Prestamos USA Review

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xSelecting the ideal loan provider may be pretty tricky. Doing extensive research before committing is essential because several lenders are fighting for your business. This article explores Prestamos USA, a lender specialising in a certain kind of loan.

You should be able to make informed financial decisions with the aid of this post by being prepared with information on Prestamos USA loan amounts, interest rates, application processes, and more.

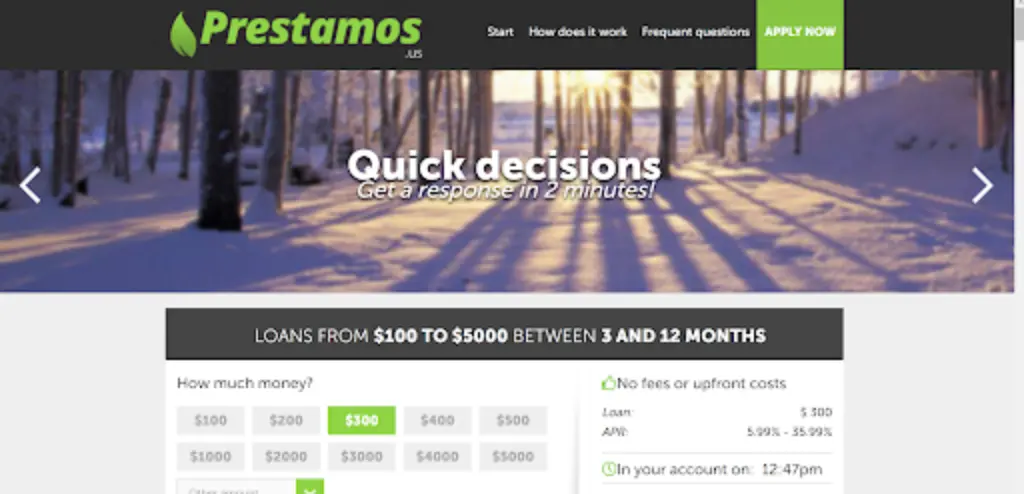

Prestamos USA Overview

Loan companies such as Prestamos USA arose to meet liquidity needs due to the nation’s increasing need for borrowing and restricted access to certain banking perks. This lending company provides money to its customers by specific regulatory standards. Paying your bills on schedule will build a solid credit history with Prestamos USA. This might empower you financially by granting you better loan conditions and advantages.

Prestamos USA Loan Details

1. Loan Amount: $100 to $5,000

This covers a range of small to medium-sized loans. The specific amount you will qualify for will depend on your creditworthiness, income, and expenses.

2. Loan Term: 3 to 48 months

Shorter terms will result in higher monthly payments but you will pay less interest overall. Conversely, longer terms mean lower monthly payments but more interest paid in the long run.

3. Interest Rates: 5.99% to 35.99% APR (variable)

It is important to note that the interest rate offered can vary depending on your creditworthiness and the loan terms. The APR (Annual Percentage Rate) includes the interest rate and any fees associated with the loan.

Eligibility Requirements to Apply for Loan at Prestamos USA

Basic Requirements:

- Age: 18 years or older

- Right to Work: Authorization to work in the desired country

- Valid Identification: Government-issued ID for verification

Financial Requirements:

- Stable Income: Verifiable source of regular income

- Direct Deposit: Ability to receive electronic payments

Key Features of Prestamos USA

The procedures are completed on their website, where you may apply for a loan anytime.

1. Quick and Simple Financing:

Prestamos USA provides a practical answer to your financial demands and is aware of the difficulties associated with traditional banking. You may apply for a loan whenever and anywhere you want using their safe online platform.

2. Customised Loan Options:

Say goodbye to one-size-fits-all approaches. Prestamos USA offers loan calculators to assist you in precalculating your payments. Thanks to this openness, you may adjust your loan request to match your budget.

3. Fast Approval Process:

You won’t have to wait weeks to hear back. Applications are immediately reviewed by the committed team of loan professionals at Prestamos USA. You will receive notification of their decision in a matter of minutes, and if the funds are accepted, they may be placed immediately.

4. Flexible Loan Amounts:

Prestamos USA will consider the amount you have requested, but they may also provide an alternative, depending on your financial circumstances. The maximum loan amount is $5000. A concise loan proposal with all the details will be sent to you so you can choose what’s best for you.

For What Purposes Are These Loans Available Online?

You will be able to pay for costs or financial liquidity situations like the following with the help of online lending options:

- Payments with a credit card.

- House maintenance.

- Funding for enterprises or companies.

- Surprise costs.

What Differentiates Prestamos USA?

1. Easy online application:

You may apply for a loan while relaxing in your home.

2. Clear loan terms:

Use the loan calculator to be fully informed about what you are getting into.

3. Quick approval process:

Receive a decision in a matter of minutes.

4. Numerous loan options:

Prestamos USA collaborates with you to select the best solution.

5. Develop your credit record:

Future loan conditions may be improved by timely payments.

It is crucial to understand that there are situations where the amount you ask for and the amount Prestamos USA approves will differ. In these situations, you may examine the loan proposal you will get and decide whether to accept or reject it based on your preferences.

Various Online Loan Options Offered by Prestamos USA

There may be several loans available to you when you examine the features of the lenders on the internet. However, it’s crucial to understand the conditions and advantages each provides. Learn about the many kinds of online loans available below, along with the features and benefits of each:

1. Loans with bad credit

Bad credit loans are an additional loan category available on Prestamos USA. When a lender offers this option, either your credit score needs to be considered or higher. This implies that you may still apply for this loan online despite your poor payment history.

2. Loans in advance or personal loans

You can apply for advance loans with modest standards, brief durations, and tiny loan amounts. Like the first two choices, those with poor credit can apply for these loans. Lenders often charge exorbitant interest rates and give borrowers up to 30 days to settle their debt.

You will get a response to your loan application reasonably immediately, and you might get your deposit in as little as 24 hours. In an emergency, they can undoubtedly assist you with sums up to $1500.

You have two options for making payments: you may use your credit or debit card to access the website on the designated payment day, or you can have the money automatically deducted from your bank account. You will only need to record your payment on the website if you make a deposit or transfer.

3. Short-Term Loans

Payday loans are known for providing amounts between $500 and $1,500, or even less if that’s what you require. Its primary attribute is its brief payment terms, often ranging from two to four weeks. They take care of such urgent necessities by repaying a portion of the loan’s interest.

You can get more outstanding sums and reduced interest rates if your loan has some guarantee. Make the most of your application by inquiring with Prestamos USA about available alternatives. Additionally, make sure you consistently pay your payments on time to build up a positive credit history, which will help you in the future when applying for loans.

If your desired amount is not accepted, lenders will contact you. This way, you may address the terms of your loan and complete the procedure. All that will be left to do is wait for the funds to be transferred straight into your bank account.

How to Apply on Prestamos USA?

1. Visit the Official Website & Determine the required loan amount.

Visit the Prestamos USA website and consider carefully how much money you will need to meet your budgetary constraints and resolve your immediate financial issues.

2. Complete an online application in its entirety.

Indicate the quantity required and include your email address. We must locate a suitable lender for you and ensure the safety and security of your data.

3. Receive a lender’s prompt approval decision.

As soon as you submit your loan request, you will be paired with the finest lender, offering these cash advances at the most competitive rates and reasonable conditions.

4. Get the money deposited into your account in a day.

The funds will be put into your bank account within one to two business days, or the same day if you apply as quickly as possible if you are accepted.

The Pros and Cons of Loans from Prestamos USA

After outlining their primary features, we cannot neglect to mention the benefits you will receive from selecting these loans and the drawbacks associated with doing so.

Pros:

- Free Application Procedure in a matter of minutes.

- Numerous online lending organizations adjust to their customers’ needs.

- You will get a response within a few minutes of receiving your application.

- Minimum standards must be met.

- Completely online procedure.

Cons:

- Low percentages of loans approved.

- Brief windows for cancelation.

Conclusion:

You will be in a better position to determine whether Prestamos USA’s loan lenders meets your financial needs if you are equipped with this information on loan amounts, interest rates, and the application procedure. Remember that before deciding on a loan, it is a good idea to check the conditions and interest rates provided by many lenders. To choose which loan is best for you, consider aspects such as your creditworthiness, the purpose of the loan, and your ability to repay the loan.

FAQs:

Q1. What are the requirements for eligibility?

Lender-specific requirements might differ significantly, but in general, you must be a permanent resident of the United States and over 18 years old.

Q2. What actual services does Préstamos US provide?

We provide a safe and free payday loan application process on our website. When you apply, we match you with a lender who says they will approve your loan request after a few more checks.

Q3. For what duration may I borrow these funds?

We allow our clients to borrow money for a maximum of twenty-four months. The interest rate range is 5.99% to 35.99%.