Credit Clock Loan Review

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xCredit Clock loan has built a great reputation for being able to quickly find lenders for payday loans with no credit check. That doesn’t mean Credit Clock matches lenders with borrowers who are still credit-checked under US regulations and helps borrowers with low credit scores to get their loans approved.

Credit Clock loan has a short and easy-to-fill-out online application form that shouldn’t take more than a few minutes. With its user-friendly website interface, it ensures that the entire loan-lending process is easy and hassle-free.

Credit Clock loan is known for offering payday loans to those with bad credit and no credit history. It helps you by providing a friendly platform for tribal loans with adjustable repayment. So, if you’re still in doubt about your options, you can always trust Credit Clock and be worry-free.

Credit Clock Loan Overview

When it comes to online payday loans for bad credit, Credit Clock loan has adopted a futuristic stance. The platform will assist you in obtaining a proposal, which, if accepted, will lead to the loan application process. It’s a simple platform for lending money.

The same-day, immediate choices for money lending within a few minutes are what makes it the best. It’s a simple platform for lending money. Loan rates and terms will vary from lender to lender and are mostly negotiable.

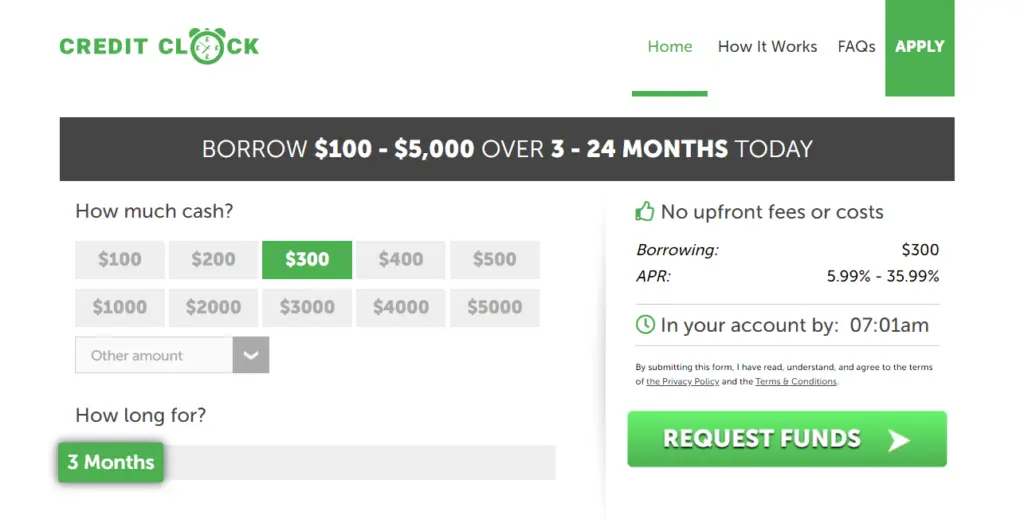

The platform offers payday or same-day loans with interest rates from 5.99 to 35.99 per cent and loan periods from 3 to 24 months. Credit Clock Loan are likely an option for people with bad credit who may find it difficult to get a loan through traditional channels.

When applying for a tribal loan, these credit ratings don’t count much in the credit clock. The online application system of the Credit Clock loan platform has become easy to navigate and use. It’s a hassle-free loan application process.

While you cannot apply for payday loans without a credit check through Credit Clock loan , you can apply for payday loans with simple eligibility criteria, flexible loans (up to $5,000) and repayment (2-24 months), and fast payments. Again, credit checks will depend on lenders mostly.

Once you have chosen how much you want to borrow and for how long, you will be matched with a lender in no more than 2 minutes. If you cannot be found with the lender, you will be notified. The maximum interest rate for lenders using Credit Clock loan is 35.99%.

Highlights of Credit Clock:

- Get a fast loan from trusted lenders.

- The loan ranges from $200 to $5,000. The loan amount is quickly transferred to the borrower’s account within 24 hours.

- Even with bad credit, be sure of favorable loan deals.

- Two minutes to complete the application

- Loans from reliable lenders.

- Rapid approval of a loan.

- Online method of application.

- Absence of the headache associated with offline documentation.

- Provide interest rates that are competitive when compared to those of other lenders in the market.

Eligibility Requirements for Credit Clock Loans:

A person must follow the following eligibility criteria to apply for Credit Clock Loan:

- Candidates must have a current ID.

- Candidates have to be US citizens.

- Candidates must be at least eighteen years old.

- Candidates need to have a current bank account.

- Must be making at least $1000 a month from a legitimate source of income.

- Candidates must submit evidence of their income.

Key Features of Credit Clock

- Contact customer service at [email protected].

- The approval process at Credit Clock loan is quite speedy.

- Flexible loan amounts are provided.

- Help with loans from reliable lenders.

- Even if your credit is not great, you can still obtain a loan.

Loans and Interest Rates

- Creditclock offers loans with interest rates from 5.99% to 35.99%.

- Flexible loan amounts can range from $5,000 to several hundred dollars.

- The loan term is three to twenty-four months.

How to Apply for Loans through Credit Clock?

- Do your research to find a reliable tribal lender that offers loans to borrowers with bad credit. Visit the official website of Credit Clock.

- Make sure you meet the requirements to qualify for a loan. Payday lenders typically require regular income, valid identification, and an open bank account.

- Get the necessary documents, which should include government-issued identification, proof of income, and proof of income.

- Go to the lender’s website and complete an online application. Determine the necessary amount for an emergency cash loan.

- Please provide the desired loan amount and terms. Options start at $100 and go up to $5000.

- Give truthful answers about your income, assets, and other necessary facts. After applying, wait for the lender to check your information and make a decision. After giving the loan, read the terms and conditions carefully.

- You will hear back on your loan application in two minutes. You will close the deal directly with the lender if you decide to accept their offer. The lender will send you a legal document outlining the terms and other pertinent details of your loan at this phase of the procedure.

- You can sign the loan and return it to the lender after you’ve taken the time to read the loan agreement and get clarification on any points that might appear unclear or complex. From this point on, the loan amount is often paid back in 15 to 1 hour.

- Once you agree to the terms of the loan, the money will be transferred directly to your bank account.

What are No Credit Check Payday Loans and How Do They Work?

As the name suggests, no credit check payday loans are easy-to-use forms of financing that are perfect for people who need a quick payment. These loans can be applied online through the providers above using a completely digital application process that can take as little as two minutes to complete.

However, due to current conditions, bad credit loans in the US are not always possible. Applying for short-term financing is still fairly easy, regardless of your credit history or FICO score. If you’re over 18, live in the United States, have a checking account, and have a regular monthly income, you can apply for these loans—some providers even offer same-day money transfers.

The last participant in this discussion is Credit Clock loan. This service provider connects borrowers and lenders through a convenient online portal, offering an application process that takes just two minutes. Credit Clock loan can facilitate up to $5,000 in financing and offers repayment terms of up to 24 months.

Pros of Credit Clock:

- Fast application Process

- Repayment period up to 24 months

- Quick decisions.

Conclusion:

In conclusion, this article went into detail about credit check loans, what they are, and whether they are possible in today’s market. Borrowers who want to get a quick loan can do so by working with Credit Clock Loan. This service provider works with a network of quality lenders and ensures a smooth application process for everyone.

It can be intimidating to apply for payday loans for the first time. The average American may apply for a loan online with ease and without any fuss, thanks to the credit clock loan that we have reviewed. To find out how easy it is to apply for loans online, simply enter your information on the Credit Clock Loan website.

FAQs:

Q1. Can I get a payday loan in the US without a credit check?

Lenders may require a credit check before deciding because compliance is mandatory in the US, but people with bad credit or no credit history can still get a loan.

Q2. What is the easiest loan to get?

The easiest loans are tribal loans with no credit check requirements. However, these loans often have incredibly high fees and interest.

Q3.Who Is Eligible to Apply for Urgent or Emergency Loans?

Emergency or urgent loans are available to anyone who fits the standards of the lender, is at least eighteen years old, and has a steady source of income.