Super Personal Finder Review

Ad Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xPrivate loan pop-ups appear frequently. It can be difficult and stressful to have your bank loans denied regularly, but what if we told you that there are some of the best private lenders out there who offer high-risk personal loans with no credit check? And no, you won’t have to pay a lot of interest in a short period. Continue reading to find out how to escape this dire financial predicament.

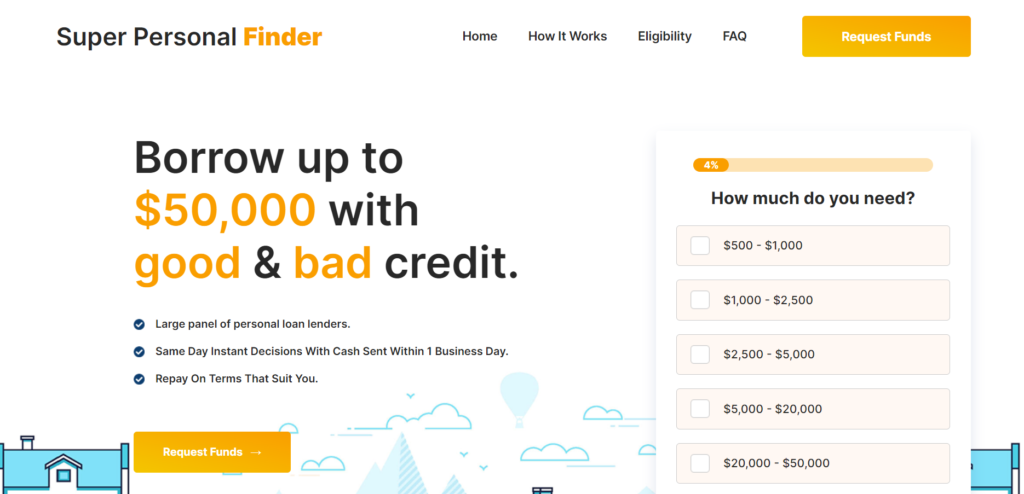

Super Personal Finder is a reliable network of internet lenders. With the least stringent qualifying requirements, the community offers personal loans of up to $50,000 to individuals with poor credit. The same-day fast decisions for money lending within sixty minutes are what makes it the greatest. Online application processing is available for loan applications.

Super Personal Finder Overview

The online lending platform called Super Personal Finder provides many affordable loan possibilities. The website established a solid reputation for offering the greatest options for emergency loans without a credit check.

At the moment, the site provides loans with repayment terms spanning more than ten years, ranging from $500 to $50,000. APRs in Super Personal Finance, which range from 5.99% to 35.99%, are often affordable despite being high in the sector.

Topmost on our list of the finest private loan lenders is Super Personal Finder, which stands out for its lightning-fast connections between lenders and borrowers via a vast network. With virtually instantaneous online lending choices and no additional costs, the organisation assists in providing personal loans up to $50,000.

Using this platform, all you need to do to apply for a personal loan is get in touch with lenders that have committed to provide the required funding. There may be times when the terms provided need further clarification.

The loan amounts range from $100 to $50,000. Different loan amounts and rates will apply based on the borrower’s creditworthiness; borrowers with excellent credit may be eligible for lower rates. There are no rigorous standards and both low and strong credit customers are eligible.

Standouts:

- $50,000 maximum personal loan amount

- No paperwork and no additional costs

- Online loan decisions are made almost instantly.

- A vast network of lenders and substitutes

- Individualised help for borrowers if needed.

- Easy loan approval procedure.

- To help borrowers make informed decisions, provide complete transparency of all loan costs.

- There aren’t any responsibilities or in-person events.

- Facilitate communication between lenders and those seeking personal loans.

Key Features of Super Personal Finder Loan

The following are the attributes and features of Super Personal Finder:

1. Flexible Approval Requirements:

Individuals with bad credit or low incomes can obtain money more easily, thanks to private lenders’ more accommodating requirements than those of traditional lenders.

2. Fast Access to Funds:

Once an application is approved, borrowers may receive funds immediately. High-risk personal loans are often easy to apply for.

3. No Property Needed:

Many high-risk personal loans are unsecured, meaning the debt is not protected by the borrower’s given property.

4. Higher Interest Rates:

Generally speaking, interest rates on personal loans to borrowers with excellent credit are lower than those on loans to less risky borrowers.

5. Borrowing Limits:

Lower borrowing limits on loans associated with high risk could not be sufficient to cover large expenditures or unanticipated expenses.

How to Apply for an Online Payday Loan through Super Personal Finder Loans?

Following are the steps to apply for the Super Personal Finder loans:

Step 1: Select the required amount of loan you want

Go to the official website of Super Personal Finder. You just need to request the amount through the application process by filling out the loan application form as per your requirements. The rest will be taken care of by the money lender.

Step 2: Go to the Instant Loan application tab and fill out the form

Here, the narrower need to provide the personal details to fill out the application form and select the amount you need to apply for.

Step 3: Get quick responses for your application

Fill out the application form as per the instructions. In two minutes, you’ll know if a lender can assist. If they can get a loan, you will be permitted to do so. You have the choice of moving forward or not. If so, the lender will set up the details of your deal directly with you and provide you with a contract that needs to be carefully read.

Step 4: Pay Back Your Installment Loans Quickly

The lender will start to process the online installment loan payout as soon as they receive your contract. This usually happens in a day or two.

Super Personal Finder Loan Details:

- Loan Amount: $500 to $50,000

- Loan Approval Time: Within 24 Hours

- Loan Rate: Based on Loan Amount

Eligibility Requirements for Super Personal Finder Loan

A person must follow the following eligibility criteria to apply for a super personal finder Loan.

- Applicants must possess a valid ID proof.

- Applicants must be residing in the USA.

- Applicants must be of the age of 18 or older.

- Applicants must have an active bank account

- Applicants must have a valid source of income of at least $1000 per month.

- Applicants must provide proof of income.

Pros of Super Personal Finder Loan

- Adaptability and versatility in the way the money is used.

- The fastest in terms of request approval.

- No extra middleman costs are involved.

- Flexible repayment options.

Highlights of Super Personal Finder

- Similar to how not all states in the USA provide the services of particular lenders, not all states give the loans.

- Borrowers don’t need to have a high credit score. It is not required to qualify for the loan.

- After acceptance, customers can get their loan amount as soon as the following working day.

- 24M loans’s application process is simple, making it available to all of their clients. We will maintain the privacy of all the information you submit.

- Upon receiving the lender’s approval, you might receive the requested amount on the same day that you applied.

- For more detailed information, you can visit support@SuperPersonalFinder.

- Money transfer would be completely electronic.

Conclusion:

When you apply for emergency loans for the first time, it can feel overwhelming. The loan finders that we have evaluated make it easy and hassle-free for the typical American to apply for a loan online. Enter your information on the Super Personal Finder Loans website to discover how simple it is to apply for emergency loans online.

FAQs:

Q1. What is the purpose of this loan?

Individuals obtain loans to assist with unforeseen costs, bills, holiday shopping, house maintenance, and other needs. You can receive the money you require with the aid of one of our lenders by applying for such a loan! If a lender is available, you can get money as soon as the next working day after completing our online form.

Q2. How are my details and privacy protected?

Super personal finder employs 256-bit SSL encryption when transferring your data to our network of lenders and other third-party lender networks because we value your privacy. This enables you to apply for a loan without stress and from the comfort of your home. We also share your data with third parties; for more details, see our Privacy Policy.

Q3. How quickly can I receive the funds?

Even though loan approvals can happen quickly—often in a matter of minutes—you probably won’t be able to collect your money until the next business day. Consider the procedure as if you were depositing a check into your bank account; normally, it takes a minimum of one business day for the check to clear and the funds to become available in your account.

Q4. Does Super personal finder work as a lender?

Super personal finder is not a lender. To try to put you in touch with a lender who might be able to give you a loan, we collaborate with many lenders as well as third-party lending networks. By completing just one form on our website, you can increase your chances of getting a loan. You won’t have to visit different websites or fill out multiple forms, which will save you time.

Q5. Do you run a credit report?

Although Super Personal Finder doesn’t run credit checks, the lenders we partner with might assess your creditworthiness and the potential loan amount.

Q6. What is the maximum amount I can borrow?

Although not all lenders can offer loans up to $50,000, loan amounts typically range from $200 to $50,000. Any lender will determine the maximum amount you can borrow based on a variety of factors, including its standards and your creditworthiness. There is no assurance that your online loan application will be accepted.

Q7. Does using this website come with a cost?

Super Personal Finder does not charge its customers, and there is no fee to submit your information online. If credit is provided to you, your lender will inform you in advance of the exact charges and interest rate associated with the loan before you accept it. Since Super Personal Finder isn’t a lender, it can’t tell you with certainty what the precise costs and interest rate of the loan option will be. The terms that the lender presents to you are not binding on you.