Viva Payday Loans Review

Simon

AuthorSimon is a Financial Analyst Writer with over 8 years of experience in credit analysis and underwriting. Simon has much expertise in the field..

xAd Discloure

iOnlinePayDay.com serves as a platform that links borrowers with payday lenders. We do not take the complete guarantee of its accuracy, completeness, or dependability. We encourage responsible borrowing and urge borrowers to consider alternative financial options before making a decision.xAnyone can be unprepared for a financial emergency. Having quick access to cash becomes important during those stressful times. Online payday loans have grown in popularity as a result of their ease and quick approval procedures. But how can you choose the best lender for you when there are so many available online? In difficult financial circumstances, payday loans in the USA assist borrowers in making ends meet and maintaining comfortable lives.

Everybody has been there. The month’s end is drawing near! The car is making a strange noise that makes you think it needs maintenance; the kids need new clothes; and even though you’ve been trying to eat healthier, there are no nutritious food alternatives in the fridge!

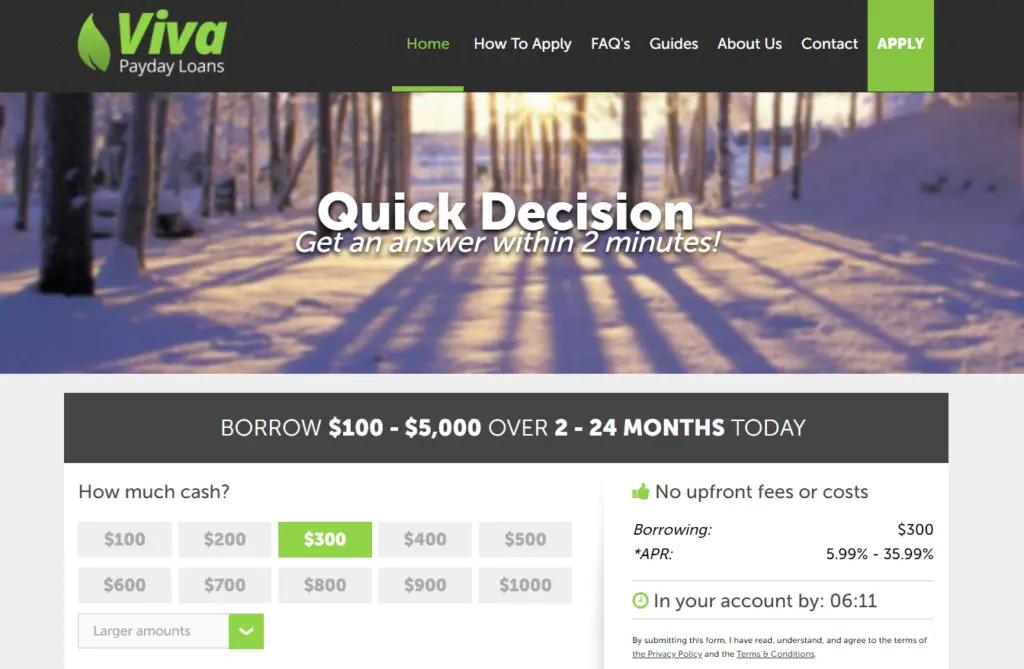

One of Viva Payday Loans unique selling points is its efficient and rapid application process, which enables customers to view loan possibilities in as little as 15 minutes. Their inclusive strategy serves a wide spectrum of borrowers by accommodating those with varying FICO scores.

It appears that money—money you don’t have—is the only thing that can resolve these problems! How can this be resolved? A loan from Viva paycheck Loans for a paycheck!

Viva Payday Loans Overview

Viva Payday Loans has made a name for itself as a reliable supplier by offering online loans that are always on time. It offers a range of the greatest payday loans to satisfy various needs and ensures a simple loan approval process, enabling clients to get money fast.

Their goal at Viva Payday Loans is to make immediate payday loans in the USA easy and accessible for all people there. You can get all the information you need at the Viva Payday Loans website, regardless of whether you’re looking for an urgent payday loan or are determined to learn if guaranteed Viva Payday Loans in the USA exist.

Even though they are not lenders, they provide a free loan-finder service to anyone looking for the best payday loans in the US that are tailored to their circumstances. Although the website cannot ensure immediate approval for Viva Payday Loans without a credit check, their quick-to-apply and quick-to-pay options are worth your time and consideration.

They provide an alluring option for people looking for the best payday loans between $100 and $1,000, with APRs as low as 5.99%. They provide adjustable payback terms that range from two to twenty-four months.

How to apply for a loan through Viva Payday Loans?

These are the four easy steps to apply to the Viva Payday Loans:

Step 1: Visit the website of the loan and choose loan amount required.

Step 1: Determine the necessary amount for an emergency cash loan. Provide the desired loan amount and terms. Options start at $100 and go up to $1000.

Step 2: Fill out the online application for an emergency cash loan.

To finish the application, click the “Request Funds” button and adhere to the instructions.

To confirm the details you give the lender, supporting documentation is needed. Keep the following ready: your most recent three pay stubs, your most recent three bank statements, proof of address, and a legitimate ID.

Step 3: Choose the Loan Term and Amount.

The range of loan amounts and terms is $100 to $1000 for three to twenty-four months. Decide how much and how long you need it. Following the submission of these details, you will be allowed to proceed by filling out an online application. When you’re ready, submit the form by following the easy instructions.

Step 4: Await the response for two minutes.

You will hear back on your loan application in two minutes. You will close the deal directly with the lender if you decide to accept their offer. The lender will send you a legal document outlining the terms and other pertinent details of your loan at this phase of the procedure.

Step 5: Complete the Loan Agreement and Receive Funds

You can sign the loan and return it to the lender after you’ve taken the time to read the loan agreement and get clarification on any points that might appear unclear or complex. From this point on, the loan amount is often paid in 15 to 1 hour.

General Eligibility Requirements

Lending organisations make sure that their clients meet specific requirements that safeguard their security and legal compliance. Make sure you meet the requirements to be considered by these institutions when applying for these loans.

In this segment, we cover the general requirements set forth by lending institutions to save you time and trouble. These are the most typical requirements, though there might be more based on the kind of loan being sought:

- Be of age. This requirement is crucial as, depending on the state, the legal age to become an adult might range from 18 to 21 years old.

- Make sure you meet this legal requirement, depending on where you are, to be eligible for any of the online loans.

- Show off a proof of identity. You can provide your SSN in this requirement, but lenders will take your PAN if you don’t have it. Additionally, there are situations in which your passport or Consular Registration will suffice.

- Since you need to provide the account number and routing information to deposit the funds, you must have a bank account in your name.

- Data on your employment or monthly income is required so that lenders can verify your ability to make payments. This criterion is typically crucial for defining many loan conditions, including the maximum amount that can be authorised and the length of the repayment period.

- A working mobile number that belongs to you personally.

Pros of Viva Payday Loans

- Quick approval in under two minutes

- Accepted FICO scores range from

- Different terms for payback

- 5.99% is the starting APR.

Fees and Rates of Interest for Viva Payday Loans

Payday loans from Viva Payday Loans include interest rates ranging from 0% to 1%. Even though this is just short-term financing, the annualised percentage rate for these expenses still varies for these loans, from 5.99% to 35.99%. The loan amounts range from $100 to $1000.

Benefits of Viva Payday Loan

The finest Viva payday loans have many benefits that make them a well-liked choice for people who require immediate financial support. Let’s examine a few of these advantages in greater detail:

- Convenience: Time and effort can be saved since the full process—from applying to getting funds—can be finished online without needing to visit a physical place.

- Speed: If accepted, applicants can have the money transferred into their account as early as the next working day. They typically receive a decision in a matter of minutes.

- Flexibility: Borrowers can select a payback plan that corresponds with their next paycheck and can choose a loan quantity that suits their urgent needs.

- Accessibility: A larger group of people, including those with bad or no credit history, can more easily obtain the best payday loans. Generally speaking, internet Viva Payday Loans have looser conditions than regular bank loans.

Conclusion:

To sum up, this article covered Viva Payday Loans in great detail, including their definition and viability in the current market. Working with Viva Payday Loans enables borrowers to obtain a loan quickly. This service provider guarantees a seamless application process for all applicants by collaborating with a network of reputable lenders.

If you need quick financial assistance, Viva Payday Loans is among the greatest online payday loan suppliers connecting with online lenders all around the US. When standard payday loan choices are not available or are too time-consuming, these services are available.

FAQs:

Q1. Are Payday Loans Available and Legal in Every State?

Indeed, loans are available in all states of the US.

Q2. What is the purpose of this loan?

Individuals obtain loans to assist with unforeseen costs, bills, holiday shopping, house maintenance, and other needs. You can receive the money you require with the aid of one of our lenders by applying for such a loan. If a lender is available, you can get money as soon as the next working day after completing our online form.

Q3. What are the eligibility criteria to get a loan?

To get a quick loan, applicants must be a resident of the US, having age 18 or older, Have a valid ID proof, and a current bank account with a decent source of income.