentage rate of those expenses still varies from 5.99% to as high as 35.99%.

- Quick decisions with cash sent the same day in minutes.

How Does It Work?

- You can visit the official website- greendollarloans.net

- Pick a loan amount: Green Dollar Loans collaborates with lenders who offer up to 24 months of loans in quantities ranging from $100 to $5000.

- Complete the Short Loan Form: You will choose the loan amount and the payback schedule when completing the form. To prevent loan default, make sure the loan amount and payback schedule you select are reasonable.

- Receive Your Cash: You will receive your loan the same working day if the lender approves your application.

Pros of Getting Personal Loans In Wilmington

A personal loans in Wilmington can help people reach their financial objectives and manage their money more skillfully. It offers several advantages. Here are some key benefits of getting personal loans in Wilmington:

1. Financial Flexibility

Borrowers can utilise Personal Loans In Wilmington to finance large purchases, pay for unforeseen bills, or consolidate debt, among other flexible uses for the money. A Personal Loans In Wilmington can give you the money you need, with no usage limitations, to cover anything from medical bills to home repairs to a dream vacation.

2. Lower Interest Rates

This can result in significant savings over time, especially for borrowers with good credit scores who qualify for the most favorable rates.

3. Quick Approval Process

Personal Loans In Wilmington approval processes are expedited by many Wilmington lenders, giving applicants access to money when they most need it. This is particularly beneficial in emergencies or situations where time is of the essence, providing peace of mind and financial relief without lengthy delays.

4. Consolidation of Debt

A Personal Loans In Wilmington can be used to combine several high-interest obligations into a single, easier-to-manage payment for people who have numerous credit card balances or medical costs. This not only simplifies the repayment process but can also potentially lower the overall interest rate, saving money in the long run.

Conclusion:

Personal loans offer individuals in Wilmington a valuable financial tool to address various needs, from emergencies to planned expenses. Through a comprehensive comprehension of the advantages, hazards, and procedures linked with personal loans, debtors can make knowledgeable choices to efficiently accomplish their financial objectives.

FAQs:

Q1. Can I get a personal loan with bad credit in Wilmington?

A1. Even while it could be harder to get approved for a Personal Loans In Wilmington if you have terrible credit, there are still alternatives, such as secured loans and internet lenders.

Q2. When is a personal loan in Wilmington approved?

A2. A personal loan’s approval procedure may differ based on the lender and your financial circumstances. While some lenders process applications instantly, others could take a few days.

Q3. For personal loans in Wilmington, what is the typical interest rate?

A3. The average interest rate on personal loans in Wilmington is determined by a number of variables, such as your income, credit score, and the terms of the lender. Generally, rates can range from single digits to over 30%, so it’s essential to look for the best deal.

Q4. Is it possible to combine my debt in Wilmington with a personal loan?

A4. Certainly, using Personal Loans In Wilmington to combine high-interest debt into a single, easier-to-pay payment can be a useful strategy. To be sure you’re saving money over time, you must evaluate interest rates and loan terms.

Q5. What occurs if I am unable to pay back my Wilmington personal loan?

A5. You can be subject to penalties for non-payment of your Personal Loans In Wilmington, which could include late fines, harm to your credit report, and even legal action from the lender. If you’re having trouble making your loan payments, you should talk to your lender and look into other possibilities.