$100 Quick Loan No Credit Check

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xDo you need fast money without having to deal with a credit check? A fast $100 loan is the perfect solution when faced with an unforeseen expenditure. These small-dollar or payday loans are marketed as quick, simple, and requiring “no credit check.” However, you should weigh your alternatives and know any potential disadvantages before taking a fast loan.

Fortunately, a simple fix is available through $100 loan fast applications. $100 Quick Loan No Credit Check. These applications provide quick access to modest loans without requiring a credit check, usually up to $100. These applications can give you the money you need when you need it, whether you are trying to pay a bill, make a purchase, or get by until your next payday.

Top 5 $100 Quick Loan No Credit Check

5 Best $100 Quick Loan No Credit Check

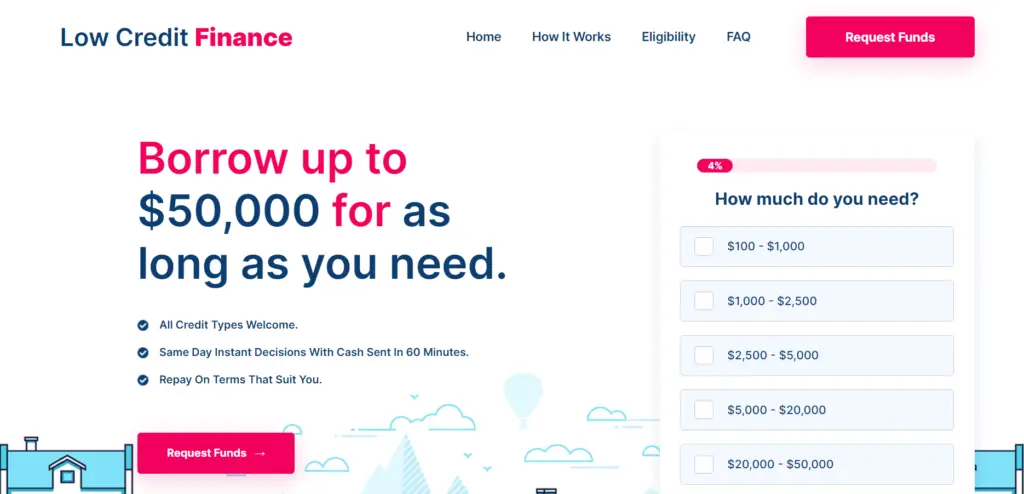

1. Low Credit Finance

Low Credit Finance offers financial services and products to help people whose credit ratings fall short of desirable levels. Getting loans and other financial aid can be challenging for those with poor credit ratings since traditional lenders frequently place a premium on creditworthiness. On the other hand, low-credit finance alternatives try to close this gap by providing inclusive solutions to fit different credit profiles.

Highlights:

- Prioritise inclusivity with diverse credit options.

- Offer flexible loan options (emergency, personal, installment).

- Provide $100 Quick Loan No Credit Check for limited credit history.

- Maintain competitive rates despite low credit scores.

- Streamline application process for easy online application.

Loan details:

- Loan Amount: $100 to $50,000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility:

- Genuine identity

- Operative bank account

- Proof of occupancy

- Checking credit history

Application Procedure:

- Visit Low Credit Finance to explore current lenders.

- Fill out the required form to find out how much you may borrow.

- When making changes to your contract, take your time and contact any interested lenders immediately.

- Once the terms are agreed upon, accept the offer.

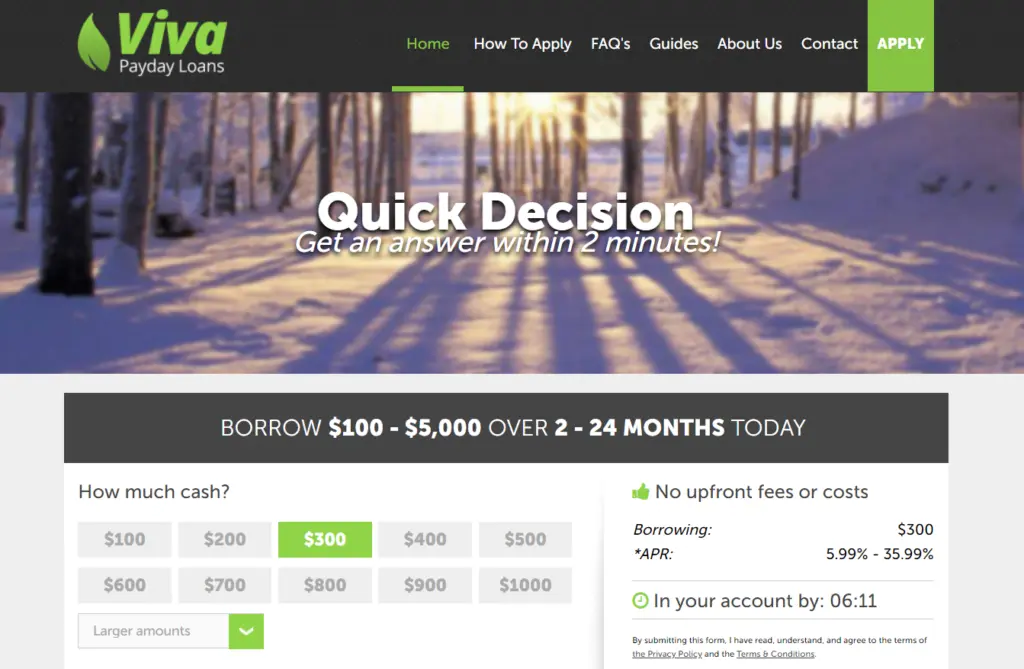

2. Viva Payday Loans

Viva Payday Loans itself is a helping hand for people facing financial difficulties. $100 Quick Loan No Credit Check. They offer emergency loans for immediate needs and personal loans for various purposes. Interestingly, they provide no credit check loans, so anyone with a poor credit background can apply.

Loan amounts vary from $100 to $5000 to accommodate various budgetary requirements. Viva Payday hopes to be an easily accessible answer for many with its straightforward qualifying requirements of being over 18, having a working US bank account, a working US cellphone number, and an active US email address.

Highlights:

- Quick access to cash for emergencies.

- Includes those who have low credit ratings.

- Loan amounts can be adjusted to accommodate different demands.

- Simplified procedure for applications.

- Competitive rates for annual percentage rates.

Loan details:

- Loan Amount: $100 to $5,000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility:

- Must be eighteen years of age or older.

- Must be a permanent resident or a citizen of the US.

- Have a full-time job.

- A personal bank account is a must.

Application process:

- Visit Viva Payday Loans

- Examine the personal loan possibilities that fit your needs.

- Prequalify online to find out what kind of loan you could be eligible for and how much it would cost.

- Send in the formal application, the accompanying paperwork, and your social security number.

- Hold off till your request is granted.

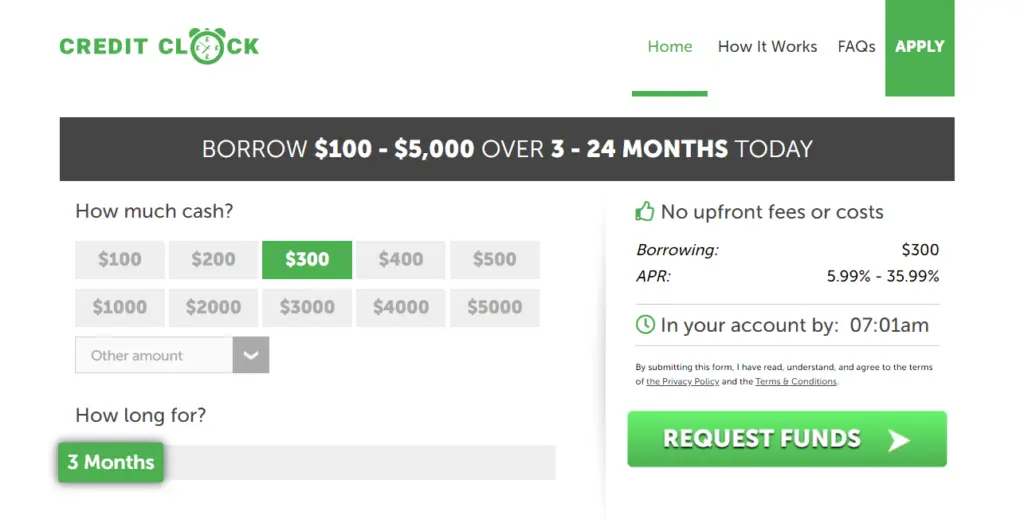

3. Credit Clock

Credit Clock caters to those facing short-term financial needs by offering small, fast loans. Loan amounts range from $100 to $5000, ideal for covering unexpected expenses or temporary gaps until your next paycheck. Despite the small size of the loans, Credit Clock keeps interest rates competitive (between 5.99% and 35.99% APR). The application process is quick and easy to complete online, focusing on getting you the money you need as soon as possible.

Highlights:

- Focuses on providing smaller loans for urgent financial requirements.

- Even with the small loan quantities, the APR rates are competitive.

- The quick approval procedure allows for prompt financial availability.

- Repayment plans that are flexible and catered to specific needs.

- Simplified the online application procedure for ease of use.

Loan Details:

- Loan Amount: $100 to $5,000

- Loan Term: 3 to 24 months

- Competitive rates based on your specific situation

Eligibility:

- The minimum age needed to apply is eighteen.

- Must have sound financial standing.

- The bank account has to be active.

Application Process:

- Visit the official website of Credit Clock

- Provide the required information on the application form.

- After approval, the loan money will be sent straight to your bank account.

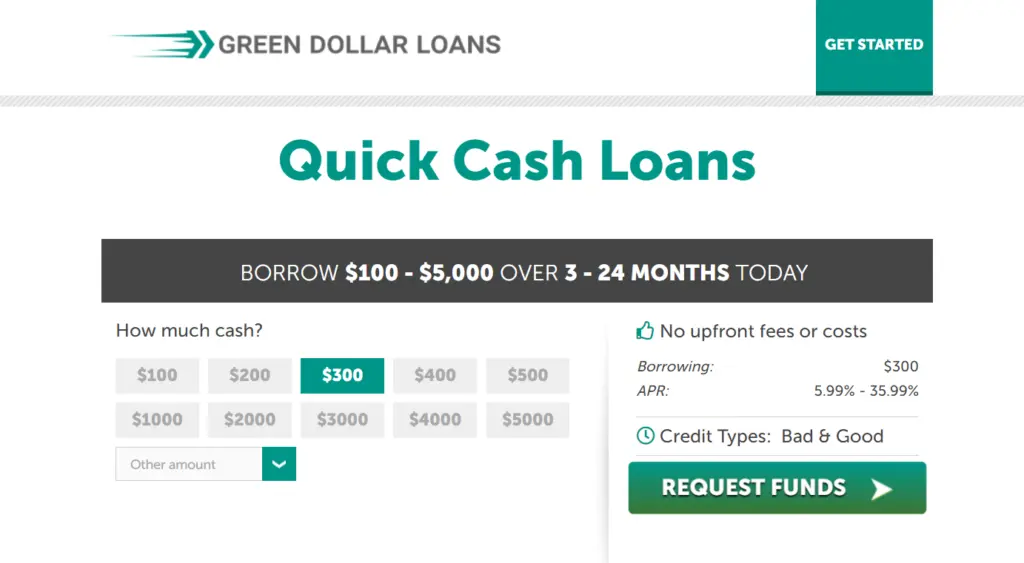

4. Green dollar loans

Green dollar loans approach lending differently than other lenders. $100 Quick Loan No Credit Check. They prioritise financial inclusion by providing loans to borrowers with various credit histories rather than only those with flawless records. Because of this, they allow applicants who may otherwise be turned down access to loans by not conducting stringent credit checks. With loan amounts ranging from $100 to $5000, you may finance any demand, whether a significant project or a minor emergency need. They nonetheless provide reasonable interest rates to make goods inexpensive, even if they cater to those with less-than-perfect credit.

Highlights:

- People with bad credit records might benefit from no-credit-check loans.

- Varying loan levels accommodate a range of budgetary requirements.

- Competitive APRs in contrast to other financing solutions for those with bad credit.

- A simple online application procedure.

- Quick funding and approval procedure.

Loan details:

- Loan Amount: $100 to $5000

- Loan Term: 3 to 48 months

- Interest Rates: 5.99% to 35.99% APR

Eligibility:

- Must be eighteen years of age or older.

- Both permanent residents and US citizens are required.

- Must be employed full-time.

- Need to maintain a personal bank account.

Application process:

- Visit Green dollar loans.

- Review the personal loan options for which you are eligible.

- Fill out an online form to determine your eligibility and possible loan amount.

- Send in the formal application with the necessary information, your social security number, and any supporting documentation.

- Await the endorsement of your proposal.

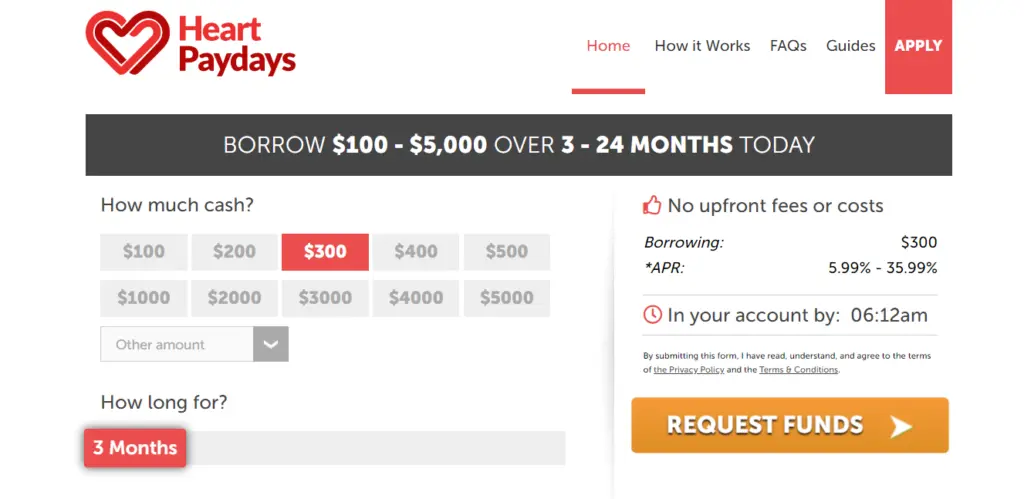

5. Heart Paydays

Heart Paydays is a handy choice for anyone needing financial assistance. They offer loans ranging from $100 to $5000 for various purposes. With this flexibility, borrowers can take on anything from planned home upgrades to unforeseen crises. The application procedure is straightforward and may be completed online alone. Heart Paydays offers affordable interest rates but has manageable qualifying requirements (over 18), making them a well-rounded option for many consumers.

Highlights:

- Various loan amounts to accommodate a range of demands.

- Flexible use of money for a range of objectives.

- Simplified the online application procedure for ease of use.

- Competitive APRs when weighed against alternative loan choices.

- Inclusive standards for accessibility eligibility.

Loan details:

- Loan Amount: $100 to $5,000

- Loan Term: 1 to 3 years

- Interest Rates: 5.99% to 35.99% APR

Eligibility:

- Must be at least 18 years old.

- Needs a reliable source of income.

- Need to have an open bank account.

Application Process:

- Visit the official website of Heart Paydays.

- Provide the required information on the application form.

- Apply and wait for acceptance.

- After approval, the loan amount will be deposited into your bank account.

Building Up Your Credit for a Better Tomorrow

Even if your credit is now bad, you may take the following steps to improve it progressively:

- Get a secured credit card: The security deposit you must pay for secured credit cards sets your credit limit. Building your credit history is easier if you use the card responsibly and pay on time.

- Become a user with authorisation: If a family member or a reliable acquaintance has a credit card in good standing, they can add you as an authorised user. Their stellar credit history may assist you in obtaining better credit.

Paying your obligations on time is the most crucial thing you can do to improve your credit score.

Conclusion:

For those with low credit ratings, Viva Payday Loans and Green Dollar loans are both excellent options as they allow access to personal loans and emergency cash without the limitations of standard credit checks.

Even if each platform has advantages of its own, taken as a whole, they improve financial inclusion and provide borrowers with the courage to face financial obstacles. When used responsibly and with the right knowledge, $100 loan instant apps can be beneficial in effectively handling temporary financial difficulties.

FAQs:

Q1. How do $100 fast loans operate, and what are other quick ways to get cash without having my credit checked?

Instant $100 loan applications make borrowing easier by providing quick and simple access to modest loan amounts. Usually, using the app, consumers may apply for a loan by giving some basic financial and personal details. These lenders frequently waive the need for a credit check, which makes it simpler for those with bad or limited credit histories to get approved for loans.

Q2. Does getting a $100 fast loan without a credit check incur any fees?

Specific rapid lending applications may impose origination or transaction fees, while others could provide loans with no further charges. It is vital to review the terms and conditions of any loan offer before signing it to guarantee you are informed of all associated charges and repayment obligations.